What Is the Stock Market & How It Really Works

The Real Beginning — The Money Game Nobody Taught Us

Imagine you’re sitting in your classroom.

Math period.

Your teacher writes on the board:

₹10,000 → ? (after 10 years)

and asks everyone what this will grow into if you just save it in your home locker.

Everyone guesses:

“₹10,000 only… maybe ₹11,000… maybe ₹12,000.”

Then she writes again:

₹10,000 → ₹31,058 (after 10 years at 12% yearly growth)

And the whole class is shocked.

“HOW?!”

This is exactly what the stock market does.

The stock market is NOT:

❌ Gambling

❌ A casino

❌ A shortcut to becoming rich

❌ A place where only ‘experts’ make money

It is simply a place where you become a tiny owner of India’s best companies.

If you invest in HDFC Bank, you become a tiny owner of HDFC Bank.

If you invest in TCS, you become a tiny owner of TCS.

If you invest in Reliance, you become a tiny owner of Reliance.

And when these companies grow, YOU grow.

🌱 What Exactly Is a Company?

Let’s imagine you and your friend start a lemonade stall at the school gate.

You need:

✅ Lemons

✅ Sugar

✅ Cups

✅ Ice

✅ A table

But you don’t have money.

So your three classmates give you:

-

Rahul: ₹300

-

Priya: ₹300

-

Ayesha: ₹400

Total ₹1,000 = your startup funding.

You say:

“Okay, I will give your money back and ALSO share the profit.”

That profit sharing = ownership.

You divide it into 10 parts (shares) of ₹100 each.

So your friends now own:

-

Rahul → 3 shares

-

Priya → 3 shares

-

Ayesha → 4 shares

These shares represent their ownership.

Now imagine the lemonade stand becomes super popular.

You earn great profits.

Suddenly each share becomes worth ₹150.

Rahul bought 3 shares for ₹300.

Now those are worth ₹450.

This is the stock market — ownership and growth.

🏛️ What Is the Stock Market Really? (And Why It Exists)

The stock market exists for two reasons:

✅ 1. Companies Need Money

Big companies raise money from the public instead of only borrowing from banks.

This is done through:

-

FPOs (Follow-on Public Offerings)

✅ 2. People Need a Place to Grow Their Money

Instead of keeping money in a locker or bank at low interest, you can:

✅ Grow with businesses

✅ Earn from compounding

✅ Build wealth

✅ Beat inflation

It’s a win-win.

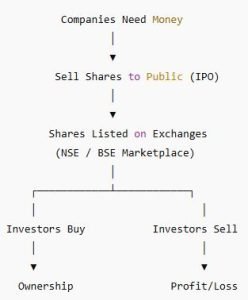

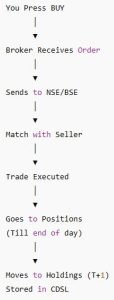

🔄 The Full System in One Simple Diagram

Here’s how everything flows:

You are basically participating in the growth engine of the country.

🧠 Trading vs Investing — The REAL Difference

🎯 Investing: The Long-Term Student

Imagine you plant a mango tree.

You water it daily.

It doesn’t grow much in 2 weeks.

It doesn’t grow much in 2 months.

But in 5 years — it becomes massive, gives shade, gives fruits.

That’s investing.

You buy good companies.

You hold them.

You let them grow.

⚡ Trading: The Short-Term Gamer

Trading is like playing cricket highlights — fast, exciting, quick.

Buy at ₹100

Sell at ₹103

Profit ₹3 per share

Exit

Done

Trading depends on:

-

Price movement

-

Timing

-

Charts

-

Patterns

It’s a skill game.

Not luck.

Not magic.

Not gambling.

But it needs:

✅ Risk control

✅ Discipline

✅ Patience

✅ Experience

🔍 Which One Should a Beginner Choose?

(Explained very honestly)

✅ If you’re a complete beginner:

Start with investing.

✅ If you’re curious about trading:

Learn slowly.

Trade tiny amounts.

Never trade without stop-loss.

Avoid F&O initially.

✅ The best approach:

Be 90% investor

and

10% learner trader

That’s the safest path.

📈 How Compounding Actually Works (Simple Explanation)

Most people misunderstand compounding.

Let’s break it down with a Class-10 level example.

Imagine:

You invest ₹5,000 every month

for 10 years

at 12% yearly return

Your total investment = ₹6,00,000

Your maturity amount ≈ ₹11.6 lakh

You earned ₹5.6 lakh without doing anything.

Look at the appreciation:

Most money comes in the later years.

That’s compounding.

What You Need to Start (Only Four Things)

Here are the four items:

That’s all.

You don’t need:

❌ Office visit

❌ Paperwork

❌ Cheque book

❌ Salary slip

❌ High income

❌ Experience

In India, opening a Demat account is completely online and takes 10 minutes.

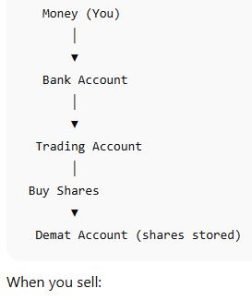

📦Understanding the Three Core Accounts

✅ 1. Bank Account

Your money lives here.

✅ 2. Trading Account

You place BUY/SELL orders from here.

✅ 3. Demat Account

Your shares stay safe here.

Here’s the simple diagram:

Demat → Trading → Bank

✨ PART 1 Summary

✅ Now you understand:

✔ What is a company

✔ Why stock markets exist

✔ What is ownership

✔ How investing works

✔ How trading works

✔ Difference between the two

✔ Compounding

✔ What documents you need

✔ How Bank → Trading → Demat flow works

Next, we move to:

✅ PART 2 : Opening the Demat Account, Choosing Broker, KYC, Safety, Charges, Recommended Broker Section

✅Opening Your Demat & Trading Account (The Real A–Z Guide for Indian Beginners)

⭐ What Exactly Is a Broker?

Imagine a big supermarket.

Inside the supermarket:

-

You pick stuff

-

You put it in your cart

-

You go to the counter

-

They scan items

-

You pay

-

You get your items

Now imagine stocks instead of groceries.

NSE/BSE = The giant supermarket

Brokers = The counters

Trading app = Your shopping cart

Demat account = Your bag

You can’t directly walk into NSE or BSE and start buying.

You need a broker, who connects YOU to the stock exchange.

Brokers are like:

✅ Delivery agents

✅ Cashiers

✅ Software providers

✅ Custodians

✅ Middlemen between you and the exchange

But unlike your grocery store cashier, brokers are regulated by SEBI and exchanges.

⭐ Broker Types in India (Detailed Breakdown)

There are TWO kinds of brokers:

✅ 1. Discount Brokers

Like:

They offer:

✅ Low brokerage fees

✅ Clean, simple apps

✅ No research reports usually

✅ Fast account opening

✅ Good for beginners

✅ Great for traders and investors

Think of them as affordable online classrooms.

✅ 2. Full-Service Brokers

Like:

-

Kotak Securities

-

HDFC Securities

They offer:

✅ Research reports

✅ Relationship managers

✅ Higher charges

✅ Older, traditional systems

Think of them like private tuitions — more expensive, more hand-holding.

⭐ How to Choose the Best Broker (The Real Factors That Actually Matter)

Most beginners choose brokers based on:

❌ YouTube ads

❌ Famous faces

❌ Random Telegram opinions

This is wrong.

Here’s the REAL list that matters.

✅ Factor 1: Brokerage Charges

Brokerage = fee charged per trade.

In India:

-

Most brokers charge zero brokerage for delivery

-

Intraday & F&O = small charges (₹10–₹20 per order)

This matters because brokerage directly affects profits.

✅ Factor 2: DP Charges

DP = Depository Participant.

DP charges apply when you sell shares in delivery.

Usually ₹13.5–₹20 per scrip.

Some brokers absorb it.

Some charge more.

✅ Factor 3: Account Opening & AMC

Account opening:

-

Mostly free nowadays

AMC (Annual Maintenance Charge):

-

Some brokers = ₹0

-

Some charge ₹300–₹500 per year

-

Some charge only if inactive

✅ Factor 4: App Stability

You need:

✅ App that doesn’t crash on volatile days

✅ Fast order execution

✅ Simple UI

✅ Good charts

Few things are more painful than:

💀 Press BUY → App hangs

💀 Press SELL → Order rejected

💀 SL not triggered because of lag

This is where the top brokers shine.

✅ Factor 5: Safety & Regulations

BROKER SAFETY IS THE MOST IMPORTANT.

Your broker must:

✅ Be registered with SEBI

✅ Be a member of NSE & BSE

✅ Be connected to CDSL or NSDL

✅ Follow the pledge/re-pledge norm (introduced after Karvy scam)

✅ Have separate client funds & broker funds

✅ Show CDSL TPIN & OTP before share selling

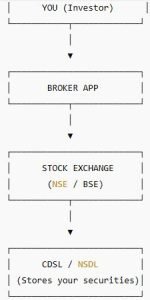

⭐ Behind the Scenes — What Happens When You Click “BUY”

Most beginners think:

Buy → Order placed → Done

But here’s the actual process:

You Press BUY

│

▼

Order sent to Broker

│

▼

Broker sends to Exchange (NSE/BSE)

│

▼

Matching Engine tries to find Seller

│

▼

Trade Executed (Matched)

│

▼

Confirmation sent back to Broker

│

▼

Shares go to Your Demat (T+1)

When you sell, the opposite process happens.

⭐ Depository System — CDSL & NSDL

Think of CDSL/NSDL as India’s digital lockers for shares.

Your broker DOES NOT hold your shares.

They only provide an interface.

Your shares are actually stored with:

✅ CDSL (preferred)

or

✅ NSDL

If Zerodha closes tomorrow → your shares still stay safe

If Upstox shuts down → your shares still stay safe

If Groww disappears → your shares still stay safe

Because they live in CDSL/NSDL, not inside the broker.

This is the biggest security of the Indian markets.

⭐ Step-by-Step Demat Account Opening (FULL WALKTHROUGH)

Let’s now go step-by-step.

✅ STEP 1 — Mobile Number + Email Verification

You enter:

-

Mobile

-

Email

You receive 2 OTPs.

This ensures:

✅ Your identity

✅ Your contact channels

✅ Spam prevention

✅ STEP 2 — PAN Verification

You enter:

-

PAN number

-

DOB

System pulls your data from the Income Tax database.

Why PAN?

✅ PAN = unique identity for all financial transactions

✅ SEBI requires it

✅ Brokers need it for tax reporting

✅ STEP 3 — Aadhaar + eKYC

Two types:

✅ 1. Aadhaar OTP-based eKYC

Fastest

100% online

Most common

✅ 2. Offline DigiLocker eKYC

Used when mobile not linked

Documents uploaded manually

Your Aadhaar verifies:

✅ Name

✅ Address

✅ DOB

✅ Identity

✅ STEP 4 — Bank Account Linking

You upload:

-

Bank statement / passbook

-

Cancelled cheque (not mandatory in many brokers)

Why this matters:

✅ Withdrawals go ONLY to this bank

✅ Safety (prevents fraud)

This prevents someone from:

❌ Depositing from stolen accounts

❌ Withdrawing to someone else’s bank

✅ STEP 5 — Signature Upload

You sign on white paper and upload.

Why?

✅ Prevents fake usage of your account

✅ Matches your legal identity

✅ Required for eSign agreements

✅ STEP 6 — IPV (In-Person Verification)

You record a short video.

Typical instructions:

-

Say your name

-

Show your PAN

-

Look into camera

-

Blink

-

Move head slightly

This ensures you’re a real person.

✅ STEP 7 — eSign via Aadhaar

You will sign:

-

Demat form

-

Trading agreement

-

Rights & obligations

-

Risk disclosure documents

All via Aadhaar OTP.

✅ STEP 8 — Activation

Usually within:

- Same day for most brokers

You will receive:

✅ Login ID

✅ Password

✅ CDSL TPIN

CDSL TPIN is used whenever you SELL shares — for safety.

⭐ Comparison Table — India’s Top Brokers

Here is a detailed comparison

Feature |

Dhan |

Upstox |

Zerodha |

Fyers |

Groww |

|---|---|---|---|---|---|

Brokerage |

₹20/order |

₹20 |

₹20 |

₹20 |

₹20 or 0.05% |

Account Opening |

Free |

Free |

Paid (₹200) |

Free |

Free |

TradingView Integration |

✅ Native |

⚙️ Partial |

❌ |

✅ Built-in |

❌ |

API Access |

✅ Free |

Paid |

Paid |

Free |

❌ |

Options Strategy Builder |

✅ Advanced |

Limited |

❌ |

✅ Basic |

❌ |

Speed |

⚡ Ultra-fast |

Fast |

Moderate |

Fast |

Average |

Margin (MTF) |

✅ 4× |

✅ 4× |

❌ |

✅ 4× |

❌ |

Verdict:

Dhan beats most brokers on speed, tech, and trader tools — especially for intraday and options trading.

-

Visit https://dhan.co

-

Click “Open Free Account”

-

Upload PAN, Aadhaar & bank details

-

Complete eSign using Aadhaar OTP

-

Start trading instantly (no paperwork)

💥: Open Free Dhan Account Now – 100% online in under 5 minutes.

✅ ★ Recommended Broker for Beginners in India

If you’re serious about intraday or options trading, Dhan is currently the best choice in India (2025).

It’s not just another discount broker — it’s a trader-first platform built around precision, analytics, and automation.

✅ Best for:

-

Intraday traders and Investor

-

Options strategists

-

Algo traders & scalpers

Overall Rating: ⭐ 9.6/10

⚡ Ready to trade like a pro?

👉 Open Free Dhan Trading & Demat Account Now

Zero paperwork. Zero opening charges. Instant setup.

Dhan also offers different financial instrument to trade and invest such as Mutual Funds IPO’s, NFO’s, ETF, SGB, Bonds etc.

All Key Features of Dhan:

Trusted by 2 million+ users, Dhan has become the go-to trading app for traders and investors looking for speed, advanced tools, reliability, and excellent customer support.

Whether you’re a beginner or a seasoned pro, Dhan offers an all-in-one trading platform designed to simplify your investment journey in the Indian stock market.

- Dhan have 3 trading platform for all devices known as Dhan App for Mobile, Dhan for desktop web version and dedicated option trading platform (Web + App) by dhan. You can do fundamental as well as technical analysis quite easily on all its platform.

- Pre-Built Option Trading Strategies for FREE plus customized Option strategy builder which you won’t be getting at any other broker.

- You can Invest and trade in all segments at Dhan broker i.e. Equity (Stocks), FNO, Commodity, Currency on NSE, BSE & MCX.

- One of the USP of Dhan is it’s brokerage structure, brokerage charges are kept at decent Rs 20 or 0.03% (Whichever is lower) per order.

- There are no brokerage charges for delivery based trades at Dhan.

- Dhan also gives Margin Trading Facility (MTF) for up to 4X leverage (75% funds) from Dhan for Equity Delivery trading. You can buy 950+ stocks and hold them for unlimited period of time.

- With Dhan you can also invest and trade in IPO’s, NFO’s, SIP, Bonds, ETF, SGB, and many other financial products with so much ease.

- Recently Dhan have also made tie up with smallcase for making portfolio based investment moreover they do have a stock recommendation tool as well which gives long term investment ideas known as Stratzy.

- Dhan App have been downloaded on playstore for more than 1 million with a user rating of 4.5 which also shows the trust they have created among users within small time period.

- Dhan also offers another feature known as WelathBasket, it is a basket of stocks/ETFs, based on a strategy, theme or idea. WealthBaskets are professionally managed and help you invest in Stock Markets in a systematic way.

- Dhan has also partnered with Tactic who provides Trade Ideas & Strategies of top SEBI registered traders in currently 3 modes – Intraday, Positional & BTST. This feature will greatly help the new as well as experience traders.

- 1Cliq by oipulse is integrated with Dhan which helps fast traders to identify trends especially scalpers. You can have trade execution with pre defined SL, auto Trailing SL, MTM target and stop loss are some of it’s amazing features.

- Dhan also has Auto-Detection of Candlestick Patterns on Charts on their trading platform which means charts will now automatically recognize & display the names of 37 widely known Candlestick Patterns. Combine this with dhan other features like 20 Depth Data, Price Alerts, Import Watchlists, etc. you have enough data to help you with your trades.

- There are different types of orders available at dhan such as forever, after market, basket order and lot more.

- For a limited time period you can open a Free Dhan trading/demat account with Zero Annual Maintenance Charges online here.

- If we talk about Margin at Dhan, after SEBI Rules on Intraday margin every stockbroker is giving same margin of 5X throughout India, hence this does not matter anymore.

- Overall, Dhan is best for intraday traders as well as investors as the brokerage is very less, moreover the trading platform is best and available with all tools and resources in all 3 versions.

If you’re serious about trading, don’t compromise on tools or speed.

🔥 Open Your Free Dhan Account Today & Start Trading Smarter →

If you’re a trader or want more control over execution, charts, and speed.

Dhan is not just another discount broker — it’s genuinely innovating, especially for the next-gen Indian trader.

If you’re tired of clunky trading platforms and want modern, high-speed trading with transparent fees — Dhan is one of the best stockbrokers in India today.

According to the latest NSE reports there are about 200+ stock brokers in India, however what makes Dhan a leading and strong contender in the stock broking industry is the tools and resources they have in their trading platform.

Moreover there are no hidden charges and the brokerages are very minimal if we do the industry comparison. They are also backed by cash enriched investors so nothing to fear.

If I have to rate Dhan app after looking at there breakthrough pricing model for brokerages as well as other charges and experiencing there simple yet great user interface for trading platform I would give it 9.6 out of 10.

There’s never been a better time to take control of your financial future and with Dhan, you get the fastest, most reliable, and feature-packed stock broker app in India for 2025.

Whether you’re a beginner eager to start investing or an experienced trader seeking advanced tools and zero brokerage on delivery trades, Dhan has everything you need to succeed.

Don’t settle for less. Join over 2 million + satisfied users who trust Dhan to power their trading journey every day. With zero account opening fees, free access to multiple platforms, and dedicated customer support, the path to smarter trading has never been easier.

🚀 Ready to Elevate Your Trading Game?

Start your journey with Dhan — India’s fastest, most reliable, and user-friendly stock broker app trusted by over 1 million users.

No hidden fees. No complicated processes. Just smart, seamless trading.

It takes less than 5 minutes to sign up and start trading.

⭐ Safety Rules You MUST Know Before Using a Broker

Let’s make this extremely simple.

✅ Rule 1 — Never Share Your CDSL TPIN

This is the PIN used to sell shares.

If someone gets it, they can sell your holdings.

✅ Rule 2 — Always Use 2FA Login

Use:

✅ PIN

✅ Biometric

✅ App passcode

✅ Rule 3 — Never Allow Remote Access to Anyone

NEVER use:

❌ AnyDesk

❌ TeamViewer

This is how 90% of frauds happen.

✅ Rule 4 — Your Money & Shares Are Safe Even if Broker Shuts Down

Why?

Because:

✅ Shares = in CDSL/NSDL

✅ Funds = kept in segregated accounts

✅ SEBI monitors everything

✅ Rule 5 — Check Broker Complaints Before Choosing

Visit:

-

NSE website

-

BSE website

-

SEBI SCORES

-

Google Play Store ratings

Check for:

✅ App freeze

✅ Withdrawal delays

✅ Repeated technical issues

⭐ A Visual Flowchart — Entire Demat + Trading System

You now deeply understand:

✔ Brokers

✔ Regulations

✔ Safety

✔ CDSL/NSDL

✔ KYC

✔ Account opening

✔ Behind-the-scenes execution

✔ Full tables

✔ Mid-article recommended broker section

Next, we move to:

✅ PART 3 — Order Types, Charges, Product Types, Your First Trade

✅ Order Types, Product Types, Charges & Your First Real Trade (The Most Important Beginner Chapter)

⭐Before You Place Your First Trade — Understand “How Prices Move”

Before learning buttons like:

-

Market

-

Limit

-

Stop loss

-

CNC

-

MIS

…you must understand why prices change, otherwise you will always be confused.

✅ Why do stock prices go up or down?

Simple:

Price goes UP when buyers are more aggressive than sellers.

Price goes DOWN when sellers are more aggressive than buyers.

It’s not magic. It’s not luck.

It’s just demand and supply.

Imagine:

-

You want to buy a cricket bat.

-

The shop has 5 bats.

-

Suddenly 10 people want the same bat.

-

Shopkeeper increases price.

Same thing happens with stocks.

⭐ What Is a Candle? (The Building Block of Trading Charts)

Whenever you see a chart in any app, you see candles.

They look like this:

Let’s break it down in Class-10 English:

✅ 1. The “body”

Shows price movement from opening to closing.

✅ 2. The “wick/shadow”

Shows highest & lowest price in that period.

✅ 3. Green candle = price went UP

✅ 4. Red candle = price went DOWN

That’s it.

A red candle doesn’t mean a company is dying.

A green candle doesn’t mean a company is becoming a unicorn.

It’s simply buyers vs sellers.

⭐ Two Major Types of Market Participants

(You need to know this before placing orders)

There are only two types of people in markets:

✅ Investors → Slow, long-term

✅ Traders → Fast, short-term

Investors don’t care if today’s candle is red or green.

Traders care deeply.

Because traders earn from movement, not holding.

⭐ Order Types Explained Like You’re in School

Let’s dive into the heart of placing orders.

Most apps show:

✅ Market

✅ Limit

✅ Stop-loss

✅ SL-M

✅ GTT

✅ AMO

Let’s break each one down like a story.

✅ 1) MARKET ORDER (The “Buy Right Now” Button)

A Market Order means:

“Buy/sell at the best available price right now.”

Example:

You want to buy Reliance.

Current price: ₹2,400

You press:

✅ Buy

✅ Quantity: 1

✅ Market Order

✅ Confirm

The order executes instantly.

But maybe you get:

-

₹2,401

-

₹2,399

-

₹2,402

Why?

Because prices are constantly moving.

✅ Use Market Order ONLY when:

-

The stock is liquid (big companies)

-

You want an immediate entry

-

Small quantity

❌ Do NOT use Market Order when:

-

The stock is low-volume

-

You want control over price

-

You are trading options (big danger)

✅ 2) LIMIT ORDER (The “Buy at EXACT Price You Want” Button)

Limit order means:

“I want to buy only at X price or better.”

Example:

Stock is ₹100.

You think a fair price is ₹98.

You place:

✅ Limit Order at ₹98.

If price drops → Your order gets executed.

If price doesn’t drop → No trade.

This is the safest type for beginners.

✅ 3) STOP LOSS (SL) — Your Safety Seatbelt

If you drive a car, you wear a seatbelt.

You don’t wear it because you expect an accident —

You wear it because IF something happens, you’re protected.

Stop-loss does the same for trading.

✅ Example:

You bought Infosys at ₹1,500.

You want to risk only ₹50 per share.

Set SL at ₹1,450.

If price touches ₹1,450 → Auto-sell → You are safe.

Without SL:

Stock could fall to ₹1,300… ₹1,200… ₹1,000…

This is how most beginners lose money.

✅ 4) SL-M (Stop-loss Market)

SL-M = Stop-loss MARKET.

Means:

“If the price hits my SL, sell at market price.”

This ensures execution.

Good for stocks with enough liquidity.

✅ 5) GTT (Good Till Triggered)

Think of GTT as:

“A standing instruction for months.”

Example:

ITC is at ₹470.

You want to buy only if it drops to ₹420.

Set a GTT BUY at ₹420.

If stock touches 420 anytime in coming months → Order triggers.

Same for selling.

GTT is like:

✅ Reminder

✅ Auto-trader

✅ Wish-list with conditions

✅ 6) AMO (After Market Order)

Used to place orders when markets are CLOSED.

Market closes at 3:30 PM.

At 8 PM you realize:

“I want to buy TCS tomorrow morning at ₹3,500.”

Place:

✅ After Market Order (AMO)

✅ Limit price: ₹3,500

✅ Quantity: 1

It will be executed next morning after 9:15 AM.

Useful for people with jobs or school.

⭐ Product Types — CNC, MIS, NRML (The Real Meaning)

Every time you buy, your app asks:

-

CNC

-

MIS

-

NRML

-

CO/BO

Let’s explode the confusion.

✅ 1) CNC — Cash & Carry (Long-term Investing Mode)

CNC means:

✅ You are buying the share

✅ It moves to your Demat

✅ You can hold it for years

✅ No auto-square off

✅ No leverage

If you are an investor → ALWAYS select CNC.

✅ 2) MIS — Margin Intraday Square-Off

MIS means:

✅ Buy/sell for intraday only

✅ Auto square-off around 3:20 PM

✅ Slight leverage

✅ High risk

✅ Not for beginners

Imagine:

You buy at 9:30 AM

Price moves till 3 PM

But your MIS position MUST be closed today.

This is like borrowing a pencil from your friend:

“I’ll return it before school ends.”

✅ 3) NRML — Overnight F&O Trades

NRML is used when:

✅ You trade Futures

✅ You SELL options (writing)

✅ You want to hold position overnight

✅ You have enough margin

Beginners → IGNORE NRML.

Futures & Options are extremely risky if you don’t know what you’re doing.

⭐ Understanding Charges (FULL Breakdown)

This is where most blogs give short bullet points.

We will explain every charge like a teacher explaining a Math’s word problem.

Charges apply on every buy/sell.

Let’s say you buy:

1 share of Infosys @ ₹1,500

Let’s break the charges:

✅ 1) Brokerage

Fee taken by broker.

For Delivery (CNC):

✅ Most brokers: ₹0

For Intraday or F&O:

✅ ₹20/order (flat)

✅ 2) STT (Security Transaction Tax)

Government tax.

-

On equity delivery BUY: 0.1%

-

On equity delivery SELL: 0.1%

STT is the cost of investing in India.

✅ 3) Exchange Transaction Charges

NSE/BSE charge tiny fee per trade.

Very small, but compulsory.

✅ 4) GST

18% on brokerage + exchange charges.

NOT on entire trade.

✅ 5) Stamp Duty

State-level tax.

Tiny.

✅ 6) DP Charges

This is important:

✅ DP charges apply ONLY WHEN SELLING shares in CNC.

✅ Around ₹13.5–₹20 per scrip.

If you sell 5 stocks in same company → only 1 DP charge applies.

⭐ A FULL TRADE EXAMPLE (with Real Numbers)

Let’s say:

✅ You buy 10 shares of ITC at ₹450

✅ Total = ₹4,500

Charges:

-

Brokerage: ₹0

-

STT: ₹4.50

-

Exchange: ₹0.30 (approx)

-

GST: ₹0.05

-

Stamp duty: ₹0.10

Total charges ≈ ₹4.95

If you SELL at ₹460:

-

Profit per share = ₹10

-

Total profit = ₹100

-

Charges = ₹4–₹8

-

DP Charge = ~₹15

-

Net Profit ≈ ₹77–₹81

This is realistic.

⭐Step-by-Step — Your First Trade as a Beginner

Let’s walk you through EXACTLY what you will see in the app.

✅ Step 1: Search the Stock

You type “HDFC Bank”.

You see:

-

Chart

-

Price

-

Buy/Sell

-

Market depth

✅ Step 2: Click BUY

App shows:

-

Market / Limit

-

CNC / MIS

-

Quantity

-

Trigger price (if using SL)

✅ Step 3: Choose CNC

Because you want to invest.

✅ Step 4: Choose LIMIT

Set your price, e.g. ₹1,480.

✅ Step 5: Confirm

Order goes to exchange.

✅ Step 6: Execution

If price drops to ₹1,480:

✅ Your order fills

✅ Shares show in “Positions”

✅ Next day it moves to “Holdings”

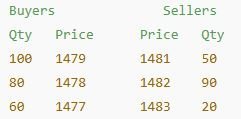

⭐ Market Depth — Understanding Buyers & Sellers

Market depth looks like this:

This shows:

✅ Where buyers want to buy

✅ Where sellers want to sell

Useful for:

✅ Intraday

✅ Scalping

✅ High-speed trading

Not important for long-term investing.

⭐ FULL ASCII Flow — Your First Buy

Beautiful system, fully regulated.

You now fully understand:

✔ Order types

✔ CNC, MIS, NRML

✔ Charges

✔ Your first trade

✔ Market depth

✔ Charts & candles

✔ Example trades

✅ PART 4 (Next): All Products — Stocks, ETFs, Mutual Funds, IPOs, Bonds, SGBs, Gilt Funds, F&O

✅ All Investment & Trading Products in India

⭐ The Big Picture — What Can You Actually Buy in the Indian Market?

Think of the stock market like a giant shopping mall.

Inside it, you have:

✅ Stocks (shares of companies)

✅ ETFs

✅ Mutual Funds

✅ IPO Shares

✅ Gold Bonds

✅ Government Bonds

✅ Corporate Bonds

✅ Treasury Bills

✅ REITs & INVITs

✅ Derivatives (Futures & Options)

Most beginners only know about “shares”.

But the Indian market is WAY bigger.

This chapter will explain each item in this mall, using stories, examples, visuals, tables.

⭐ STOCKS — Owning a Piece of a Company

Let’s start with the simplest word:

Stock = A tiny part of a company.

Owning 1 share of Reliance means:

You own 1 small piece of Reliance Industries Ltd.

Even Mukesh Ambani cannot stop you from attending AGM (yes, it’s true).

✅ Why do stock prices go up?

Because the company grows.

That growth comes from:

-

Increasing profits

-

New products

-

Expansion

-

New customers

-

Better management

-

Strong economy

Stocks follow businesses, not magic.

✅ Why do stock prices fall?

Because:

-

Company performs badly

-

India’s economy slows

-

Global markets crash

-

News/panic

-

Poor results

-

Scams

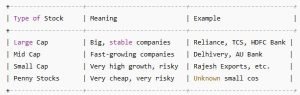

✅ Types of stocks (explained simply)

Here’s a clean table:

Beginners should stick to Large caps and Index ETFs.

✅ How to buy your first stock

Example:

You want to buy 1 share of ITC.

Steps:

-

Search “ITC” in your broker app

-

Check the chart

-

Press BUY

-

Select CNC (long-term)

-

Select LIMIT

-

Enter quantity: 1

-

Enter price: e.g. 450

-

Confirm

Congratulations — you now own a part of ITC.

⭐ ETFs — The “Smart Basket” of Investing

Think of ETFs as:

One share that contains MANY companies.

Example:

Nifty 50 ETF includes 50 of India’s top companies.

You buy one ETF unit → You automatically own parts of 50 companies.

✅ Why ETFs are perfect for beginners

✅ No need to pick stocks

✅ Low risk

✅ Low fees

✅ Highly diversified

✅ Recommended globally

✅ Easy to understand

✅ Popular ETFs in India

✅ Example: Buying a Nifty 50 ETF

Suppose Nifty 50 ETF = ₹220.

You buy 10 units = ₹2,200.

Inside this one ETF unit, you get exposure to:

-

Reliance

-

Infosys

-

HDFC Bank

-

ICICI Bank

-

TCS

-

Asian Paints

-

HUL

-

ITC

-

And 42 more

Instant diversification.

⭐ Mutual Funds — The “Investment Tiffin Box” Made by Experts

Mutual Funds are like:

“Give your money to a professional cook who prepares a healthy meal.”

In mutual funds:

-

Thousands of people invest

-

Money is pooled

-

A fund manager picks stocks/bonds

-

You get units of the fund

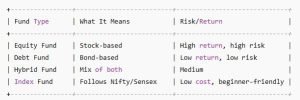

✅ Types of Mutual Funds (Super Simple Chart)

✅ SIP — Systematic Investment Plan

SIP = Monthly auto-deduction.

Example:

You invest ₹1,000 every month in a Nifty index fund.

After 10 years → approx ₹2.3–2.5 lakh

After 20 years → approx ₹10–12 lakh

SIPs are the superpower of Indian middle class investing.

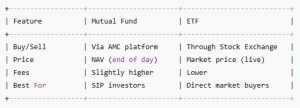

✅ Mutual Fund vs ETF (Comparison)

⭐ IPO — The Company’s First Day in the Stock Market

IPO = Initial Public Offering

First time a company sells shares to the public.

Example:

Zomato IPO, Nykaa IPO, Paytm IPO, LIC IPO.

Companies raise money.

Investors try to buy early.

✅ How to Apply for an IPO (Real Steps)

Using UPI:

-

Go to your broker

-

Open IPO section

-

Select IPO (e.g., LIC)

-

Enter lot size

-

Enter UPI ID

-

Approve mandate on your UPI app

-

Wait for allotment

If allotted → Shares credited to Demat

If not → Money released

✅ Should beginners apply for IPOs?

Not always.

Reason:

New stocks can crash quickly (Paytm fell 70%).

Only apply for:

✅ Profitable companies

✅ Strong brand

✅ Reasonable valuations

⭐ Government Securities (G-Secs), T-Bills & Bonds — The Safe Side of Investing

Think of bonds as loans you give to the government or companies.

Government says:

“You give us money today, we will give you interest and return your money on maturity.”

This is one of the safest ways to invest.

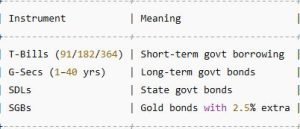

✅ Types of Govt Securities

✅ Buying Government Bonds through Broker

You can buy:

✅ SDLs

✅ T-Bills

✅ G-Secs

✅ SGBs

Directly on your trading app through:

-

NSE GoBID

-

Broker order window

-

RBI Retail Direct (direct government platform)

⭐ SGBs — Sovereign Gold Bonds (The BEST Way to Buy Gold)

SGB = Gold investment + 2.5% extra interest.

Better than:

-

Gold jewellery

-

Digital gold

-

Gold ETF

Why?

✅ No making charges

✅ No storage problem

✅ Guaranteed by Indian Govt

✅ 2.5% interest yearly

✅ Tax-free profit after 8 years

Example:

You buy 10g SGB @ ₹6,000 each → ₹60,000.

Every year you get:

₹60,000 × 2.5% = ₹1,500 interest.

Plus gold value appreciation.

⭐ REITs & INVITs — Real Estate for Students & Small Investors

REIT = Real Estate Investment Trust

INVIT = Infrastructure Investment Trust

These allow you to earn rent-like income without buying property.

Example REITs:

-

Embassy REIT

-

Mindspace REIT

-

Brookfield REIT

Example INVITs:

-

PowerGrid INVIT

-

IRB INVIT

✅ Benefits

✅ Low entry amount (₹300–₹500)

✅ Regular payouts

✅ Diversification

✅ Better than buying flats on loan

⭐ F&O (Futures & Options) — The Simplest Explanation Ever

Most “gurus” make F&O sound too complex.

Let’s make it child-level.

✅ Futures (Explained using a Mango Story)

Suppose:

Mangoes cost ₹100/kg today.

You think prices will go up next month.

You make a deal with a shopkeeper:

“You will sell me mangoes after 1 month at ₹100/kg no matter what.”

This is a future contract.

If price becomes ₹150/kg → You profit.

If price becomes ₹60/kg → You lose.

✅ You must honor the contract.

✅ Profits/losses settle daily.

✅ Options (Explained like buying a movie ticket)

Imagine:

You book a movie ticket refundable for ₹20 extra.

You pay:

✅ ₹20 for the option to cancel

✅ Not the full ticket price

This ₹20 is like options premium.

If you want, you can use the ticket.

If not, you lose only ₹20.

OPTIONS = Right, not obligation.

✅ Two types of options:

-

Call Option → Right to buy

-

Put Option → Right to sell

✅ THE GOLDEN WARNING

F&O is NOT for beginners.

Why?

Because:

❌ Leverage

❌ High speed

❌ Fast losses

❌ Emotional pressure

❌ No guaranteed profit

Start with:

✅ Stocks

✅ Index funds

✅ ETFs

Then later, slowly learn F&O.

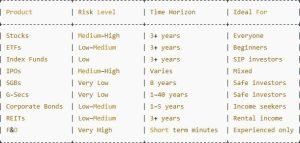

⭐ All Investments Compared (Beginner Friendly)

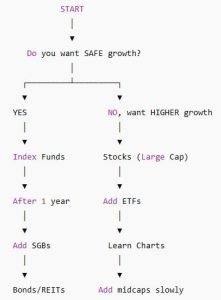

⭐ A Beginner’s Product Map — What You Should Buy First

Imagine this flowchart printed on your wall:

For now:

✅ Start with Index Funds (SIP)

✅ Buy 1-share of top companies

✅ Learn gradually

✅ Avoid F&O

✅ PART 5: Taxes, Risk Management, Psychology, Asset Allocation

It will cover:

✅ STCG / LTCG explained simply

✅ F&O taxation explained easily

✅ Examples with numbers

✅ Risk rules

✅ 1% rule explained

✅ Position sizing formula

✅ Fear, FOMO, biases

✅ Long-term allocation

✅ Crash survival system

✅ Taxes, Risk Management, Psychology & Asset Allocation (The Chapter That Saves Beginners From Losing Money)

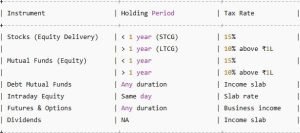

⭐ TAXES — Explained So Simply Even a 10th Grader Can Understand

Most adults don’t understand taxes.

This chapter fixes that permanently.

Taxes apply on:

✅ Selling shares

✅ Selling mutual funds

✅ Selling ETFs

✅ Selling bonds (sometimes)

✅ F&O profits

✅ Dividends

Let’s break ALL of this down using stories, tables, and simple maths.

✅ Capital Gains Tax (When You Sell Shares)

Imagine you buy:

-

10 shares of Infosys at ₹1,500

-

Total cost = ₹15,000

After 8 months, you sell at ₹1,600.

Your profit = ₹1,000.

This profit is called capital gains.

But the tax depends on holding period.

Let’s simplify:

✅ If you hold STOCKS for LESS than 1 year → STCG

STCG = Short Term Capital Gains

Tax = 15% flat

Example:

Profit = ₹1,000

Tax = ₹150

Your net = ₹850

✅ If you hold STOCKS for MORE than 1 year → LTCG

LTCG = Long Term Capital Gains

Tax = 10% on profit above ₹1,00,000

Example:

You invested in ITC for 3 years:

-

Profit = ₹1,20,000

-

Tax-free limit = ₹1,00,000

-

Taxable = ₹20,000

-

Tax = ₹2,000

Your net = ₹1,18,000.

✅ Tax on Mutual Funds

Same rule as stocks IF they are equity funds.

Equity mutual funds include:

-

Large cap

-

Mid cap

-

Flexi cap

-

Index funds

-

ELSS

Tax:

✅ Less than 1 year → 15%

✅ More than 1 year → 10% beyond 1 lakh

✅ Tax on Debt Mutual Funds

Debt funds include:

-

Liquid

-

Corporate bond

-

Government bond

-

Money market funds

Here:

✅ Gains are added to your income

✅ Taxed as per your income slab

Simple.

✅ Dividend Tax (Important Update)

Dividends are:

✅ Added to your income

✅ Taxed as per your tax slab (5%, 20%, 30%)

Example:

Your dividend from ITC = ₹1,000

Your tax slab = 10%

Tax = ₹100

You keep = ₹900

⭐ F&O TAXATION (Made Stupidly Simple)

This is where most websites overcomplicate things.

Let me simplify to school level.

✅ FUTURES

Profits from Futures = Business Income

Losses = Business Loss

✅ Can be set off

✅ Can be carried forward for 8 years

✅ OPTIONS

There are two sides:

Options BUYERS pay tax on final profit.

Options SELLERS have complex adjustments, but beginners should not sell options anyway.

✅ Do beginners need audit?

Only if:

✅ Your turnover crosses certain limits

✅ OR you have losses & want to carry forward

But 90% of new investors don’t need audit.

⭐ TAX TABLE — Simple Summary

⭐ RISK MANAGEMENT — The Real Holy Geeta of Trading

If every beginner followed this chapter,

80% of losses would disappear.

Let’s break it down into 5 core parts:

✅ Position sizing

✅ Stop loss

✅ Risk-reward ratio

✅ Maximum daily loss

✅ Capital safety rules

⭐ POSITION SIZING — The Formula That Protects You

This one formula can save beginners ₹50,000–₹5,00,000 in losses.

Formula:

Let’s say:

-

Capital = ₹10,000

-

You risk = 1% per trade = ₹100

-

Stop loss = ₹5 (distance between entry & SL)

Then:

You buy 20 shares, NOT 100.

This is how professional traders operate.

⭐ WHAT IS STOP LOSS REALLY? (Story Version)

You are at the fair.

There’s a ride called “The Risky Drop”.

It looks exciting.

You get on.

But there’s a seatbelt.

Why?

Because rides can malfunction.

The seatbelt doesn’t stop the ride.

It only protects you if something goes wrong.

Stop loss is that seatbelt.

Example:

You buy HDFC Bank at 1,500.

Your SL = 1,470.

If price falls ⇒ you exit safely.

If price rises ⇒ you ride the wave.

Stop-loss protects your capital

so you can trade again tomorrow.

⭐ RISK–REWARD RATIO — How Much You Can Earn vs Lose

Ideal ratio = 1 : 2 or 1 : 3

Meaning:

If you risk ₹100,

You aim to earn ₹200–₹300.

Why?

Because even if you lose 50% of trades,

you still make money.

Example:

5 winning trades (profit ₹500 each) = ₹2,500

5 losing trades (loss ₹200 each) = ₹1,000

Net profit = ₹1,500

This is how professionals win consistently.

⭐ MAX DAILY LOSS RULE — Prevent Anti-Destruction Mode

Set a rule:

✅ If you lose 2% of total capital in a day → STOP

If you continue trading after a big loss,

you will trade emotionally.

Emotion = disaster.

This rule prevents revenge trading.

⭐ CAPITAL SAFETY RULES (Every Beginner Must Tattoo These Mentally)

✅ Never put more than 10% of money in one stock

✅ Never invest money you need within 1 year

✅ Do not borrow money to trade

✅ Do not use leverage until 12 months of experience

✅ Avoid penny stocks

✅ Avoid F&O for first 1–2 years

✅ Avoid tip groups, WhatsApp signals, Telegram gurus

These rules protect you from major damage.

⭐ PSYCHOLOGY — The Real Boss of Stock Market

The market doesn’t defeat beginners.

Their own emotions defeat them.

The four deadly enemies are:

✅ Fear

✅ Greed

✅ FOMO

✅ Revenge trading

Let’s break them down in stories.

✅FEAR (The Fear of Losing Money)

When your stock falls from ₹100 to ₹95,

you panic.

You sell.

Then price goes to ₹120.

Solution:

✅ Use stop-loss

✅ Know why you bought

✅ Trust your plan

✅ Don’t watch charts every second

✅ GREED (The “I Want More” Syndrome)

You buy at ₹100.

Price hits ₹115.

You want ₹130.

It goes back to ₹100.

You lose.

Solution:

✅ Take profits at target

✅ Follow 1:2 rule

✅ Never break your plan

✅ FOMO (Fear Of Missing Out)

News: “Adani stock up 20% today!”

You buy the next day.

Stock falls 10%.

You regret.

Solution:

✅ Avoid impulsive trades

✅ Avoid hype

✅ Trade with reason, not excitement

✅ REVENGE TRADING (The Worst Emotion)

You lose ₹500.

You get angry.

You want to recover it immediately.

You take random trades.

You lose more.

Solution:

✅ Stop after 2% daily loss

✅ Walk away

✅ Return next day with fresh mind

⭐ ASSET ALLOCATION — The Smart Way to Divide Your Money

This determines your long-term success more than stock picking.

Let’s break it down like a school timetable.

✅ The 60–30–10 Model (Perfect for Ages 15–30)

✅ Why this works:

✅ Enough growth

✅ Enough safety

✅ Enough liquidity

✅ Prevents big losses

✅ Allows compounding

✅ Simple Allocation Example for ₹10,000/month

✅ ₹6,000 in Nifty 50 Index Fund

✅ ₹3,000 into SGB/Bond fund

✅ ₹1,000 emergency fund

✅ 1. DO NOT panic sell

In every crash,

people who sell in panic regret later.

✅ 2. Continue SIPs

This is where the real wealth is created.

During dips:

✅ Same amount

✅ More units

✅ Higher long-term profit

✅ 3. Keep emergency fund separate

Never invest money needed for rent, school fees, food, etc.

✅ 4. Avoid checking charts every hour

It increases anxiety.

✅ 5. Buy gradually (not all at once)

Use 4-part buying:

✅ Part 1: -5%

✅ Part 2: -10%

✅ Part 3: -15%

✅ Part 4: -20%

This lowers your average.

⭐ Golden Rule — Never Compare Your Returns With Anyone

Never.

Because:

-

Everyone has different capital

-

Different timeframes

-

Different risk appetite

-

Different life goals

Your only competition is:

✅ Your past self

✅ PART 6 (Next): Beginner Plans, Systems, Mistakes, Scams & How to Build a Wealth Machine

It will include:

✅ 1-share method

✅ Beginner-to-pro learning path

✅ Simple trading systems

✅ SIP frameworks

✅ Goals-based investing

✅ Top 20 mistakes

✅ All India-specific scams to avoid

✅ Realistic wealth-building examples

✅ Beginner Plans, Growth Systems, Mistakes, Scams & Your Wealth Machine (The Zero-to-Expert Blueprint)

⭐ The Biggest Lie Most Indians Believe About Investing

Most people think:

“I need a lot of money to start investing.”

This is completely wrong.

You can start investing with:

✅ ₹10

✅ ₹100

✅ ₹500

✅ ₹1,000

The amount doesn’t matter.

What matters is:

✅ discipline

✅ consistency

✅ patience

✅ a system

The market doesn’t reward rich people.

The market rewards consistent people.

⭐ The 1-Share Strategy — The BEST Beginner Method in India

Forget fancy courses.

Forget complicated trading.

Forget “How to pick multi-baggers.”

Start with just buying ONE share at a time.

Example:

✅ Month 1

Buy 1 share of ITC (₹460)

✅ Month 2

Buy 1 share of HDFC Bank (₹1,480)

✅ Month 3

Buy 1 share of Asian Paints (₹3,000)

✅ Month 4

Buy 1 share of Titan (₹3,400)

✅ Why this method is brilliant

Because:

✅ Affordable

✅ Zero pressure

✅ You learn by DOING

✅ You experience holding a stock

✅ You experience green days & red days

✅ You learn dividends, splits, bonus

✅ You get emotionally trained

✅ You build a small, safe portfolio

Even with ₹500–2,000 per month, you become a REAL investor.

⭐The Beginner SIP Plan (India’s Most Reliable Wealth Generator)

The safest, most reliable way to build wealth in India:

✅ SIP in a Nifty 50 Index Fund

✅ SIP in a Nifty Next 50 Fund

✅ Optional: Gold/SGB once a year

✅ Emergency fund separately

Let’s build a SIP plan:

✅ SIP Example (₹1,500/month)

Total: ₹1,500/month

Stay invested for 10–20 years.

Expected outcome (not guaranteed):

₹1,500/month for 20 years @ 12% → ₹11–13 lakh

✅ SIP Example (₹5,000/month)

20 years → ₹35–45 lakh (approx)

✅ SIP Example (₹10,000/month)

20 years → ₹70–90 lakh

⭐ The “5 Bucket System” — For People Who Want a Full Wealth Plan

This system is so simple even a school student can use it.

Imagine your money split into 5 buckets.

The goal is:

✅ Keep your life stable

✅ Keep investing simple

✅ Avoid using long-term money for short-term needs

⭐A Beginner-to-Pro Learning Path

Let’s build your learning from Day 1 → Year 3.

✅ Phase 1 (0–30 days): Basic Setup & Safety

-

Open Demat account

-

Do first buy (1 share rule)

-

Learn limit/market order

-

Understand risks

-

Learn basics of taxes

-

Start a small SIP

Outcome: You become a real investor.

✅ Phase 2 (Month 2–5): Start Building Your Mindset

-

Read basic investing books (1 per month)

-

Learn how to use charts

-

Understand sectors

-

Learn stop-loss

-

Track 3–5 companies

Outcome: You understand how markets behave.

✅ Phase 3 (Month 6–12): Controlled Trading Practice

-

Paper trade for 30 days

-

Do tiny value trades (1–5 shares)

-

Learn 2 simple chart patterns

-

Practice 1:2 risk-reward

-

Try GTT orders

Outcome: You learn discipline without losing big money.

✅ Phase 4 (Year 2): Intermediate Level

-

Build ₹1–2 lakh portfolio

-

Add SGBs

-

Add bonds

-

Add Nifty Next 50

-

Study 1 sector deeply (banking, pharma etc.)

-

Learn F&O basics (no trading yet)

Outcome: You think like an investor, not a gambler.

✅ Phase 5 (Year 3): Growth Stage

-

Increase SIP 10% each year

-

Build income streams

-

Add REIT/INVIT

-

Consider learning options selling (slowly)

-

Start a small research journal

Outcome: You are ahead of 95% Indians in financial literacy.

⭐ Simple Trading Systems for Beginners (Only 3 You Need)

These are not “get rich quick” systems.

They are beginner-safe, low-risk frameworks.

✅ System 1: Moving Average Crossover (School-Level Simple)

Use:

✅ 20-day moving average

✅ 50-day moving average

Buy when 20 EMA goes above 50 EMA.

Exit when 20 EMA goes below 50 EMA.

Works best for:

-

Nifty

-

ETFs

Not good for:

-

Penny stocks

-

Low-volume stocks

✅ System 2: Support/Resistance Bounces

Find a stock that touches the same price multiple times.

Example:

420 = support.

Buy when price bounces again.

Place stop-loss just below support.

✅ System 3: Breakout Trading (For Slightly Advanced Beginners)

Identify a horizontal line where stock keeps failing to go above.

Example:

If it breaks 1500 with high volume → Buy.

Stop-loss below breakout zone.

⭐ The 20 Biggest Mistakes Indian Beginners Make

Let me list them exactly as they happen in real life.

✅ Mistake 1: Buying stocks because someone on Telegram said so

✅ Mistake 2: No stop-loss

✅ Mistake 3: Expecting to double money quickly

✅ Mistake 4: Watching profit but ignoring risk

✅ Mistake 5: Buying penny stocks

✅ Mistake 6: Overconfidence after 1 profit

✅ Mistake 7: Revenge trading

✅ Mistake 8: Borrowing to trade

✅ Mistake 9: Using entire salary to invest

✅ Mistake 10: Checking prices 40 times a day

✅ Mistake 11: Too many stocks (over-diversifying)

✅ Mistake 12: Too few stocks (concentrating)

✅ Mistake 13: Selling winners early

✅ Mistake 14: Holding losers forever

✅ Mistake 15: Buying after huge news

✅ Mistake 16: Not studying companies

✅ Mistake 17: Entering F&O without basics

✅ Mistake 18: No emergency fund

✅ Mistake 19: Ignoring taxes

✅ Mistake 20: Lack of patience

If beginners fix these, success becomes MUCH easier.

⭐ India-Specific Scams & How to Avoid Them

This may be the most important chapter for safety.

Let’s expose all the real scams.

✅ Scam 1: Telegram & WhatsApp “Tips Groups”

They promise:

-

100% returns

-

Jackpot calls

-

Guaranteed profits

These are ALL scams.

✅ Scam 2: Screen Sharing Scam

Scammer says:

“Sir, I will help you install the trading app.

Share your screen.”

Then:

-

Installs AnyDesk

-

Takes control of phone

-

Steals OTP

-

Sells your shares

✅ Scam 3: Fake Broker Apps

Fraudsters create:

-

Fake brokers

-

Fake trading apps

-

Fake profit dashboards

Always check:

✅ SEBI registration

✅ NSE/BSE membership

✅ CDSL DP number

✅ Scam 4: Pump-and-Dump Scheme

Someone tells you:

“Buy this 5 rupee stock, big news coming!”

They pump the stock → you buy → they dump → price crashes → you lose.

✅ Scam 5: F&O “Guaranteed Profit Packages”

They promise:

“Give ₹25,000, we will trade for you.”

Illegal.

Fraud.

Never do this.

⭐ Building Your First Wealth Machine

Let’s combine everything we learned into 1 complete machine.

Assume you earn:

₹20,000/month

You can invest ₹5,000/month.

Here is the perfect plan:

✅ Step 1: Emergency Fund

Build ₹10,000–₹20,000 buffer.

✅ Step 2: Monthly SIP (₹3,000)

✅ Step 3: Stocks (₹1,000)

Use the 1-share rule.

✅ Step 4: SGB (once a year)

Invest ₹5,000–₹10,000 when issue opens.

✅ Step 5: Cash (₹1,000)

For sudden opportunities.

✅ Expected outcome after 10 years:

✅ ₹6–8 lakh corpus

✅ SGB gold returns

✅ Equity compounding

✅ A personal finance habit

✅ Fully protected financial lifestyle

⭐ 30-Day Beginner Challenge (So You Learn Without Losing Money)

Try this for 30 days:

✅ Week 1

-

Buy 1 share of any bluechip

-

Learn candle basics

-

Read 10 pages of an investing book

-

Watch 1 company news per day

✅ Week 2

-

Start ₹500 SIP

-

Learn stop-loss

-

Learn limit & market order

-

Do 2–3 tiny trades

✅ Week 3

-

Create a watchlist of 10 companies

-

Learn support/resistance

-

Learn risk-reward

-

Do 5 paper trades

✅ Week 4

-

Review your activity

-

Fix mistakes

-

Make a long-term plan

-

Add ₹100–500 more to your SIP

This challenge ensures you learn completely risk-free.

✅ TECHNICAL ANALYSIS MASTER PART

⭐ What Is Technical Analysis, Really?

Most people think Technical Analysis (TA) is:

❌ Some magic formula

❌ Some secret guru chart pattern

❌ Random lines on a chart

❌ Buy when green, sell when red

Wrong.

Technical Analysis is simply:

✅ Studying price

✅ Studying volume

✅ Understanding crowd psychology

✅ Identifying trends

✅ Recognizing momentum

✅ Protecting yourself with good entries/exits

It’s NOT predicting the future.

It’s calculating probabilities.

Think of TA like weather forecasting:

-

Clouds forming? Possible rain.

-

Humidity rising? Possible storm.

-

Wind direction changing? Possible shift.

TA helps you read the market weather.

⭐ Timeframes — The Foundation Before Any Indicator

Before any indicator works, you must understand timeframes.

Different timeframes = different behaviours.

✅ For beginners:

-

Intraday → 5m + 15m

-

Swing trading → 1H + Daily

-

Investing → Daily + Weekly

If you use the wrong timeframe → all indicators fail.

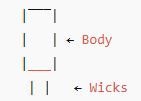

⭐ Candlestick Patterns — The Alphabet of Technical Analysis

Before learning indicators, you MUST learn candles.

Candles can be categorized as a bullish(green) or bearish(red) candle usually. The colors can be customized to any color of your choice depending upon the technical analysis software you use.

To read candlesticks one has to pay a closer attention to the overall body of the candle.

Above image tells us the same. There are three parts in a single candle, let us try to understand bullish(green) candle first.

- The main body or real body, rectangular in shape it connects the opening and closing price

- Upper shadow link the high point to the close

- Lower Shadow joins the low point to the open

Let us see now the bearish(red)candle:

- The main body or real body, rectangular in shape it connects the opening and closing price. However, bearish candles is opposite to bullish candles, the opening is at the top end and the closing is at the bottom end of the rectangle.

- Upper shadow link the high point to the open

- Lower Shadow joins the low point to the close

I don’t think, I need to explain what is open, high, low, close? they are self explanatory if you see the candle. However for reference this what OHLC means:

Open – When the markets open for trading, the first price at which a trade gets execute is called the opening price.

High – This tells us the highest price at which the market participants (traders or investor) are willing to transact for the given day.

Low – This shows the lowest level at which the market participants (traders or investor) are OK to transact for the given day.

Close – Closing price is the most important price, as it is the final price at which the market closed for a particular period of time.

Closing price also useful as an indicator for the intraday strength. If the close is higher than the open, then it is considered a positive day(bullish) otherwise negative(bearish).

If you have the OHLC data with you, now you can easily plot both the candlesticks (bullish and bearish). However, you do not need to do this manually, the software does it for you.

You just need to take a look at the various points to understand its opening, closing, high, low value.

Range of the candle:

The length of the candle (upper shadow to lower shadow) denotes the range, it moves depending upon the time frames you have chosen (1min, 5min, 30min, day, week, month etc.) for candlestick charts. It gets calculated by subtracting the high from the low of the candlestick.

Range = High – Low

Range also indicates the volatility, higher the range more is the volatility and vice versa. Another key point is of short candles, it can be considered that the trading action was gloomy for the day without much movement.

You can consider the shadows as tests of a price range. whereas, Candles with no shadow indicate a strong trend in one direction.

So, just to sum up these are things you need to look seeing a candlestick:

Price:

Opening price / Closing price/ stock price went up or down

Shadows/wicks:

The lower shadow shows Lowest level for the time frame / The upper shadow shows highest level for the time frame

Bearish(red) candle:

A red candlestick shows the open price at the top of the body / A red candlestick shows closing price at the bottom of the body.

Bullish (green) candle:

A green candlestick shows the open price at the bottom of the body / A green candlestick shows the closing price at the top of the body

Below charts depicts, how does a candlestick chart look like when combine with data point on a software analysis tool.

Now, that you know the basics of how to read a candlestick, learn different pattern formations and how to use them while trading or investing in stock market.

⭐ SUPPORT & RESISTANCE — The Skeleton of Every Chart

Think of:

✅ Support = floor

✅ Resistance = ceiling

Price keeps bouncing between floor and ceiling.

✅ Support Example

Stock touches ₹150 three times:

This means:

✅ Buyers protect this level

✅ If price falls below → big drop possible

✅ Resistance Example

Stock fails at ₹200 repeatedly:

This means:

✅ Sellers are strong

✅ If price breaks above → big rally possible

In a very simple terms support means to hold up something, so that it does not fall further. In the world of trading and investing support is a tool to find a point or a level on a chart that prevents the price of a stock/index from falling further. Surprisingly, you will find most of the buying activities here.

Support is the level at which the demand is powerful enough to stop the stock/index from falling any further. Whenever the price falls to the support point, it is expected to bounce back.

The rationale behind any stocks to bounce back is the demand due to falling of share price. It’s a very common logic people often use, even buying normal things in life.

If you can get 10% discount, instead of full price, people feel its worth buying, thinking maybe I won’t get this at those prices in future.

However it may happen the thing you have bought may be available at much discount tomorrow.

One thing to keep in mind, you will find support level always below the current market price. So whether you are trading stocks, or any index, you will find the support level below its current price.

⭐ MOVING AVERAGES (SMA, EMA) — The Simplest Trend Tool

Moving averages smooth price movements.

✅ Simple Moving Average (SMA)

Example: 20 SMA

Average of last 20 candles.

If price stays above 20 SMA → uptrend

If price stays below 20 SMA → downtrend

✅ Exponential Moving Average (EMA)

EMA gives more weight to recent candles → faster signals.

For beginners:

✅ 20 EMA

✅ 50 EMA

✅ 200 EMA

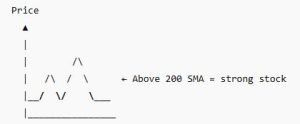

✅ Practical Uses of MA

Scenario 1: Long-term investing

Look at 200 SMA

Scenario 2: Trend trading

Use 20 EMA & 50 EMA crossover

Works on Nifty, Bank Nifty, ITC, Reliance.

What Are Best SMA periods to use in Trading?

The major popular moving averages used by most traders are the 10, 20, 50, 100 and 200 days. I have listed below which is best according to type of trading one do in market.

- 5 -SMA – This is for the hyperactive traders. The shorter the SMA period, the more signals you will receive when trading. The best way to use a 5-SMA is in conjunction with a longer SMA period.

- 10-SMA – popular with short-term traders, best for swing traders and intraday traders.

- 20-SMA – For short-term traders or investors, beyond the 20-SMA, you are looking at primary trends.

- 50-SMA – used by traders or investors to scale mid-term trends.

- 200-SMA –These are for long-term trend followers. As an investor you should look for a cross above or below this average to represent if the stock is in a bullish or bearish trend.

You can read complete guide on Simple Moving Average and Best Strategies Here.

⭐ RSI (Relative Strength Index) — The Mood Detector

RSI shows momentum.

Range: 0 to 100

✅ RSI above 70 → Overbought

✅ RSI below 30 → Oversold

But beginners misunderstand:

RSI is NOT a buy or sell signal alone.

✅ How RSI Actually Helps

Scenario 1: Price touches support, RSI 25

High chance of bounce.

Scenario 2: Price near resistance, RSI 75

High chance of rejection.

✅ RSI Divergence (The advanced but useful concept)

Price making lower low:

RSI making higher low:

This often signals reversal.

The RSI indicator is much more than a buy and sell signal indicator. Do not think it is only useful for day trading, for an investors perspective RSI has better things to offer too. It is because RSI can provide you the ability to gauge the primary direction of the trend.

You can read RSI Indicator based intraday trading strategies here.

⭐ MACD — The Trend + Momentum Combo

MACD indicator is indisputably very popular momentum(trend) indicator used in technical analysis in stock market. MACD is a acronym used for Moving Average Convergence Divergence.

MACD indicator is a combination of two different exponential moving average.

Out of the two moving averages one is of shorter time period (12day EMA) and the other longer time period (26day EMA). It gets calculated by subtracting 26 day EMA from 12day EMA.

This results in giving a MACD line. After that, a 9day ema also called as signal line is plotted on the top of the MACD line to generate a trigger for buy and sell signal for any stock or index.

One can buy (go long) the security when the MACD (line) crosses above its signal line (9day EMA line) and sell (go short) the security when the MACD crosses below the signal line.

The MACD are useful for measuring market momentum as well as possible price trends and is employed by many traders and investors to identify potential entry and exit points in market.

MACD has 3 parts:

✅ MACD line

✅ Signal line

✅ Histogram

✅ How MACD Works

When MACD crosses above the Signal line → bullish

When MACD crosses below → bearish

Works fantastic on:

✅ Nifty

✅ Bank Nifty

✅ Large caps

✅MACD Trend Example

Crossovers = turning points.

You can read MACD Indicator based intraday trading Strategies here.

⭐ Bollinger Bands (BB) — The Volatility Detector

BB has 3 lines:

✅ Middle = 20 SMA

✅ Upper band

✅ Lower band

Bands expand = volatility increasing

Bands contract = volatility decreasing

✅ Bollinger Squeeze — Major Breakout Signal

When BB becomes tight:

Expect big breakout or breakdown.

This works AMAZINGLY on:

-

Nifty

-

Bank Nifty

-

Reliance

-

HDFC Bank

Read more about Bollinger Bands Here

⭐ VWAP — The KING of Intraday Indicators

VWAP = Volume Weighted Average Price.

Shows:

✅ Fair price of the day

✅ Where big players are buying

Rules (intraday):

✅ Price above VWAP → bullish

✅ Price below VWAP → bearish

VWAP combined with RSI = powerful intraday formula.

⭐ Fibonacci Retracement — The Market’s Natural Math

Fib levels:

✅ 23.6%

✅ 38.2%

✅ 50%

✅ 61.8%

✅ 78.6%

The most powerful = 61.8%

✅ How to use Fib (Beginners)

If stock moves from ₹100 → ₹150

Then retraces:

Fib levels:

-

23.6% → 138

-

38.2% → 131

-

50% → 125

-

61.8% → 119 (most important)

Price often bounces at 61.8%.

Read more about Fibonacci Here

⭐ Volume — The Lie Detector of Breakouts

Volume tells you how many shares are traded.

Rule:

✅ Breakout + HIGH volume = Strong

✅ Breakout + LOW volume = Fake

You can read more on volume based strategies in stock market here

⭐ Combining Indicators — The REAL Power

Indicators alone = weak

Indicators + context = strong

Let’s build combinations.

✅ Combination 1: Moving Average + RSI

Use case: Trend + Overbought/Oversold

Example:

-

Price above 50 EMA

-

RSI dips to 30

-

Price at support

→ HIGH probability BUY.

✅ Combination 2: VWAP + RSI (Intraday)

Rules:

✅ Price above VWAP → look for buys

✅ RSI bounce from 30 → buy entry

Simple and powerful.

✅ Combination 3: Bollinger + Volume (Breakouts)

Watch for:

-

BB squeeze

-

Volume spike

-

Price closing above upper band

→ Breakout confirmed.

✅ Combination 4: Fibonacci + Support/Resistance

When price retraces:

✅ Fib 61.8% overlaps with support → strong buy zone.

⭐ 3 Complete Beginner Strategies (Ready-to-Use)

Now the part you will LOVE.

These are beginner-safe, no-nonsense strategies.

✅ Strategy A: 20-50 EMA Trend System

(For Nifty, Bank Nifty, Reliance)

Buy when:

-

20 EMA crosses above 50 EMA

-

Volume above average

-

RSI above 40

Sell when:

-

20 EMA crosses below 50 EMA

This works best in trending markets.

✅ Strategy B: RSI + Support Bounce

(For swing trading)

Buy when:

-

RSI < 30

-

Price near major support

-

Bullish candle pattern

Sell when:

-

RSI near 60–70

-

Price near resistance

Simple, effective.

✅ Strategy C: VWAP Intraday Entry

(For beginners doing small trades)

Buy when:

-

Price crosses above VWAP

-

Retests VWAP

-

RSI between 40–60

-

Bullish candle on retest

Stop-loss: just below VWAP

Target: 1:2 RR

This is the safest intraday system.

⭐ Common Technical Analysis Mistakes Beginners Make

✅ Using too many indicators

✅ Trading against the trend

✅ Not waiting for confirmation

✅ No stop-loss

✅ Trading based on “patterns only”

✅ No understanding of volume

✅ Changing strategy too often

Keep it simple.

✅ Glossary, FAQs, Final Recommended Broker Section, Summary & Conclusion

✅ BEGINNER FAQs

Q1. What is a Demat account?

A digital account where your shares are stored safely.

Q2. What is a Trading account?

Used to place buy/sell orders.

Q3. What is the minimum money required to start investing?

You can start with ₹100, even ₹10 for UPI-based mutual funds.

Q4. Is trading safe for beginners?

Only with stop-loss and proper risk rules. Best to start as an investor.

Q5. Is investing better than trading?

Investing is safer and compounding works better long-term.

✅ ORDERS & BROKER FAQs

Q6. What is CNC?

Cash & Carry — for long-term investing.

Q7. What is MIS?

Intraday only — position closes at 3:20 PM.

Q8. What is a GTT order?

Trigger order valid for months.

Q9. What are DP charges?

Fee charged when you SELL delivery stocks.

Q10. Is account opening free?

Many brokers offer FREE opening & ZERO AMC.

✅ TECHNICAL ANALYSIS FAQs

Q11. Which indicator is best for beginners?

Moving Averages + RSI + VWAP for intraday.

Q12. What is the best timeframe?

5m/15m for intraday, 1H/1D for swing, 1D/1W for investing.

Q13. How accurate are indicators?

Indicators are probabilistic, not guaranteed.

Q14. What is a breakout?

Price breaking above resistance or below support with volume.

Q15. What is a pullback?

Temporary drop in an uptrend.

✅ INVESTING FAQs

Q16. Which fund is best for beginners?

Nifty 50 Index Fund.

Q17. Is SIP safe?

Yes, long-term SIP reduces risk and increases compounding.

Q18. Should I buy stocks or mutual funds?

Start with funds → add stocks slowly.

Q19. Best time to invest?

Anytime — market timing doesn’t matter long term.

Q20. How many stocks should I hold?

8–15 good companies are enough for beginners.

✅ DERIVATIVES FAQs

Q21. What is F&O?

Futures & Options — high-risk leveraged instruments.

Q22. Should beginners trade options?

NO — avoid until 1–2 years of learning.

Q23. Why do most option buyers lose money?

Time decay + low edge + emotional trading.

Q24. What is option selling?

Advanced strategy requiring margin and deep understanding.

Q25. What is a lot size?

Fixed quantity per F&O contract.

✅ TAX FAQs

Q26. What is STCG tax?

15% on equity profits held < 1 year.

Q27. What is LTCG tax?

10% on profits above ₹1 lakh for holdings > 1 year.

Q28. How are intraday profits taxed?

As normal income (slab rate).

Q29. How are F&O profits taxed?

As business income.

Q30. Are dividends taxed?

Yes — added to your income slab.

✅ PSYCHOLOGY & SAFETY FAQs

Q31. Is stock market gambling?

No — gambling is chance, market is skill & discipline.

Q32. How to avoid losses?

Use stop-loss, avoid leverage, follow risk rules.

Q33. How to avoid scams?

Avoid Telegram groups & screen-sharing requests.

Q34. What is FOMO?

Fear of missing out — leads to bad trades.

Q35. Why do beginners lose money?

No plan, no risk management, emotional decisions.

✅ ADVANCED FAQs

Q36. Can I invest in the US market?

Yes, via brokers supporting US stocks or ETFs.

Q37. What is a bonus share?

Extra shares given free by company.

Q38. What is a stock split?

Company reduces price per share & increases quantity.

Q39. What is rebalancing?

Adjusting your portfolio by selling high and adding to low.

Q40. Should I buy during market crashes?

Yes — use staggered buying (4-part buying method).

✅ PRACTICAL FAQs

Q41. How much return can I expect yearly?

Equity historically returns 10–14%.

Q42. How to track my investments?

Use your broker, Value Research, Tickertape, Screener.

Q43. Can I invest without Aadhaar?

No. Aadhaar + PAN are mandatory.

Q44. How long does Demat activation take?

5 minutes to 24 hours.

Q45. Which stocks are safest?

Large caps & index funds.

⭐ Final Recommended Broker Section

Dhan Overview — Company, Background & Credibility

-

Founded by Pravin Jadhav (ex-Paytm Money CEO).

-

SEBI registered, NSE/BSE member, CDSL depository.

-

Focused on active traders — not just investors.

-

100% Indian fintech company.

Quick Facts Table:

Parameter |

Details |

|---|---|

Founded |

2021 |

Founder |

Pravin Jadhav |

Headquarters |

Mumbai, India |

SEBI Reg. |

INZ000XXXXXX |

Depository |

CDSL |

Active Users (2025 est.) |

2+ million |

Platforms |

Web, Mobile, Dedicated Options App |

Dhan Brokerage & Charges

-

₹0 on equity delivery

-

₹20 or 0.03% (whichever lower) per executed order for intraday, F&O, commodity, and currency.

-

No hidden charges, no minimum balance.

Other Fees:

Service |

Charges |

|---|---|

Account Opening |

₹0 |

Annual Maintenance (AMC) |

₹0 |

Pledge/Unpledge |

₹12.5 per request |

Auto-square off |

₹20 per order |

Verdict: ✅ Transparent, simple, and competitive.

Dhan Trading Platforms (Web + App + Dedicated Options App)

1. Dhan Web

-

Full-fledged professional interface

-

Real-time charts powered by TradingView

-

Fast execution & 20-depth market view

-

Multi-tab workspace for multiple scripts

2. Dhan Mobile App

-

Clean, intuitive UI

-

Live option chain data

-

Pre-built strategies for beginners

-

Advanced indicators & pattern recognition

3. Dhan Options Trader App

-

Specifically designed for options traders

-

Built-in strategy builder (free)

-

IV, PCR, Max Pain analytics

-

“Payoff” graph for visual risk/reward analysis

Advanced Features That Make Dhan Stand Out

🧩 1. Native TradingView Integration

-

Direct chart trading from TradingView.

-

Place, modify, or cancel orders from the chart — no toggling screens.

⚡ 2. Scalper Mode

-

For high-frequency intraday traders.

-

Execute orders instantly with one tap.

💡 3. Iceberg & Super Orders

-

Split large trades automatically for better execution.

-

Set entry, SL, and target in one click.

🔍 4. ScanX Screener

-

Technical + fundamental screener with live trends.

-

Detect breakouts, momentum shifts, and candlestick patterns.

🔔 5. Trader Controls

-

Smart alerts to prevent over-trading or margin exhaustion.

-

Ideal for disciplined trading.

🤖 6. API & Algo Trading

-

Free API access for all users.

-

Compatible with Python, TradingView alerts, or third-party platforms.

Margin & Leverage (MTF)

Dhan offers up to 4× leverage (75% funding) for equity delivery under Margin Trading Facility (MTF).

-

You can buy delivery shares by paying only 25% upfront.

-

Pledge existing holdings for additional leverage.

Intraday Margin:

-

Equity: Up to 5x

-

Index Options: 1x to 2x (based on liquidity)

-

Futures: Full margin applicable as per SEBI norms

Charting, Technical Analysis & Tools

-

TradingView & ChartIQ both supported.

-