What is an Iron Butterfly Strategy?

Think of a real butterfly — its wings are symmetrical, and the center is narrow. That’s how your payoff curve looks too.

You’re setting up a trade where:

-

You sell 1 Call and 1 Put at the same ATM strike (to collect premiums)

-

You buy 1 OTM Call and 1 OTM Put (to protect yourself from big moves)

This creates a net credit, and you profit the most when the price expires exactly at the middle strike.

Strategy Type: Neutral, multi-leg strategy (4 options involved)

Market View: You expect the market to stay very close to a particular level (not move much).

Max Profit: Occurs when the underlying expires exactly at the strike price of the short options (ATM strike). At this point, all options expire worthless except the premiums collected upfront — which is your maximum reward.

Max Loss: Occurs if the stock/index moves sharply in either direction, breaching the breakeven points (lower and upper strikes ± net credit received). Despite this, the loss is capped because of the protective long options.

The Iron Butterfly is a powerful range-bound strategy that allows traders to profit from time decay while keeping both risk and reward defined.

It is best deployed in low-volatility markets when you expect the underlying (like NIFTY or RELIANCE) to expire near a central strike price, typically the ATM (At-The-Money) strike.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Now Let’s explore Iron Butterfly Strategy with examples.

Iron Butterfly Example with NIFTY

-

NIFTY = ₹22,000

-

Sell 22,000 CE = ₹90

-

Sell 22,000 PE = ₹90

-

Buy 22,200 CE = ₹40

-

Buy 21,800 PE = ₹40

Net Premium Received:

= ₹90 + ₹90 – ₹40 – ₹40 = ₹100

Lot Size = 50

Total Premium = ₹100 × 50 = ₹5,000

What Can Happen?

Scenario 1: NIFTY closes at ₹22,000

-

All options expire worthless

-

You keep ₹5,000

-

Max Profit

Scenario 2: NIFTY closes at ₹21,900 or ₹22,100

-

You start giving back some premium

-

Still profit, but less than max

Scenario 3: NIFTY closes below ₹21,800 or above ₹22,200

-

Max loss happens

-

Loss = Width of spread – net premium = ₹200 – ₹100 = ₹100 × 50 = ₹5,000

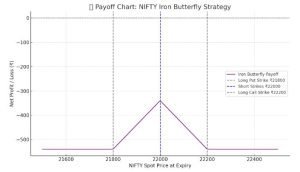

Similarly let us create another setup for iron butterfly

-

Buy 1 Put at ₹21,800 (OTM)

-

Sell 1 Put and 1 Call at ₹22,000 (ATM)

-

Buy 1 Call at ₹22,200 (OTM)

-

Net Credit = ₹140

-

Max Profit: When NIFTY closes exactly at ₹22,000 (short strikes).

-

Max Loss: Occurs if NIFTY expires below ₹21,800 or above ₹22,200.

-

Risk-Reward: Limited risk, limited reward. Ideal for low-volatility, range-bound outlook.

Breakeven Points:

For a short Iron Butterfly (net credit strategy):

-

Lower Breakeven = Lower Strike (Put) − Net Credit

-

Upper Breakeven = Higher Strike (Call) + Net Credit

In our NIFTY example:

-

Lower Breakeven = ₹21,800 − ₹140 = ₹21,660

-

Upper Breakeven = ₹22,200 + ₹140 = ₹22,340

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

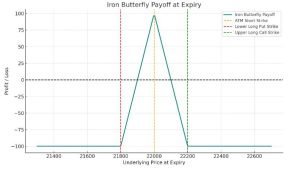

Iron Butterfly Payoff Graph

-

Sharp peak at center (ATM strike) = max profit

-

Slopes down quickly if price moves away

-

Max loss is limited due to hedge

Below is the Payoff Chart for the NIFTY Iron Butterfly Strategy for the second setup we discussed above.

Iron Butterfly Strategy Table

| Action | Option Type | Strike | Premium |

|---|

| Sell | Call | 22,000 | ₹90 |

| Sell | Put | 22,000 | ₹90 |

| Buy | Call | 22,200 | ₹40 |

| Buy | Put | 21,800 | ₹40 |

| Net Credit | – | – | ₹100 |

| Max Profit | – | – | ₹5,000 |

| Max Loss | – | – | ₹5,000 |

Greek Behavior

Greek |

Effect |

|---|---|

Delta |

Close to neutral at entry |

Theta |

✅ Positive — you benefit from time decay |

Vega |

❌ Negative — rising volatility hurts the trade |

When to Use Iron Butterfly?

-

Market is expected to stay range-bound or move very little.

-

Implied volatility is high when entering the trade (expecting it to decrease).

-

You want a strategy with limited risk and limited reward.

-

You have access to liquid options and can enter all four legs efficiently.

Do’s and Don’ts

Do’s:

-

Use when markets are calm or range-bound

-

Always monitor position near expiry

-

Enter when premiums are juicy (IV high)

Don’ts:

-

Don’t use during major news or event weeks

-

Don’t set strikes too close or too far

-

Avoid if you’re not actively monitoring the market

Iron Butterfly Cheat Sheet

| Feature | Value |

|---|

| Max Profit | Net Credit Received |

| Max Loss | Spread Width – Net Credit |

| Breakeven (low) | Lower Strike – Net Credit |

| Breakeven (high) | Upper Strike + Net Credit |

| Ideal Outlook | Neutral, low volatility |

| Risk Profile | Limited Risk, Limited Reward |

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Pro Tips:

-

Don’t overstay — close early if the underlying remains stagnant and you’ve captured most of the premium.

-

Liquidity matters — execute when bid-ask spreads are tight.

-

Avoid entering just before major news, earnings, or events that can cause large moves.

-

Ideal for index options (like NIFTY/BANKNIFTY) where range-bound behavior is more likely.

Iron Butterfly Strategy Summary Table

Parameter |

Details |

|---|---|

Market Outlook |

Neutral / Range-bound |

Risk |

Limited |

Reward |

Limited |

Cost |

Net Credit (Premium Inflow) |

Breakeven Points |

Lower Strike − Credit, Upper Strike + Credit |

Greeks Focus |

Positive Theta, Negative Vega |

The Iron Butterfly is a professional-grade neutral strategy that gives a high reward-to-risk ratio only if you’re confident about price staying near the middle strike.

It rewards patience, discipline, and timing — making it a favorite for expiry week setups or when expecting volatility crush after big news events.

Conclusion – The Power of Non-Directional Trading

The Iron Butterfly is a go-to strategy for options traders who love to earn from time and expect nothing big to happen in the market.

It’s safer than naked options and more capital-efficient than many directional trades.

You’re learning to think like a strategist, not a gambler — and that’s what separates the pros.

Please do not just speculate while trading in stock market in any segment, instead look for learning new strategies such as

Single Leg Options Strategies for Indian Markets

Calendar Spread – Earn from Time Like a Pro Trader (Beginner-Friendly Guide)

Bear Call Spread – A Safer Way to Profit When You Think the Market Won’t Go Up

Bear Put Spread Strategy – A Smart Strategy for Falling Markets

Call Butterfly Spread Strategy

Call Ratio Back Spread Strategy

Disclaimer:

This content is intended for educational purposes only and does not constitute financial or investment advice. Options trading involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Always do your own research or consult a SEBI-registered financial advisor before making any trading decisions. The examples provided are for illustration only and do not represent any recommendations.