Salary Breakup Optimizer (India): Increase Take-Home Pay Legally in 2026

Most salaried professionals in India focus on CTC, but what really matters is take-home salary.

Two people with the same CTC can take home very different amounts, depending on how their salary is structured.

This is exactly where a Salary Breakup Optimizer helps.

In this guide, we’ll explain:

-

What a salary breakup optimizer is

-

How salary structure impacts tax and take-home

-

When salary restructuring actually helps (and when it doesn’t)

-

Real examples for ₹25L, ₹30L, and ₹45L salaries

-

How to use our Salary Breakup Optimizer correctly

All calculations are explained for FY 2026–27 (Old Tax Regime).

What Is a Salary Breakup Optimizer?

A Salary Breakup Optimizer is a tool that analyzes your current salary structure and checks whether changing components like:

-

Basic salary

can increase your take-home pay legally.

Instead of assuming a fixed rule (like “40% basic is best”), a good optimizer:

-

Tests multiple realistic salary structures

-

Applies actual income-tax rules

-

Accounts for PF limits and HRA exemptions

-

Shows whether restructuring is worth it or not

Our tool does exactly that.

Why Salary Structure Matters More Than You Think

Your CTC is divided into components such as:

-

Basic Salary

-

HRA

-

Allowances

-

Employer PF contribution

These components decide:

-

How much PF is deducted

-

How much HRA becomes tax-free

-

How much income remains taxable

A poorly structured salary can silently reduce your take-home by tens of thousands every year.

Key Rules Used by the Salary Breakup Optimizer (India)

To stay realistic and compliant, the tool follows these rules:

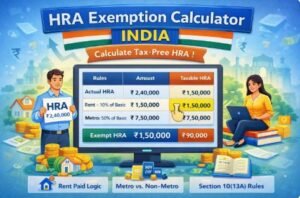

1️⃣ HRA Exemption Rules

HRA exemption is the lowest of:

-

Actual HRA received

-

Rent paid minus 10% of basic salary

-

50% of basic (Metro) or 40% (Non-Metro)

2️⃣ PF Contribution Cap

Even if your basic salary is high:

-

Employer PF is effectively capped at ₹1,80,000 per year

-

Increasing basic beyond this does not increase PF further

This rule is crucial for high-income employees.

3️⃣ Realistic Salary Structures

Most companies allow:

-

Basic salary between 25% and 45% of CTC

Our optimizer does not suggest unrealistic 50%+ structures.

How the Salary Breakup Optimizer Works ?

The tool performs these steps:

-

Takes your current salary details

-

Calculates current take-home pay

-

Simulates salary structures from 25% to 45% basic

-

Applies:

-

PF cap

-

HRA exemption

-

Standard deduction

-

Old Regime tax slabs

-

-

Finds the structure with the highest take-home

-

Tells you whether restructuring is:

-

Beneficial

-

Negligible

-

Not required

-

This makes the tool decision-oriented, not promotional.

Now go ahead and use the Salary Breakup Optimizer calculator below

Checkout Income Tax Calculator India (Old vs New Regime)

Salary Breakup Calculator India – Calculate Take-Home Salary from CTC

HRA Exemption Calculator India – Calculate Tax-Free HRA Easily

If you’re looking for a modern, feature-rich, and trader-friendly platform, Dhan is easily one of the best choices available today. From zero account opening charges to advanced tools like native TradingView, options strategy builder, and free API access, Dhan is clearly built with the modern Indian trader in mind.

With Dhan you can also invest and trade in IPO’s, NFO’s, SIP, Bonds, ETF, SGB, and many other financial products with so much ease.

Whether you’re an intraday trader, an options strategist, or a long-term investor, Dhan offers the perfect blend of speed, simplicity, and smart technology — without burning a hole in your pocket.

Why wait? Open your Dhan account now and take control of your trading journey with confidence.

👉 Click here to get started with Dhan

Open a Free Dhan Trading & Demat Account

Dhan offers cutting-edge tools for fast, powerful, and informed trading:

- ✅ Zero brokerage on delivery trades

- ✅ Auto-detection of candlestick patterns on charts

- ✅ Advanced Option Chain with Greeks, Max Pain, PCR & more

- ✅ Pre-built & custom Option Strategy Builder (Free)

- ✅ 20 Depth Market Data and Flash Trade execution

- ✅ Margin Trading Facility (MTF) with 4X leverage (75%)

- ✅ 3 Platforms: Mobile App, Web App & Dedicated Options App

- ✅ ScanX Screener: stock insights, trends & news

- ✅ Advanced orders: Trailing SL, Iceberg, Forever Orders

- ✅ Instantly pledge 1,500+ stocks for options margin

- ✅ Trade commodities: Gold, Silver, Crude, Natural Gas

- ✅ Fundamental + Technical analysis across all platforms

No paperwork. Zero account opening charges. Setup in minutes.

Example 1: ₹25 Lakh Salary (Metro City)

Scenario

-

CTC: ₹25,00,000

-

Current Basic: 38%

-

City: Metro

Result

-

Best structure found at ~44% basic

-

Take-home increase: ~₹450 per month

Conclusion

Your salary is already near-optimal.

Restructuring offers only marginal benefit.

👉 This is exactly what a trustworthy tool should say.

Example 2: ₹30 Lakh Salary (Non-Metro)

Scenario

-

CTC: ₹30,00,000

-

Current Basic: 33%

-

City: Non-Metro

Result

-

Best structure around ~44% basic

-

Take-home improvement: negligible

Conclusion

At this income level, PF and HRA effects almost cancel each other.

Salary restructuring is not a major lever anymore.

Example 3: ₹45 Lakh Salary (Non-Metro) — Where Optimization Really Works

Scenario

-

CTC: ₹45,00,000

-

Current Basic: 35%

-

City: Non-Metro

What changes here?

-

PF is already capped at ₹1.8L

-

Increasing basic increases HRA exemption

-

PF does not increase further

Result

-

Best structure at ~44% basic

-

Take-home increase: ₹36,450 per year (~₹3,000/month)

Conclusion

Once PF is capped, salary restructuring can create real tax savings.

Why the Tool Sometimes Says “Already Near-Optimal”

Many calculators always show “savings” to look attractive.

That’s misleading.

In reality:

-

At higher salaries

-

In metro cities

-

With already balanced salary structures

👉 Salary optimization often has diminishing returns.

Our tool intentionally tells you when:

-

Restructuring isn’t worth the effort

-

You should focus on tax regime choice or investments instead

This honesty builds long-term trust.

Who Should Use the Salary Breakup Optimizer?

This tool is most useful if you:

-

Are salaried in India

-

Are under the Old Tax Regime

-

Earn above ₹10–12 lakh per year

-

Have flexibility in salary structure

-

Want legal ways to increase take-home

It is especially powerful for:

-

₹30L+ salaries

-

Employees where PF is already capped

When Salary Restructuring Does NOT Help Much

Salary optimization may not be very effective if:

-

Your basic salary is already ~35–40%

-

You are in a Non-Metro city with moderate rent

-

PF is not yet capped

-

Your salary structure is fixed by company policy

In such cases, tax regime selection usually has a bigger impact.

What to Do After Using This Tool

Once you know whether restructuring helps, your next steps should be:

1️⃣ Compare Old vs New Tax Regime

2️⃣ Plan 80C / 80D investments

3️⃣ Review take-home salary projections

This is exactly why we link this tool to our other calculators.

Frequently Asked Questions (FAQs)

Is salary restructuring legal in India?

Yes, if done within company policy and tax rules.

Does everyone benefit from increasing basic salary?

No. Higher basic increases PF and may reduce take-home unless PF is capped.

Is 40% basic always ideal?

No. The optimal basic percentage depends on:

-

CTC

-

City type

-

PF cap status

Does this tool assume Old Tax Regime?

Yes. HRA exemption applies only under the Old Regime.

Final Thoughts

A Salary Breakup Optimizer should not promise guaranteed savings.

It should tell you when restructuring helps — and when it doesn’t.

That’s exactly what this tool does.

👉 Use it to make informed, realistic salary decisions, not guesses.

If you’re serious about trading, don’t compromise on tools or speed.

🔥 Open Your Free Dhan Account Today & Start Trading Smarter →

If you’re a trader or want more control over execution, charts, and speed.

Dhan is not just another discount broker — it’s genuinely innovating, especially for the next-gen Indian trader.

If you’re tired of clunky trading platforms and want modern, high-speed trading with transparent fees — Dhan is one of the best stockbrokers in India today.

According to the latest NSE reports there are about 200+ stock brokers in India, however what makes Dhan a leading and strong contender in the stock broking industry is the tools and resources they have in their trading platform.

Moreover there are no hidden charges and the brokerages are very minimal if we do the industry comparison. They are also backed by cash enriched investors so nothing to fear.

If I have to rate Dhan app after looking at there breakthrough pricing model for brokerages as well as other charges and experiencing there simple yet great user interface for trading platform I would give it 9.6 out of 10.

There’s never been a better time to take control of your financial future and with Dhan, you get the fastest, most reliable, and feature-packed stock broker app in India for 2025.

Whether you’re a beginner eager to start investing or an experienced trader seeking advanced tools and zero brokerage on delivery trades, Dhan has everything you need to succeed.

Don’t settle for less. Join over 2 million + satisfied users who trust Dhan to power their trading journey every day. With zero account opening fees, free access to multiple platforms, and dedicated customer support, the path to smarter trading has never been easier.

🚀 Ready to Elevate Your Trading Game?

Start your journey with Dhan — India’s fastest, most reliable, and user-friendly stock broker app trusted by over 1 million users.

No hidden fees. No complicated processes. Just smart, seamless trading.

It takes less than 5 minutes to sign up and start trading.

If, you have liked the content please do share it with your friends or on social media, as sharing do bring the good karma. If you have any questions or feedback you can leave them in comment box below.

🌟 4 Best Brokers for Trading in India – Dhan vs Upstox vs Zerodha vs Fyers

🏆 Best Demat & Trading Account in India – Dhan vs Upstox vs Zerodha vs Groww

Dhan vs Zerodha vs Upstox vs Groww: Best Broker for Options Trading in India

Best App for Options Trading in India | Dhan vs Zerodha, Upstox, Fyers

Commodity Trading in India: A Beginner’s Guide to Earning from Gold, Oil & More

Here is the list of things as a beginner you should know, if you are thinking for doing intraday trading.

A brief understanding of

How To Invest In Indian Stock Market – Explained With Examples For Beginners

The Ultimate Step-by-Step Monster Guide to Trading & Investing in India

Learn about the basics of candlestick chart patterns and how to use them for intraday trading and investing. You should also learn about the best moving averages to use for better trading result.

Checkout Mastering Intraday Trading: A Beginner’s Guide to Profitable Strategies in the Indian Stock Market

Note: Please do your own research and make investment. Moneycontain will not be responsible for any of your losses at all. The point made is for educational purpose only and intended to give information. All investments are subject to risks, which should be considered prior to making any investments.

Disclaimer: Results shown are indicative and based on standard tax rules and assumptions for FY 2026–27 (Old Regime). Actual outcomes may vary due to employer policies and individual circumstances. This tool is not a substitute for professional tax advice.