⭐ PRE-CHAPTER INTRODUCTION

Before You Begin: A Message to Every New Trader

Most beginners enter the world of options with excitement, hope, and ambition…

and within weeks, they face the same painful cycle:

-

random entries

-

confusing premium behavior

-

losses they don’t understand

-

emotional decisions

-

revenge trades

-

“what just happened?” moments

-

sudden blowups

-

zero consistency

It’s not because they are careless.

It’s because options trading is brutally complex… until someone explains it the right way.

This guide is that explanation.

This is not a normal blog post.

It is not a 1,500-word shallow article like most websites publish.

It is a complete trading education, broken down into 20 deeply structured, beginner-friendly, step-by-step chapters.

You are about to learn:

-

how options actually work (in simple words)

-

why 90% of traders lose & how not to be one of them

-

the exact entries and exits professionals use

-

how to avoid OTM traps

-

how to control fear, greed, FOMO, anxiety

-

how to build your own trading system

-

how to think like a disciplined professional

-

how to avoid catastrophic losses

-

how to protect capital and grow consistently

Most importantly…

**You will stop trading emotionally

and start trading systematically.**

If you read this guide carefully,

if you follow the rules,

if you practice with discipline…

Then this guide will help you:

✔ cut losses

✔ avoid traps

✔ protect your capital

✔ increase accuracy

✔ maintain consistency

✔ reduce stress

✔ survive volatility

✔ and finally start becoming profitable

Most traders fail because they never invest the time to understand the market properly.

But you chose to read a 20-chapter mega guide —

that alone puts you ahead of 95% of the crowd.

Do yourself a favor:

**Read this entire guide once.

Save it.

Then read it again.

And then start applying it chapter by chapter.**

This guide can compress years of experience into a few days of reading…

and save you from mistakes that cost traders lakhs every year.

Trading is not a game.

It’s a serious skill.

Treat this guide like a textbook, not a casual blog post —

because the knowledge inside it is enough to transform your entire trading journey.

Now take a deep breath…

let’s begin your evolution as a trader.

⭐ CHAPTER 1 – THE MARKET BEFORE OPTIONS

(Understanding the Game Before Learning the Instruments)

Before You Learn Options, You Must Learn the Market’s Language

Let’s begin at the beginning.

Most beginners jump straight into:

- Calls

- Puts

- Premium

- Greeks

- ITM / OTM

- Strategies

…without ever truly understanding what the market is.

Trying to understand options without understanding the market underneath is like trying to read Shakespeare before learning the alphabet.

Options are built on top of the market.

To master them, you need to understand the market’s heartbeat first.

And that’s what this entire chapter is about.

The Market Is NOT What We Think It Is

Ask someone what the stock market is, and they’ll say:

“It’s where people buy and sell stocks.”

But that answer is as incomplete as saying:

“The ocean is just water.”

The market is a living system —

a dynamic ecosystem where:

- Greed breathes

- Fear screams

- Logic whispers

- Liquidity flows

- Prices dance

- Opinions clash

- Narratives dominate

- Money moves like currents under the surface

Options are simply the language built on top of this ecosystem.

Before learning options, we must understand:

- How price moves

- Why price moves

- What drives trends

- What creates levels

- Why the market behaves irrationally

- Why volatility exists

- Who the players are

Because options pricing, behavior, Greeks, strategies —

ALL of them are built on the foundation of this market behavior.

The True Identity of the Market

(A Story You Will Never Forget)

I want to give you an analogy that will stay with you forever.

Imagine you are standing in front of a giant, ancient elephant.

This elephant is:

- Majestic

- Powerful

- Unpredictable

- Wise

- Emotional

- Slow at times

- Aggressive at others

Tons of people around you are trying to predict what the elephant will do next:

- Some believe it will turn left

- Some believe it will charge forward

- Some believe it will sit

- Some believe it will stay still

- Some believe it will panic and run

Every person has a different opinion.

Now remember:

**The elephant = The market.

The people around = Traders, investors, institutions.**

The elephant doesn’t care about anyone’s opinion.

It simply moves according to:

- Its mood (market sentiment)

- Its fears (risk)

- Its instincts (fundamentals)

- Its environment (news & macros)

- Shadows it sees (rumors & expectations)

- Unexpected sounds (events & shocks)

This is why:

- Markets go up when everyone expects a fall.

- Markets crash when everything seems perfectly fine.

- Markets move sideways when news is explosive.

- Markets explode when news is silent.

The elephant moves on its own logic, not yours.

Price = The Elephant’s Footprints

You rarely see the elephant directly.

You only see its footprints in the sand.

In markets:

**Price is simply the visible footprint

of the invisible forces underneath.**

Options, by the way, are priced almost entirely based on:

- Price

- Speed of price

- Fear about price

- Expectation of price

- Time until price moves

This is why deep understanding of price movement is essential for options mastery.

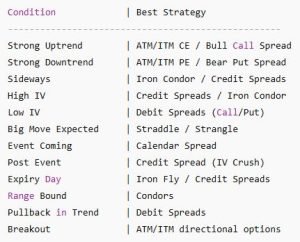

The 5 Forces That Move the Market

Every price movement — big or small — is caused by five universal forces.

Force 1: Fundamentals

EPS, growth, inflation, interest rates, corporate earnings, GDP…

This affects long-term price.

Force 2: Liquidity

Where is institutional money flowing?

Force 3: Sentiment

Fear, greed, uncertainty, panic, confidence.

This is the strongest force in short-term markets.

Force 4: Technical Structure

Support, resistance, supply/demand zones, patterns, volume.

Force 5: Volatility & Expectations

This is the foundation of options pricing.

Volatility =

“How much uncertainty is expected from the elephant?”

We will deep dive into this in later chapters.

The Market Is Driven by Players (and You Must Know Them)

Think of the market as a giant stadium.

Inside this stadium, four major players are competing:

- Retail Traders

Small fish.

Most emotional.

Often late to trends.

Driven by fear and greed.

Easily shaken out.

Often trade OTM options without understanding.

- Institutions (FIIs / DIIs)

Whales.

Move slowly, strategically, with deep planning.

Move the market with billions.

These are the people who create:

- Levels

- Support

- Resistance

- Major price moves

- Smart Money / HNIs

Agile sharks.

They enter quietly, exit quietly, but profit consistently.

They trade structure, not emotions.

They love options because options allow:

- hedging

- leverage

- controlled risk

- structured payouts

- Market Makers

They are the invisible architects behind option premiums.

Their job:

provide liquidity and manage risk, not speculate.

Market makers care about:

They are the reason option prices behave the way they do.

They are the invisible puppeteers behind the scenes.

Price, Volume, and Trend

(The Holy Trinity Before Options)**

Before touching options, you must understand:

- Price shows direction

- Volume shows strength

- Trend shows intention

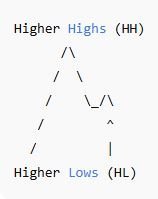

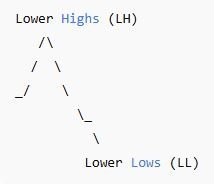

And here is your first diagram to visualize trend:

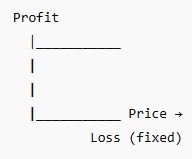

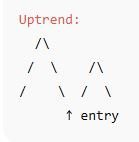

UPTREND

DOWNTREND

SIDEWAYS

The future chapters on Greeks, IV, and strategies will build heavily on these structures.

(The Elephant’s Favorite Spots)**

Imagine the elephant walking on a path.

There are soft muddy patches where it likes to rest (support).

There are rocky areas it avoids or gets stuck (resistance).

Here is a clean visual:

Support

↓ Price falls

————————-

| SUPPORT |

————————-

↑ Reversal

Resistance

↑ Price rises

————————-

| RESISTANCE |

————————-

↓ Rejection

Institutions love to:

- accumulate on support

- distribute on resistance

Options strategies like condors, credit spreads, iron flies heavily rely on these levels.

Volatility (The Elephant’s Mood Swings)

Volatility is the single most important concept in options trading.

But before we dive into IV (Implied Volatility) later, you must understand:

Volatility = “How violently the elephant might move.”

It measures:

- uncertainty

- fear

- excitement

- expected movement

Volatility doesn’t care about direction.

Only magnitude.

Later in the guide, you will learn why:

- IV increases premiums

- IV crush destroys buyers

- IV drives Vega

- IV can override Delta

- IV dictates strategy selection

This chapter lays the foundation for that.

Price is Truth — Everything Else is Interpretation

In trading:

- News is delayed

- Opinions are biased

- Predictions are illusions

- Indicators lag

But price does not lie.

This is why:

The best options traders are first excellent price-action readers.

Because options are built directly on:

- price

- rate of change of price

- expectation of price

- fear of price

- time left for price to move

Everything comes back to this.

Why This Chapter Matters Before Options

Most traders fail at options because they:

- don’t understand market structure

- don’t know how price behaves

- don’t understand volatility

- don’t understand levels

- don’t think in probabilities

- don’t understand who they are trading against

- don’t see options as risk tools, not lottery tickets

This chapter builds the mindset required to interpret GREKS, moneyness, IV, OI, strategies, and risk later.

You now understand:

- the elephant (market)

- its footprints (price)

- its moods (volatility)

- its preferences (levels)

- its environment (fundamentals)

- its interactions (players)

This is the foundation for the next chapter.

⭐ CHAPTER 2 – WHAT EXACTLY ARE OPTIONS?

A MASTERCLASS FOR TRUE BEGINNERS

Before We Begin: The Goal of This Chapter

By the end of this chapter, you will understand options so clearly that:

- You can explain them to a child

- You will NEVER confuse calls/puts again

- Risk/reward will make intuitive sense

- Premium pricing will feel logical

- Buyers vs Sellers will feel like characters in a story

- You will actually “feel” what an option is

This is not a shallow textbook-like explanation.

This is a masterclass, written for someone who must understand options at the DNA level.

Let’s begin.

The Real-Life Origin Story — The Fruit Vendor and the Farmer

Before options existed on exchanges, options existed in life.

Let me tell you a story that explains options better than 100 definitions.

A Farmer & A Seller

A mango farmer is worried:

“What if mango prices fall at harvest?

I might suffer a loss.”

A fruit trader is worried:

“What if mango prices suddenly rise?

I won’t be able to afford stock.”

Both want stability.

Both want protection.

Both want certainty.

So they strike a deal:

The Deal (Option Contract)

The trader says:

“I want the right to buy 1,000 kg of mangoes

from you at ₹50/kg next month.”

The farmer says:

“Okay, but give me ₹2 per kg TODAY

to keep this right reserved for you.”

THIS is the premium.

- Trader = Option Buyer

- Farmer = Option Seller (Writer)

- ₹50/kg = Strike Price

- ₹2/kg = Premium

- Next month = Expiry

If mango prices rise to ₹80/kg

The trader will happily exercise his right:

Buy at ₹50 → Sell at ₹80 → Profit

The farmer must sell at ₹50 even though market is ₹80.

He suffers loss — BUT he took ₹2 premium initially.

If mango prices fall to ₹30/kg

The trader will NOT exercise the right.

He will buy from the open market at ₹30.

The farmer gets to keep the premium ₹2/kg for nothing.

This, in its purest essence, is a Call Option.

You now understand:

- Right

- Strike

- Premium

- Buyer

- Seller

- Expiry

- Profit

- Loss

- Obligation

Without a single technical word.

Options Are Rights — Not Obligations

This is the golden rule:

Option Buyer = Has Right (No Obligation)

Option Seller = Has Obligation (No Right)

Below table help you to memorize it:

ROLE | NATURE |

+———————-+————————+

| Option Buyer | Right, but no duty |

| Option Seller | Duty, but no right |

+———————-+————————+

The buyer buys a right.

The seller sells that right and takes on the obligation.

This is why:

Buyers have limited risk.

Sellers have unlimited (or very large) risk.

We’ll explore this with examples soon.

Two Types of Options: CALLS & PUTS

Options come in only two flavors.

You master these two,

you master all strategies later.

CALL OPTION

Right to BUY something at a fixed price (strike).

You buy a call when you think price will go up.

PUT OPTION

Right to SELL something at a fixed price (strike).

You buy a put when you think price will go down.

Call vs Put — Super Simple Chart

| IF YOU EXPECT PRICE | OPTION TO BUY |

+————————-+—————————+

| Go Up | Call Option (CE) |

| Go Down | Put Option (PE) |

+————————-+—————————+

A Beautiful Analogy: Call Option = Movie Ticket

You buy a movie ticket for ₹300.

Does the ticket FORCE you to watch the movie?

No.

It gives you a right to watch.

If you don’t go, worst-case:

You lose the ₹300 premium.

Exactly how a call option behaves.

Option Structure

An option has 4 key components:

- Underlying (Stock/Index)

- Strike Price

- Premium

- Expiry

Here’s how an option contract looks:

UNDERLYING : NIFTY |

| TYPE : CALL |

| STRIKE : 20,000 |

| PREMIUM : 120 |

| EXPIRY : 27 FEB 2025

This contract gives the buyer the right to buy NIFTY at 20,000.

Real Indian Market Example (Simplest Possible)

NIFTY Spot = 20,000

You think NIFTY will go up.

You buy:

20,000 CE @ ₹120

If NIFTY moves to 20,300:

Premium might go → ₹250

Profit = (250 – 120) × Lot Size

If NIFTY stays below 20,000:

Premium → 0

Loss = premium paid only.

Put Option — Explained Like Magic

Put options confuse beginners the most.

Let’s make it crystal clear.

Buying a Put = You bought a parachute.

You profit when prices fall,

just like a parachute helps when you drop.

Simplest Example

NIFTY = 20,000

You buy:

20,000 PE @ ₹100

If NIFTY crashes to 19,700:

Premium might go → ₹250

Huge profit.

If NIFTY stays above 20,000:

Premium → 0

Loss = premium only.

Why Option Buyers Love Options

- Low capital

- Limited risk

- Unlimited upside (for calls)

- Hedge against crashes

- Perfect for trend following

- No obligation

Why Option Sellers Dominate the Market

This is where we get premium.

See this table:

+————————+————————-+

| BUYER | SELLER |

+————————+————————-+

| Limited Risk | Unlimited Risk |

| Unlimited Reward | Limited Reward |

| Low Win Rate | High Win Rate |

| Needs Big Moves | Benefits from Stability |

+————————+————————-+

Buyers are betting on movement.

Sellers are betting on no movement.

- Buyers play offense

- Sellers play defense

But sellers earn steady income —

which is why major institutions are sellers.

The Breakthrough Concept: Options = Insurance

Options were NEVER designed for speculation.

They were created as insurance products,

centuries before exchanges existed.

A call option = Insurance against price rising

A put option = Insurance against price falling

Today traders use them for:

- Directional trades

- Income

- Volatility plays

- Hedging

- Arbitrage

…but the soul of options remains → insurance.

This is why:

- Sellers (insurance companies) earn steady premium

- Buyers (insurance buyers) make money only during rare, large events

You now understand the industry’s core truth.

Understanding Premium (WHY It Exists)

Premium is NOT random.

Premium =

Intrinsic Value + Time Value + Volatility Value

This will be explored deeply later.

But here is a metaphor:

Premium = The cost of renting certainty in an uncertain world.

Buyers pay for certainty.

Sellers get paid to take uncertainty.

Why Expiry Exists? (The Clock That Always Wins)

Options cannot exist forever.

Just like:

- Milk expires

- Movie tickets expire

- Insurance contracts expire

Options have a time limit.

Time decay is the silent killer —

we will dive deeply in Chapter 5.

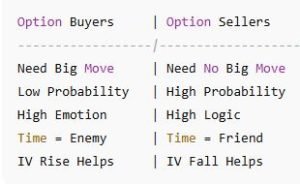

Visual — Buyer vs Seller Battle

BUYER (Wants Movement) SELLER (Wants Stability)

——————————————————-

Big price moves No big moves

High volatility Low volatility

Trend Range-bound

Low probability High probability

High reward Small reward

Limited risk Unlimited/large risk

This dynamic is the soul of options trading.

Why This Chapter Was Critical Before Greeks, IV & Strategies

You now understand:

- Calls & puts

- Premium

- Rights & obligations

- Buyer vs seller

- Insurance analogy

- Basic payoff logic

- Real examples

- Diagrams

- Origins of options

- Why expiry exists

This is the foundation for everything ahead.

The rest of the guide will become 10x easier for you now.

⭐ CHAPTER 3 – MONEYNESS, STRIKE SELECTION & INTRINSIC VALUE

The Most Misunderstood Concepts Simplified to the Core

Before We Begin — Why This Chapter Is Crucial

Most beginners lose money in options not because they choose the wrong direction…

…but because they choose the wrong strike.

Think about it:

You were right about the trend.

You were right about the movement.

You even picked the correct side (call or put).

Yet you still lost.

Why?

Because moneyness, intrinsic value, and strike selection are the real backbone of profitable option trading.

This chapter will make these three concepts so clear that you will NEVER buy the wrong strike again.

Let’s begin.

First, What Is a Strike Price? (The Doorway to Your Option)

Think of a strike price as a door you choose before entering a house.

Different doors lead to different rooms:

- Some rooms give you flexibility

- Some rooms give you speed

- Some rooms give you safety

- Some rooms give you risk

- Some rooms give you lottery-like outcomes

- Some rooms give you slow, steady outcomes

Choosing the wrong door = you end up in the wrong room.

Strike selection works the same way.

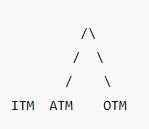

What Is Moneyness? (The Distance From Reality)

Moneyness is simply:

Where your strike price stands in relation to the current market price.

There are only 3 types:

- ITM (In The Money)

- ATM (At The Money)

- OTM (Out of The Money)

Let’s decode them like a story.

ATM — “The Current Battlefield”

The Strike Closest to the Current Market Price

If NIFTY is 20,000:

- 20,000 CE = ATM

- 20,000 PE = ATM

ATM is where the market is currently fighting.

PRICE

↓

—————–

| ATM Strike |

—————–

ATM options have:

- The highest volatility

- Fast premium movement

- Highest gamma

- Unpredictable swings

ATM is like standing on the battlefield frontline.

ITM — “Inside the House Already”

In-The-Money means:

Your strike is already better than the market price.

For Calls: ITM = Strike Below Spot

NIFTY = 20,000

19,900 CE → ITM

19,800 CE → ITM

For Puts: ITM = Strike Above Spot

20,100 PE → ITM

20,200 PE → ITM

ITM ← Spot Price → OTM

ITM options:

- Cost more

- Have higher Delta (faster response)

- Are more stable

- Lose less from time decay

ITM is like entering a race 10 meters ahead of others.

OTM — “The Lottery Ticket Zone”

Out-of-the-money means:

Your strike is worse than the current market price.

For Calls: OTM = Strike Above Spot

NIFTY = 20,000

20,200 CE → OTM

20,300 CE → OTM

For Puts: OTM = Strike Below Spot

19,800 PE → OTM

19,700 PE → OTM

ITM ← Spot Price → OTM (Cheap but Low Probability)

OTM options:

- Are cheap

- Look attractive

- Have tiny Delta

- Move slowly

- Often expire worthless

- Are the biggest trap for beginners

OTM is like entering a race 50 meters behind competitors.

You can win…

but you probably won’t.

The Golden Formula: Premium = IV + Time Value + Intrinsic

Let’s break it down.

1️⃣ Intrinsic Value (IV₁): The Real Value

Intrinsic value is:

“How much the option is worth right now if exercised.”

For Calls:

Intrinsic = Spot – Strike

For Puts:

Intrinsic = Strike – Spot

Only ITM options have intrinsic value.

2️⃣ Time Value: The Possibility Value

Time value is:

“How much extra value exists because time is left.”

Time = Hope.

Time = Chance.

Time = Expectation.

Time value exists for ALL options (ITM, ATM, OTM).

3️⃣ IV (Implied Volatility): The Fear Value

This is:

“How uncertain/unpredictable the market is.”

When volatility is high, premiums inflate like balloons.

Detailed Example — Breaking Down Premium

NIFTY Spot = 20,000

20,000 CE = Premium ₹120

Let’s break it:

- Intrinsic = 0 (ATM)

- Time Value = 75

- Volatility Value = 45

Total = 120

This is why ATM is volatile:

- Zero intrinsic

- High time value

- High IV sensitivity

Deep Example — ITM Call Breakdown

NIFTY Spot = 20,000

19,800 CE = Premium ₹270

Intrinsic = 200

Time Value = 70

Total = 270

Premium = 200 (Intrinsic) + 70 (Time)

Why ITM is expensive?

Because it already has money embedded in it.

Deep Example — OTM Call Breakdown

NIFTY Spot = 20,000

20,400 CE = Premium ₹25

Intrinsic = 0

Time Value = 25

Total = 25

Premium = 0 + 25(100% pure time value)

This is why OTM collapses fast →

Time has no mercy.

The Single Biggest Beginner Mistake: Buying Deep OTM

Let’s illustrate with an example.

NIFTY Spot = 20,000

Beginner buys 20,700 CE at ₹5 hoping to become rich.

This is the payoff zone:

You need HUGE movement.

Low probability.

Time decay kills quickly.

Sellers love when beginners buy these.

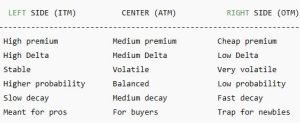

The Professional Way: Delta-Based Strike Selection

This is where pros shine.

Delta is a Greek we’ll study later — but for now:

Delta measures how sensitive premium is to price movement.

Professional traders choose strikes based on Delta ranges.

✔ For Option Buyers (Directional Traders):

- Slight ITM (Delta 0.55–0.65)

- ATM (Delta 0.45–0.55)

These react fast.

These reward trending markets.

✔ For Option Sellers (Income Traders):

- OTM strikes (Delta 0.15–0.25)

- Safe distance from spot

- High probability of expiring worthless

Buyers seek: Δ = 0.5 to 0.7

Sellers seek:Δ = 0.1 to 0.25

You will master this in Chapter 4 (Greeks).

The 20-Strike Probability Rule (Institutional Method)

This is an advanced but simple rule:

**The further the strike from spot,

the lower the probability of touching.**

Probability drops exponentially as you move away from ATM.

Let’s illustrate:

NIFTY Spot = 20,000

Strike |

Type |

Touch Probability |

20,000 |

ATM |

50% |

20,100 |

OTM |

35% |

20,200 |

OTM |

20% |

20,300 |

DEEP OTM |

10% |

20,400 |

DEEP OTM |

5% |

This is why ITM/ATM behave differently from OTM.

Visualization — Strike Bands

This table alone can change your entire approach.

Which Strike Should YOU Choose? (The Final Answer)

✔ If you are a beginner → Choose ATM or Slight ITM

Ideal Delta: 0.50–0.65

Why?

- Responds well

- Not too expensive

- Not too slow

- Not too risky

- Not too decaying

Perfect balance.

✔ If you are a trend trader → Choose Slight ITM

Ideal Delta: 0.60–0.70

Why?

- Stronger premium movement

- Lower time decay impact

- Higher stability

✔ If you are a breakout trader → Choose ATM

Best for momentum plays.

Explosive gamma movement.

✔ If you are an expiry scalper → Choose ATM (but with experience)

Super fast movement.

High risk.

High reward.

✔ If you are a conservative hedged seller → Sell OTM spreads

Strike: Delta 0.15 to 0.25

Why?

- Safer

- Time decay advantage

- Limited risk

Summary of This Chapter

You learned:

- What moneyness is

- How strikes relate to price

- Intrinsic value

- Time value

- Volatility value

- Why OTM is a trap

- Why ITM is powerful

- Why ATM is volatile

- Delta-based strike selection

- Institutional probability method

- Complete buyer/seller strike logic

This chapter forms the backbone of:

- Greeks (Chapter 4)

- IV (Chapter 5)

- Strategy selection (Chapters 7–12)

- Hedging (Chapter 13)

You now deeply understand the internal architecture of strike pricing.

⭐ CHAPTER 4 – THE GREEK GOD CHAPTER

Delta, Gamma, Theta, Vega — Explained Like You’re 12

Before We Begin (Read This Slowly)

Options pricing is NOT random.

Premium moves because of Greeks.

If you understand Greeks, you understand:

- why your premium increased

- why it didn’t increase

- why it fell

- why it collapsed

- why your trade behaved opposite to what price did

- why OTM died

- why ATM exploded

- why ITM behaved predictably

- why expiry day feels like a war zone

Without Greeks, option trading is pure gambling.

With Greeks, option trading becomes mathematics, logic, and probabilities.

This chapter will make Greeks feel intuitive — almost obvious.

Let’s begin.

Delta — The Speed of Your Option

(The First Greek You Must Master)

Delta tells you:

For every 1 point move in the underlying, how much will the premium move?

Meaning:

- If Delta = 0.50

And NIFTY moves +10

Premium moves +5

Think of Delta as the speedometer of your option.

Delta Explained With a Very Simple Story

Imagine you are cycling uphill.

Some cycles move faster.

Some move slower.

- ITM options = gear cycles (fast)

- ATM options = normal cycles

- OTM options = cycles with flat tires (slow)

- Deep OTM = cycles with broken chains (very slow)

This is Delta.

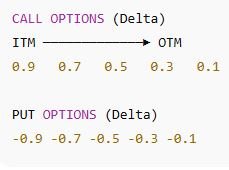

Delta Values (Memorize This Table)

For Call Options (CE):

- ITM → High Delta (0.60–0.90)

- ATM → Medium Delta (0.45–0.55)

- OTM → Low Delta (0.25–0.35)

- Deep OTM → Very low Delta (0.05–0.20)

For Put Options (PE):

- ITM → High negative Delta (–0.60 to –0.90)

- ATM → Around –0.50

- OTM → –0.30

- Deep OTM → –0.10

Why Delta Matters

Delta tells you:

- how fast your premium will react

- how much you’ll gain on movement

- how much you’ll lose on reversals

- how stable vs unstable the option is

- how likely an option is to expire ITM

High Delta = High probability of finishing ITM

Low Delta = Low probability of finishing ITM

This is why professionals never buy deep OTM.

Delta is near zero →

Premium barely moves →

Full premium loss.

Gamma — The Acceleration of Your Option

(How Fast the Speed Changes)

If Delta is speed,

Gamma is the acceleration.

Gamma tells you:

How fast Delta will change if the price moves.

Gamma is highest at ATM.

This is why:

- ATM options behave like rockets

- OTM suddenly become ITM

- ITM suddenly become deep ITM

- Premium jumps feel magical

- Expiry moves feel violent

Gamma is the Greek responsible for expiry madness.

Gamma Behavior Table

ITM ATM OTM

Low HIGH Low

Gamma looks like a volcano:

The peak is ATM.

Why Beginners Love Gamma (Without Knowing It)

Every time a beginner trades:

- “Breakout candle”

- “Momentum spike”

- “Sudden reversal”

- “Huge move”

…and sees premium shoot up suddenly…

That’s Gamma at work.

They think it was magic.

It wasn’t.

It was Gamma + Delta expansion.

Why Expiry Day Is Dangerous (Gamma Explosion)

On expiry day:

- Premium is low

- Time left is near zero

- Gamma explodes

- Delta changes rapidly

- ATM behaves like lightning

Small price changes → massive premium jumps.

This is why:

- Expiry scalping is addictive

- Premium jumps are crazy

- Reversals kill instantly

Gamma = the drama Greek.

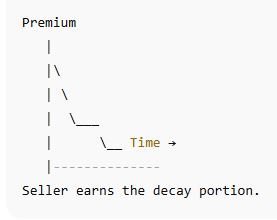

Theta — Time Decay (The Silent Killer)

Theta tells you:

How much premium you lose every day just because time passes.

Options are rented assets.

Every passing minute charges rent.

Buyers HATE Theta.

Sellers LOVE Theta.

Simple Theta Example

If Theta = –10

Every day your premium falls by ₹10, even if price does NOTHING.

This is decay.

And it NEVER stops.

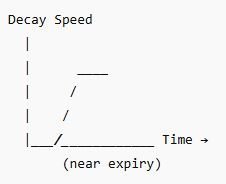

Theta Decay Timeline (Super Important)

Far from Expiry: Slow Decay

Near Expiry : Fast Decay

Expiry Week : Very Fast Decay

Expiry Day : Brutal Decay

visual:

Weekend Theta — The Silent Deduction

Saturday + Sunday decay happens at once.

A Friday option will open lower on Monday even if price didn’t move.

Because the clock doesn’t stop.

(The Greek That Makes or Breaks Your Trade on News Days)

Vega tells you:

How much premium will move when volatility (IV) changes.

If IV rises → Premium rises

If IV falls → Premium falls

Vega loves:

- news

- uncertainty

- gaps

- events

- panic

- trend reversals

Vega is strongest in ATM options.

When Does IV Rise?

- Volatile markets

- Before big news

- Before earnings

- Before elections

- Before RBI policy

- During global crises

- During uncertainty

High IV = high premium

When Does IV Fall? (IV Crush)

After events finish:

- Budget

- Results

- RBI update

- Fed announcement

- Election results

Suddenly premiums collapse.

This is why even CORRECT directional trades lose money on event day.

Buyers get IV crushed.

Sellers earn huge.

Rho — The Forgotten Greek

Interest-rate sensitivity.

Not very relevant for intraday or weekly expiry.

Ignored by most retail traders.

We keep it simple.

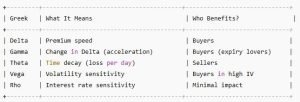

Summary Table for All Greeks

Real Market Example — Understanding All Greeks Together

NIFTY = 20,000

20,000 CE = Premium ₹120

Greek snapshot:

- Delta = 0.45

- Gamma = 0.12

- Theta = –8

- Vega = 5

Let’s interpret:

✔ If NIFTY moves +10 → premium moves +4.5 (Delta)

✔ If NIFTY keeps trending → Delta increases (Gamma)

✔ If price stays flat → premium loses ₹8/day (Theta)

✔ If IV rises → premium increases ₹5 for every IV jump (Vega)

This is REAL option behavior.

Comparing Greeks by Moneyness (Extremely Important)

ITM OPTIONS

Delta = High

Gamma = Low

Theta = Medium

Vega = Low

Stable. Predictable. Slow decay.

ATM OPTIONS

Delta = Medium

Gamma = High

Theta = High

Vega = High

Volatile. Exciting. Dangerous.

OTM OPTIONS

Delta = Low

Gamma = Low

Theta = High

Vega = Low

Cheap but dangerous.

Why Beginners Lose Money (The Greek Explanation)

❌ They buy OTM (low Delta)

Premium barely moves.

❌ They buy near expiry (high Theta)

Premium evaporates.

❌ They buy before news (high Vega)

Get IV crushed.

❌ They don’t understand Gamma

Get whipsawed on expiry.

Greeks explain nearly ALL beginner losses.

The Professional Rules (The Greek Framework)

Here are the 10 elite rules:

✔ Rule 1 — Buy high Delta

Choose ATM or slight ITM.

✔ Rule 2 — Sell low Delta with hedges

OTM spreads.

✔ Rule 3 — Avoid buying when Theta > 7% of premium

Too much decay.

✔ Rule 4 — Avoid buying in high IV

Wait for IV to cool.

✔ Rule 5 — Avoid selling in low IV

Premium is poor.

✔ Rule 6 — On expiry, Gamma rules everything

Stay small.

✔ Rule 7 — Vega dominates during event weeks

Expect inflated premiums.

✔ Rule 8 — Theta is king for sellers

Time is your ally.

✔ Rule 9 — Delta is king for buyers

Trend is your engine.

✔ Rule 10 — Master Greeks → Master options

Summary of Chapter 4

You now understand:

- Delta = Speed

- Gamma = Acceleration

- Theta = Decay

- Vega = Volatility effect

- How Greeks differ across strikes

- Why ATM moves like madness

- Why OTM dies fast

- Why ITM is stable

- Why expiry behaves like fireworks

- Why IV crush destroys buyers

- Why sellers rely on Theta

- Why buyers rely on Delta

You have just learned the soul of option pricing.

This is the true turning point in your learning journey.

⭐ CHAPTER 5 – IMPLIED VOLATILITY (IV) & IV CRUSH

The Invisible Hand Behind Every Premium

Why This Chapter Matters More Than You Think

If Chapter 4 (Greeks) was the “soul” of options…

Then Implied Volatility (IV) is the invisible force that controls everything the soul interacts with.

Most beginners lose money because they:

- Buy options when IV is high

- Get trapped in IV Crush

- Don’t understand why premium collapses

- Don’t know when IV matters vs price

- Don’t understand why premium doesn’t rise even when price moves

- Don’t know when to buy or sell based on IV

This chapter removes all confusion.

You’ll understand IV so well that you’ll “feel” it while trading.

Let’s begin with a story.

The Pressure Cooker Story — The Best IV Analogy Ever

Imagine a pressure cooker on a stove.

Inside the cooker:

- Heat increases

- Pressure builds

- Steam expands

The cooker begins shaking.

You don’t know when it will whistle,

but you know it will whistle soon.

That pressure building inside the cooker = IMPLIED VOLATILITY.

It represents:

- Expectations

- Fear

- Anticipation

- Uncertainty

- Potential explosion

Now imagine someone suddenly turns off the stove.

Pressure drops instantly.

This sudden collapse = IV CRUSH.

Premiums collapse the same way the pressure disappears from a cooker once the heat is turned off.

This analogy is the foundation for this entire chapter.

What EXACTLY is Implied Volatility (IV)?

(The Real Definition in Simple Words)**

Implied Volatility means:

How much movement the market EXPECTS in the future.

Key word: expects

Not past volatility.

Not actual volatility.

Not real movement.

But expected movement.

summary:

ACTUAL Volatility = Past movement

IMPLIED Volatility = Expected future movement

Options are priced based on the future — not the past.

This is why IV is often MUCH more important than price.

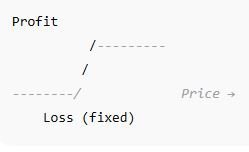

Why Does IV Matter So Much?

(Simple but Powerful Insight)**

Because:

High IV = High Premium

Low IV = Low Premium

Even if price doesn’t move.

Premium is literally inflated or deflated by IV.

visualization:

IV ↑ → Premium ↑

IV ↓ → Premium ↓

Which means:

You can lose money even when price moves in your direction

if IV drops.

This is the #1 reason beginners get confused.

The Balloon Analogy (Best Explanation of IV)

Imagine two balloons:

🎈 Balloon A — tightly stretched (high pressure)

🎈 Balloon B — loosely filled (low pressure)

If you push Balloon A,

it reacts fast,

because it’s full of pressure (high IV).

If you push Balloon B,

it reacts slow,

because there’s no pressure (low IV).

Options behave the same way.

Price vs IV (The Two Drivers of Premium)

Premium has two engines:

- Price movement

- IV movement

Most beginners think engine #1 is the only one.

They ignore engine #2.

Sometimes IV is SO powerful that:

IV fall > Price rise

→ Premium falls (loss)

OR

IV rise > Price fall

→ Premium rises (profit)

This is why options feel “illogical” until you understand IV.

When Does IV Rise? (The Fear Index)

IV rises when uncertainty increases.

Situations that increase IV:

- Elections

- Budget

- RBI meeting

- Fed meeting

- Earnings

- War fears

- Sudden gaps

- Crashes

- Major events

- Global volatility

- Breaking news

- Unexpected political or geopolitical situations

When fear rises → premiums inflate.

Fear ↑ → IV ↑ → Premium ↑

This is why event weeks have expensive options.

When Does IV Fall? (The Calm After The Storm)

IV falls when uncertainty disappears.

Situations that decrease IV:

- After earnings

- After elections

- After RBI speech

- After budget

- After major event

- After news is fully out

- After a large predictable move

Fear ↓ → IV ↓ → Premium ↓

This leads to IV Crush, the enemy of all beginners.

What Is IV Crush? (The Silent Assassin of Option Buyers)

IV Crush means:

Premium collapses instantly because volatility expectation disappears.

It can destroy option buyers within seconds.

It happens especially:

- On event days

- After earnings

- After big announcements

- After high-IV periods

- After overnight news

- After sudden resolution of uncertainty

Example:

Before event:

- IV = 28%

- Premium = ₹200

After event:

- IV = 12%

- Premium = ₹90

You lose money even if price moved in your direction.

This is IV Crush.

Real-Life Example — Election Day IV Crush

NIFTY = 19,900

20,000 CE premium = ₹350

IV = 30%

After results:

- NIFTY jumps to 20,300

- Premium should increase, right?

But IV collapses from 30% → 14%

Premium actually falls to ₹220

You were right about direction

You were right about trend

But IV worked against you.

This is the moment where 99% beginners say:

“Yaar, premium kyun gira? Nifty toh upar gaya.”

This chapter is the answer.

Why IV Matters More Than Direction on News Days

On normal days:

Price movement > IV movement

Premium behaves predictably.

On event days:

IV movement > Price movement

Premium behaves “weirdly.”

Remember:

Event = Uncertainty

Post-event = Certainty

Markets hate uncertainty and remove it aggressively.

IV, Vega, and Premium — The Perfect Triangle

IV is connected to the Greek called Vega.

Vega tells you:

“How much premium will change if IV changes by 1%?”

Example:

Option Vega = 4

If IV increases by 5% → Premium increases by 20 points

If IV decreases by 5% → Premium collapses by 20 points

Even if price doesn’t move.

IV → Vega → Premium

How Professionals Use IV (Institutional Grade Logic)

Pro traders:

- Buy when IV is low

- Sell when IV is high

- Avoid buying before events

- Sell premium before events

- Buy after IV crush

- Sell when IV spikes

- Use IV Rank to compare current IV to history

- Use IV Percentile to evaluate relativity

Professionals think in probabilities, not emotions.

IV Rank & IV Percentile — Simplified Genius

These two concepts are often misunderstood.

Let’s decode them perfectly.

IV Rank (IVR)

IV Rank tells you:

“Compared to the last 1 year, is today’s IV high or low?”

Example:

- IVR = 70

Means IV is higher than 70% of the last 1-year data.

Higher IVR → Sell

Lower IVR → Buy

IV Percentile (IVP)

IV Percentile tells you:

“How many days in the last year had IV lower than today?”

Example:

- IVP = 80

Means today’s IV is higher than 80% of days.

Same logic:

High IVP = sell

Low IVP = buy

The Institutional Rule (Very Important)

✔ BUY options when IV is low

Trend traders love low IV.

✔ SELL options when IV is high

Income traders love high IV.

IV Low → Buy

IV High → Sell

If you follow nothing else but this, you will avoid 70% of beginner mistakes.

Expiry Week IV Behavior (Hidden Secret)

Expiry week has a different IV structure:

✔ Time value collapses

✔ IV often collapses

✔ Gamma rises

✔ Vega becomes weak

✔ Direction + speed matter more

Conclusion:

Expiry week is great for selling, risky for buying.

The Most Important IV Rule Every Trader Must Know

❌ DO NOT BUY options when IV is high

(Especially before events)

✔ DO BUY when IV is low

(Especially after event or in calm markets)

❌ DO NOT SELL when IV is low

(No juice in premium)

✔ DO SELL when IV is high

(Overinflated balloons)

If you reverse these rules, you will lose money consistently.

If you follow them, you will grow consistently.

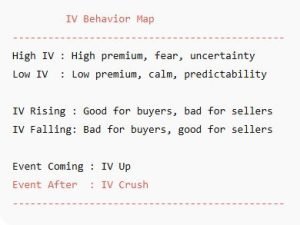

Summary — IV Behavior Map

Chapter Summary

You now understand:

- What IV really is

- Why premium inflates

- Why premium collapses

- How IV affects buyers

- How IV affects sellers

- What IV crush is

- When IV rises

- When IV falls

- IV Rank

- IV Percentile

- Vega & IV connection

- Why event days are dangerous for beginners

- Why sellers love high IV

- Why buyers love low IV

This chapter unlocks the pricing behavior behind options.

From here onward, strategy selection becomes logical.

You’re ready for the next chapter.

⭐ CHAPTER 6 – OPTION CHAIN, OPEN INTEREST (OI), PCR & MAX PAIN

Reading Market Intent Like a Professional Trader

Why This Chapter Matters More Than You Think

Options trading without reading the Option Chain, OI, and PCR is like driving blindfolded.

Anyone can enter a trade.

Only professionals enter trades after reading where the big money is positioned.

This chapter makes you capable of reading the market like:

- Institutional traders

- Market makers

- Professional option writers

- Advanced hedgers

- Volatility traders

By the end of this chapter:

- Support & resistance will look obvious

- Trend continuation/reversal will make sense

- OI buildup patterns will feel intuitive

- PCR sentiment will be easy to interpret

- Max Pain will become a natural tool

Let’s start.

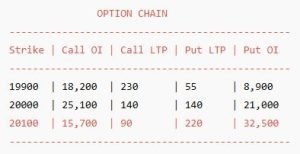

What Is an Option Chain? (The Market’s Dashboard)

The Option Chain is a list of all:

- strikes

- premiums

- calls

- puts

- open interest

- IV

- bid–ask

- Greeks

- volumes

It’s the X-ray report of the entire options market.

It tells you:

- where traders are buying

- where traders are selling

- where institutions are building levels

- where support/resistance sits

- where expiry might gravitate

- what sentiment is developing

Every row tells a story.

What Is Open Interest (OI)?

(The Foundation of Institutional Trading)

OI = Number of open outstanding contracts

Not volume.

Not trades.

Not prices.

It represents positions that exist.

✔ High OI = lots of interest

✔ Low OI = little interest

✔ Increasing OI = new money entering

✔ Decreasing OI = old money exiting

OI is the footprint of big players.

OI Buildup — The Four Patterns Used by Institutions

Institutions leave footprints through OI.

There are only 4 patterns you must master.

1️⃣ Long Build-Up

Price ↑ and OI ↑

→ Traders are buying

→ Bullish sentiment

Price ↑

OI ↑

Sentiment → Bullish

2️⃣ Short Build-Up

Price ↓ and OI ↑

→ Traders are selling

→ Bearish sentiment

Price ↓

OI ↑

Sentiment → Bearish

3️⃣ Short Covering

Price ↑ and OI ↓

→ Bears are closing positions

→ Bullish reversal

Price ↑

OI ↓

Sentiment → Bullish Reversal

4️⃣ Long Unwinding

Price ↓ and OI ↓

→ Bulls are closing

→ Bearish reversal

Price ↓

OI ↓

Sentiment → Bearish Reversal

These four patterns are the holy grail of reading intention.

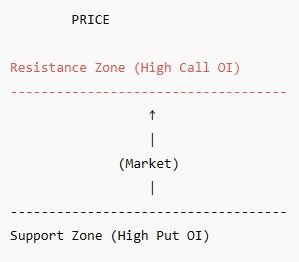

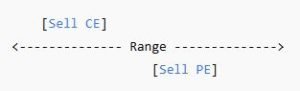

Call OI vs Put OI — How Big Money Creates Support & Resistance

Calls = resistance

Puts = support

Why?

Because:

Sellers write calls at resistance

Sellers write puts at support

Sellers are usually smart money.

So:

- High Call OI zone → strong resistance

- High Put OI zone → strong support

This chart alone makes option chain reading 10x easier.

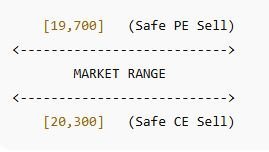

How to Identify Strong Support & Resistance Using Option Chain

Let’s say NIFTY is 20,000.

You scan the chain:

- 20,300 CE has huge OI

→ Strong resistance - 19,800 PE has huge OI

→ Strong support

You instantly know the range:

19,800 – 20,300 = high probability range

This forms the basis of:

- credit spreads

- iron condors

- safe selling

- expiry trading

- intraday bias

- trend identification

Reading CALL OI Buildup

Call OI ↑ → sellers are active

If price is going up BUT call OI also rising:

Smart money is expecting reversal or capping the upside

This looks like:

Price ↑

Call OI ↑

→ Weak momentum, possible reversal

Reading PUT OI Buildup

Put OI ↑ → sellers are active

If price is falling BUT put OI rising:

Smart money expects reversal from downside

Price ↓

Put OI ↑

→ Downside might reverse

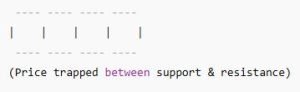

The “Struggle Zones” — When Both Call & Put OI Are High

Sometimes both Call & Put sellers are active at the same strike.

This is called:

Straddle Writers Zone

(High battle → sideways)

CALL OI ↑

PUT OI ↑

→ Sideways expected

→ Trap zone

→ Low movement

This is where smart sellers profit from time decay.

PCR (Put/Call Ratio) — Market Sentiment Meter

PCR = Put OI / Call OI

Interpretation:

✔ PCR > 1

More puts written.

Market is overly bearish → bullish reversal likely.

✔ PCR < 0.7

More calls written.

Market overly bullish → bearish reversal possible.

✔ PCR around 1

Neutral → sideways.

PCR < 0.7 → Bearish

PCR > 1.2 → Bullish

PCR ~ 1 → Sideways

Why PCR Works So Well

Because option sellers are:

- smart money

- experienced

- disciplined

- capital-heavy

- probability-based

PCR tells you which side traders are overexposed on.

If too many people expect downside (many puts written),

market often surprises the other way.

Max Pain — The Magnet of Expiry

Max Pain is the level where option buyers lose maximum money

and sellers lose minimum.

This is why the index often gravitates toward Max Pain on expiry —

because sellers hedge and adjust positions to minimize losses.

It’s not magic.

It’s math + hedging behavior.

Expiry Magnet

↓

Max Pain Strike

Example:

If Max Pain is 20,000 →

Expect expiry pinning around 19,950–20,050.

How Professionals Read the Entire Option Chain in 60 Seconds

Here’s the institutional checklist:

✔ Step 1 — Identify biggest Put OI → Support

✔ Step 2 — Identify biggest Call OI → Resistance

✔ Step 3 — Check OI change → sentiment

✔ Step 4 — Compare Call vs Put OI → directional bias

✔ Step 5 — Check PCR → sentiment

✔ Step 6 — Note Max Pain → expiry bias

✔ Step 7 — Check IV → volatility expectations

In 60 seconds,

you know where the market is likely to move.

Complete Example — Reading NIFTY Option Chain Like a Pro

Let’s say:

- Spot = 20,000

Observations:

- Put OI highest at 19,800

- Call OI highest at 20,300

- PCR = 0.92 (slightly bearish)

- Max Pain = 20,000

- IV moderate

- OI rising at 20,000 CE & 20,000 PE

- Both sides active → sideways bias

Conclusion:

Range-bound 19,800–20,300

Expiry likely near 20,000

Selling strategies ideal

Buyers avoid until breakout

This is PROFESSIONAL level reading.

Summary Table — Entire Chapter in One Look

SUPPORT = High Put OI

RESISTANCE = High Call OI

LONG BUILDUP = Price↑ + OI↑ (Bullish)

SHORT BUILDUP = Price↓ + OI↑ (Bearish)

SHORT COVER = Price↑ + OI↓ (Bullish reversal)

LONG UNWIND = Price↓ + OI↓ (Bearish reversal)

PCR < 0.7 = Bearish

PCR > 1 = Bullish

PCR ~ 1 = Sideways

MAX PAIN = Expiry Magnet

Why This Chapter Makes You 10x Better Than Most Retail Traders

Because retail traders:

- look only at price

- ignore OI

- ignore PCR

- ignore Max Pain

- ignore institutional footprints

- trade emotionally

- get trapped by sellers

You now think like:

- a market maker

- an institutional writer

- a professional hedger

- a risk manager

- a volatility trader

This chapter builds the intelligence needed for safe and consistent options trading.

⭐ CHAPTER 7 – OPTION BUYING MASTERCLASS

When to Buy, Why to Buy, Which Strikes to Choose, & How NOT to Get Trapped

Before We Begin — The Harsh Truth About Option Buying

Most beginners start their options journey with buying.

It’s cheaper.

It feels simpler.

It offers unlimited upside.

It gives adrenaline.

And the dream of turning ₹2,000 into ₹20,000 feels intoxicating.

But here’s the truth:

Option buying is the most tempting… but also the most unforgiving.

Why?

Because option buying requires:

- Correct direction

- Correct timing

- Correct speed of movement

- Correct volatility conditions

- Correct strike

- Correct exit discipline

If even ONE of these is wrong, the entire premium collapses.

This chapter will show you how to buy options the right way — like professionals do.

You’ll avoid 80% of traps beginners fall into.

Let’s begin.

What Makes Option Buying So Attractive?

Option buying offers:

✔ Low Capital

You can control exposure with a small amount.

✔ Limited Risk

Max loss = premium paid.

✔ Unlimited Reward (CE) / Large Reward (PE)

Trend trades can explode premiums.

✔ Perfect for Breakouts

Breakout = huge Gamma expansion.

✔ High Leverage

A ₹120 premium can become ₹250 in minutes.

✔ Suitable for Intraday & Swing

If rules are followed.

But beginners abuse these advantages.

Because they buy options when probability is extremely low.

We’ll fix that.

The Single Most Important Rule of Option Buying

BUY OPTIONS ONLY WHEN MARKET IS EXPECTED TO MOVE FAST.

Not slow.

Not sideways.

Not choppy.

Not confused.

Option buyers need:

- Direction

- Momentum

- Conviction

- Speed

Why?

Because buyers fight against:

- Theta decay

- IV falling

- Low Delta (if OTM)

- Whipsaws

- Noise

- Time limits

The only way to beat these forces is…

Finding strong movement.

This chapter teaches you how.

When To Buy? (The 5 Golden Conditions)

Professional option buyers enter ONLY in these 5 conditions.

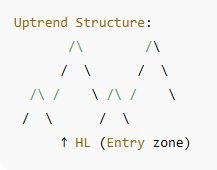

1️⃣ Strong Trend (Uptrend or Downtrend)

Nothing beats a clean trend.

If the market is trending:

- Higher highs + higher lows → Buy Call

- Lower highs + lower lows → Buy Put

Trend is your engine.

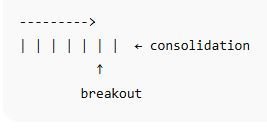

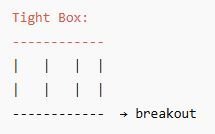

2️⃣ Breakout from Tight Consolidation

Price builds pressure →

then explodes →

Gamma expands →

Premium shoots up fast.

Buyers thrive here.

3️⃣ Low to Medium IV

Low IV means:

- premiums are cheaper

- Vega is low

- future expansion possible

Avoid buying in high IV — you’ll get IV crushed.

4️⃣ Strong Volume Confirmation

Volume = conviction.

Breakout + volume = powerful moves.

5️⃣ Support or Resistance Breaks

When price breaks an institutional level:

- Stoploss hunts

- Liquidity sweeps

- Momentum acceleration

→ Perfect for buyers.

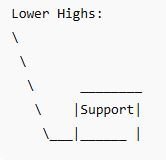

When NOT to Buy (This Saves You More Money Than Anything Else)

Option buyers MUST avoid these conditions:

❌ 1. Sideways Market

Sideways market = death for premium.

You lose:

- Theta

- Gamma

- Vega

- Patience

- Premium

—- —- —-

| | | |

—- —- —- (flat zone)

Avoid.

❌ 2. High IV Conditions

High IV before:

- events

- news

- big announcements

Premium is inflated.

Post-event → IV crashes.

Your premium collapses even if direction is correct.

❌ 3. Buying Deep OTM

Deep OTM = low Delta

= premium barely moves

= maximum decay

= highest probability of zero

Avoid unless scalping with precision.

❌ 4. Buying Late in Expiry Week (Wednesday/Thursday)

Theta kills aggressively.

ATM options lose 30–70% value in hours.

❌ 5. Buying Against Trend (The Ego Trade)

If NIFTY is trending up…

DO NOT buy puts hoping for a top.

You are fighting big players.

Which Strike to Buy? (The Delta Rule)

This is the professional rule:

**Ideal Strikes for Option Buyers:

ATM or Slight ITM**

WHY?

Because these strikes have:

- Medium to high Delta

- Good speed

- Reasonable cost

- Fast gamma expansion

- Better stability

- Less time decay impact

✔ ATM Delta ≈ 0.5

✔ ITM Delta ≈ 0.6 to 0.7

This is the golden range.

Strike Comparison — Which One Wins?

Let’s compare 3 call options when price rises 100 points:

- ITM (Delta 0.65)

Moves ≈ 65 points → Best reaction

More expensive but reliable.

- ATM (Delta 0.50)

Moves ≈ 50 points → Good reaction

Perfect for momentum.

- OTM (Delta 0.25)

Moves ≈ 25 points → Slow

Often disappointing.

ITM: ██████████████ (fast)

ATM: ████████ (medium)

OTM: ███ (slow)

Buying ITM/ATM is a superpower.

Entry Rules for Option Buying (Institutional Framework)

Here is the step-by-step professional entry checklist:

✔ Step 1: Identify market trend

Trend = engine.

✔ Step 2: Confirm breakout or breakdown

Structure first.

✔ Step 3: Check OI shift

OI increase on puts → bullish

OI increase on calls → bearish

✔ Step 4: Confirm IV is low/medium

Premium must be fairly priced.

✔ Step 5: Choose ATM or ITM strike

Delta= 0.50–0.65 is ideal.

✔ Step 6: Enter only after confirmation candle

Avoid impulsiveness.

✔ Step 7: Place stoploss (25–35% of premium)

Non-negotiable.

✔ Step 8: Exit on reversal candle

Do NOT wait for losses to grow.

This is how professionals buy options.

Exit Rules (The Mature Part That Beginners Reject)

✔ Exit Rule 1: Book profits at 30–60% gain

This protects from reversals.

✔ Exit Rule 2: Trail stoploss once premium doubles

Lock in profits.

✔ Exit Rule 3: Exit if trend weakens

Trend is your fuel.

Fuel gone = exit.

✔ Exit Rule 4: Exit before big events

Avoid IV crush.

✔ Exit Rule 5: Do NOT hold for “big move dreams”

Take what the market gives.

Buying Calls — Real Example (Simple but Powerful)

NIFTY = 20,000

Price breaks 20,050 resistance with high volume.

You buy:

20,000 CE @ ₹120

- Delta = 0.48

- IV = medium

- Trend strong

- OI shows put writing at 20,000

Within 25 minutes,

NIFTY hits 20,120.

Premium = ₹185

Exit at +65 (54% profit).

Clear, logical, repeatable.

Buying Puts — Crash Example

NIFTY = 20,000

Breaks support at 19,960

OI shows call buildup

IV rising

Volume expanding

Buy:

20,000 PE @ ₹110

NIFTY drops to 19,880

Premium jumps to ₹210

Exit with +100 (91% profit)

No guesswork.

Pure structure.

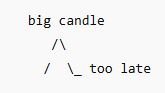

Buying on Breakouts — Example

Resistance: 20050

▲

candle breakout

▲

Buy CE

After breakout:

Strong volume

High momentum

Clean direction

Option buyer’s favorite.

Why Beginners Fail at Option Buying (Truth Bomb)

❌ They buy deep OTM

Premium doesn’t move.

❌ They buy in sideways market

Premium decays.

❌ They buy just before event

IV crush hits.

❌ They don’t understand Delta

Slow premium.

❌ They hold losers

Hoping for a miracle.

❌ They don’t follow trend

Fight the market.

❌ They buy too late

After most of the move is over.

❌ They don’t exit

Wait until premium becomes 0.

Option buying is NOT for gamblers.

It’s for traders who follow rules.

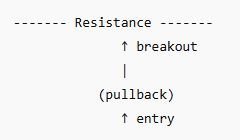

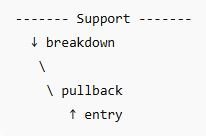

The 3 Best Setups for Option Buyers (Institutional Quality)

✔ Setup 1: Breakout + High Volume + Low IV

The premium explodes.

✔ Setup 2: Trend Continuation Pullback

Pullback enters support →

Bounce →

Enter with call (or put).

✔ Setup 3: OI Shift in Your Direction

Put OI buildup → bullish

Call OI buildup → bearish

This confirms momentum.

The Golden Rule of Option Buying

Buy only when the market MUST move.

Not “should” move.

Not “might” move.

Not “probably” move.

It must move — due to:

- breakout

- breakdown

- strong trend

- sudden OI shift

- volume burst

- structure change

If movement is uncertain, DO NOT buy.

Chapter Summary

You now understand:

- When to buy

- When NOT to buy

- Which strike to choose

- Why ATM/ITM is better

- How to use Delta

- How IV impacts buying

- How OI confirms direction

- How to enter properly

- How to exit safely

- Why beginners lose

- How to avoid traps

- Best setups

- Risk control

- Trend logic

This chapter gives you the complete blueprint for successful option buying.

From here, you are ready to learn the other side of the game:

Option Selling — where consistency and income truly come from.

⭐ CHAPTER 8 – OPTION SELLING MASTERY

The Probability Game, Time Decay Advantage & Safe Hedged Selling Techniques

Why This Chapter Matters (The Hard Truth of the Market)

The market is brutally simple:

**Option Buyers dream.

Option Sellers earn.**

Why?

Because:

- Buyers need to be RIGHT in direction + time + speed

- Sellers only need the market to not make a huge move

- Buyers fight Greeks

- Sellers profit from Greeks

- Buyers need miracles

- Sellers rely on probability and math

In fact:

**70–80% of options expire worthless.

Which means 70–80% of the time → SELLERS WIN.**

This chapter shows you why.

But we will not promote dangerous naked selling.

Everything will be taught safely, with hedges.

The Core Philosophy of Option Selling

Professionals don’t predict. They position.

Option buyers must predict:

- Up?

- Down?

- When?

- How fast?

- How big?

But option sellers do NOT predict direction.

They bet on:

- Slow market

- Sideways market

- Controlled moves

- Probability

- Time decay

- IV crush

- Range-bound behavior

Professionals sell based on statistics, not guesses.

The Mathematical Edge of Selling Options

Let’s break it down in simple logic.

When you buy an option:

- Theta hurts you

- IV crush hurts you

- Wrong timing hurts you

- Wrong direction hurts you

- Slow movement hurts you

- Sideways hurts you

- Reversal hurts you

When you sell an option:

- Theta helps you

- IV crush helps you

- Slow movement helps you

- Sideways helps you

- Small movements help you

- Time helps you

This is why professional traders make consistent returns selling options.

Why Option Selling Works (The 5 Laws of Probability)

Think of it like insurance.

✔ Law 1: Most days are NOT big-trend days

Indices trend big only 10–20% of days.

✔ Law 2: Markets stay in ranges most of the time

Perfect for sellers.

✔ Law 3: Time decay works 24/7

Sellers get paid even when nothing happens.

✔ Law 4: IV crush after events always rewards sellers

Finance 101.

✔ Law 5: Institutions hedge professionally

They sell with structure.

Not naked gambling.

Who Should Sell Options? (The Honest Answer)

Option selling is ideal for:

- disciplined traders

- risk managers

- traders with structure

- traders who follow rules

- traders who want consistent income

- not jackpot hunters

Selling is not for people who:

- refuse hedges

- want quick excitement

- can’t take slow profits

- don’t control emotions

This chapter teaches the safe, hedged way of selling.

Why Hedging Is Mandatory (The Difference Between Pro & Amateur)

UNHEDGED = Unlimited risk

A single black-swan event → account gone.

HEDGED = Limited risk

Risk is capped.

Margin is lower.

Peace of mind is high.

Institutions ALWAYS hedge.

Unhedged : Risk → ∞

Hedged : Risk → Limited

In this guide, we ONLY teach hedged selling.

The Time Decay Engine (Why Sellers Earn Even During Sleep)

Theta decay is the money-printing engine for sellers.

Theta Example

If Theta = 10,

seller earns ₹10 per day IF price stays within range.

Over weekends:

- Saturday + Sunday decay applied

- Seller earns 2 days of decay instantly

When Should You Sell Options? (The Professional Conditions)

Option sellers MUST follow these 8 conditions:

1️⃣ When IV Is High

Inflated premiums → better selling price.

2️⃣ When Market Is Range-Bound

Sideways markets are seller heaven.

3️⃣ When Volume is Stable

Low volatility helps seller positions stay safe.

4️⃣ After Major Events

Budget → results → election → Fed

IV collapses. Perfect for sellers.

5️⃣ When PCR ≈ 1

Neutral sentiment → sideways move expected.

6️⃣ When Strong Support & Resistance Exists

Sell above resistance.

Sell below support.

7️⃣ In Expiry Week (Safely)

Time decay accelerates.

Premium dies fast.

8️⃣ When You Have Hedges

Never sell naked.

The Safe Selling Rule: “Sell Where Market Will NOT Go”

Professional sellers think this way:

“Where will the market NOT go today?”

NOT where it will go.

This is the core mindset.

Example:

- Strong support at 19,800

- Strong resistance at 20,200

Sell:

- 20,300 CE

- 19,700 PE

Because probability of touching these is low.

This is where consistency is born.

The Three Master Selling Strategies (Beginner to Pro)

We will now break down:

- Credit Spreads

- Iron Condor

- Iron Fly

All hedged and safe.

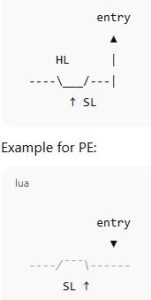

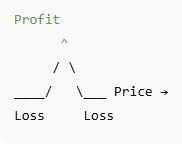

Strategy 1: Credit Spread (The Safest Option Selling Method)

A credit spread =

Sell an option + Buy further OTM option for protection.

Example:

- Sell 20,200 CE @ ₹80

- Buy 20,300 CE @ ₹40

Net credit = ₹40

Max risk = (difference in strikes – credit) = 100 – 40 = ₹60

Why this is safe:

- Risk is limited

- Margin is low

- Trend reversal won’t kill you

- Night gaps are safe

- Black swan protected

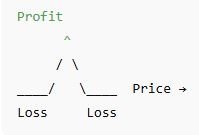

payoff:

Credit spreads are perfect for beginners.

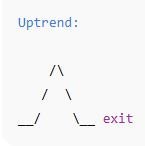

Strategy 2: Iron Condor (Sideways Income Machine)

Iron condor =

Sell OTM call

Sell OTM put

Buy further OTM call

Buy further OTM put

Structure:

Sell CE (OTM)

Buy CE (far OTM)

Sell PE (OTM)

Buy PE (far OTM)

This profits when market stays in a range.

payoff:

Best used when:

- IV high

- Market sideways

- Strong support/resistance exists

Perfect for weekly income.

Strategy 3: Iron Fly (Expiry Professional Setup)

Sell ATM straddle + hedge both sides:

- Sell ATM CE

- Sell ATM PE

- Buy higher CE

- Buy lower PE

Narrow range but HIGH reward.

Used by professional expiry traders.

Higher risk than condor, but highly profitable during consolidation.

The Five Deadly Mistakes of Sellers (Avoid These!)

❌ 1. Naked Selling

Unlimited risk.

❌ 2. Selling too close to spot

Easy to get hit.

❌ 3. Selling during low IV

Premium too small.

❌ 4. Selling without checking OI

Bad levels.

❌ 5. Holding losing trades too long

Adjust early, adjust small.

Adjustments — The Professional Skill

Professionals adjust positions, not hold blindly.

For CE side hit:

Roll call spreads upward.

For PE side hit:

Roll put spreads downward.

Adjustments reduce:

- loss

- stress

- volatility risk

This is how institutions stay consistent.

How Dhan Helps Option Sellers (Practical Advantage)

Dhan’s options platform is very friendly for selling:

✔ One-click spreads & condors

✔ Margin calculator built-in

✔ IV charts

✔ OI heatmaps

✔ Fast execution

✔ Visual payoff diagrams

✔ Auto-hedged structure builder

✔ Premium alerts

✔ Strategy Greeks display

A perfect environment for safe, systematic selling.

If you’re looking for a modern, feature-rich, and trader-friendly platform, Dhan is easily one of the best choices available today. From zero account opening charges to advanced tools like native TradingView, options strategy builder, and free API access, Dhan is clearly built with the modern Indian trader in mind.

With Dhan you can also invest and trade in IPO’s, NFO’s, SIP, Bonds, ETF, SGB, and many other financial products with so much ease.

Whether you’re an intraday trader, an options strategist, or a long-term investor, Dhan offers the perfect blend of speed, simplicity, and smart technology — without burning a hole in your pocket.

Why wait? Open your Dhan account now and take control of your trading journey with confidence.

👉 Click here to get started with Dhan

Open a Free Dhan Trading & Demat Account

Dhan offers cutting-edge tools for fast, powerful, and informed trading:

- ✅ Zero brokerage on delivery trades

- ✅ Auto-detection of candlestick patterns on charts

- ✅ Advanced Option Chain with Greeks, Max Pain, PCR & more

- ✅ Pre-built & custom Option Strategy Builder (Free)

- ✅ 20 Depth Market Data and Flash Trade execution

- ✅ Margin Trading Facility (MTF) with 4X leverage (75%)

- ✅ 3 Platforms: Mobile App, Web App & Dedicated Options App

- ✅ ScanX Screener: stock insights, trends & news

- ✅ Advanced orders: Trailing SL, Iceberg, Forever Orders

- ✅ Instantly pledge 1,500+ stocks for options margin

- ✅ Trade commodities: Gold, Silver, Crude, Natural Gas

- ✅ Fundamental + Technical analysis across all platforms

No paperwork. Zero account opening charges. Setup in minutes.

Chapter Summary

You now master:

- Why selling works

- Why sellers earn consistently

- Time decay advantage

- IV crush advantage

- Safe selling conditions

- Credit spreads

- Iron condor

- Iron fly

- Risk management

- Adjustments

- Professional mindset

- Seller psychology

This chapter turns a beginner into a professional-style income trader.

You now understand:

**Option Buying = engine

Option Selling = stabilizer**

Both are needed at different times.

⭐ CHAPTER 9 – THE 17 MOST COMMON BEGINNER MISTAKES

(And How to Avoid Every Single One of Them)

Why This Chapter Is a Turning Point

Options trading is NOT difficult.

But beginners make it difficult by:

- choosing wrong strikes

- buying at wrong times

- selling at wrong times

- ignoring Greeks

- ignoring IV

- misunderstanding OI

- mistiming entries

- mismanaging exits

- overtrading

- ego trading

- gambling with deep OTM

- refusing hedges

This chapter acts as a mirror.

It shows everything beginners do wrong…

and teaches the exact fix.

By the end, you’ll trade with the clarity of a professional.

Let’s go.

⭐ BEGINNER MISTAKE #1

Buying Deep OTM Options (The Lottery Addiction)

Beginners see:

- CE at ₹5

- PE at ₹8

- CE at ₹3

- PE at ₹2

And think:

“When this becomes 50 rupees, I will be rich.”

But they don’t understand:

- Delta is too low

- Movement is too slow

- Time decay is very fast

- Probability is extremely low

Deep OTM is NOT a trade.

It is a lottery ticket.

✔ FIX:

Buy ATM or slight ITM only.

⭐ MISTAKE #2

Buying in Sideways Markets

Beginners think:

“Market toh upar neeche hota hi rahta hai… let me buy.”

Wrong.

Sideways market =

Theta massacre + Delta stagnation = Premium collapse

—- —- —-

| | | |

—- —- —-

Premium dies.

✔ FIX:

Buy only when:

- Breakout

- Breakdown

- Trend continuation

- High volume expansion

⭐ MISTAKE #3

Buying in High IV (Just Before Events)

Events like:

- Budget

- Elections

- RBI meeting

- Fed meeting

- Earnings

inflate IV massively.

Premiums are heavy, fat, bloated.

After event → IV crush

Premium collapses even if direction is correct.

✔ FIX:

Do NOT buy options before major events.

Buy AFTER event when IV drops.

⭐ MISTAKE #4

Not Understanding Greeks

Beginners trade “naked”:

- No Delta understanding

- No Gamma awareness

- No Theta knowledge

- No Vega caution

- No IV logic

This is like driving without brakes or mirrors.

✔ FIX:

Use the Greek cheat-sheet:

- Buyers → Focus on Delta & Gamma

- Sellers → Focus on Theta & Vega

⭐ MISTAKE #5

Choosing Wrong Strikes

Beginners love:

- Deep OTM (cheap, but useless)

- Too narrow ITM (slow, expensive)

- Far ATM or random picks

✔ FIX:

Follow the Delta rule:

- Buy → Delta 0.50–0.65

- Sell → Delta 0.15–0.25

Professionals ALWAYS use this.

⭐ MISTAKE #6

Averaging Losing Options

This is suicide.

If premium falls from ₹120 → ₹80 → ₹40 → ₹20 → ₹5

DO NOT average.

Options decay fast.

Averaging accelerates the loss.

✔ FIX:

Set a hard stoploss (25–35% of premium).

Exit instantly.

NEVER average losers.

⭐ MISTAKE #7

Buying Too Late (After Most of the Move Happened)

Beginners join AFTER momentum is over.

They buy at the top.

Then premium collapses on normal pullback.

✔ FIX:

Enter early in the trend:

- On breakout

- On breakout retest

- On structure change

- When volume appears

- When OI shifts

⭐ MISTAKE #8

Holding Losing Trades Hoping for a Miracle

The market doesn’t care about hope.

If structure breaks:

GET OUT.

Options require small, quick, mechanical decisions.

✔ FIX:

Set one exit rule:

“If the candle closes against my direction → EXIT.”

⭐ MISTAKE #9

No Stoploss for Option Buying

Premium can collapse 40–70% in minutes.

Without stoploss you will:

- wipe capital

- lose discipline

- lose confidence

- hate trading

✔ FIX:

Use a stoploss ALWAYS:

- Fixed % (25–35%)

- Or based on structure

- Or based on points

⭐ MISTAKE #10

Overtrading (The Emotional Spiral)

Beginners think:

- “One more trade.”

- “I’ll recover this loss now.”

- “Almost reached target.”

- “Aaj toh market de hi dega.”

Overtrading turns winners into losers.

✔ FIX:

MAX 2–3 trades per day.

MAX 1 expiry trade.

Stop after major win or major loss.

⭐ MISTAKE #11

Trading Against Trend (Ego Trading)

Beginners short in uptrend.

Buy calls in downtrend.

Hope for reversals.

This is ego, not trading.

✔ FIX:

Follow the structure:

- Higher highs & lows → Calls only

- Lower highs & lows → Puts only

- Sideways → No buying

⭐ MISTAKE #12

Not Understanding OI (Open Interest)

Beginners ignore OI.

Professionals check:

- Put OI for support

- Call OI for resistance

- OI buildup for direction

- OI exit for reversals

✔ FIX:

Use Option Chain every day:

- High Put OI → Support

- High Call OI → Resistance

- Both high → Sideways

⭐ MISTAKE #13

Holding Options Till Expiry (Dangerous)

Theta explodes.

Gamma creates whipsaws.

Premium collapses unexpectedly.

✔ FIX:

If you’re a beginner:

- Do NOT buy options on expiry

- Do NOT hold till the last hour

- Do NOT expect miracles

⭐ MISTAKE #14

Selling Without Hedge (Unlimited Risk)

Unhedged selling =

One black-swan → Account gone.

Professionals NEVER do this.

✔ FIX:

Use hedges:

- Credit spreads

- Iron condors

- Iron flies

Always limited risk.

Lower margin.

Low stress.

⭐ MISTAKE #15

Entering Without Confirmation

Beginners enter:

- in anticipation

- in hope

- without structure

- without trend

- without breakout

- without volume

✔ FIX:

Before entering, ask:

“Is the market forced to move right now?”

If answer is NO → do NOT trade.

⭐ MISTAKE #16

No Exit Plan

Beginners have no clarity on:

- When to book profit

- When to exit loss

- When to cut quickly

- When to trail

- When to stay

- When to walk away

✔ FIX:

Use this simple rule:

**BOOK PARTIAL profits at 30–40%

BOOK FULL profits at 60–80%**

And:

Exit losers at –25% stoploss

⭐ MISTAKE #17

Trading Without Position Sizing

Beginners trade with:

- random lot sizes