What is a Diagonal Spread?

A Diagonal Spread is a smart options strategy that combines two powerful forces:

-

Direction — You’re either bullish or bearish.

-

Time — You take advantage of time decay (Theta).

You create a diagonal spread by buying one option (longer expiry) and selling another (shorter expiry) with different strike prices — but both are either calls or puts.

It’s called “diagonal” because it’s a cross between:

-

Vertical spreads (same expiry, different strikes)

-

Calendar spreads (same strike, different expiries)

Suitable For: Intermediate traders

Ideal Market: Moderate bullish or bearish outlook

Instruments Used: Indian Options (NIFTY, BANKNIFTY, RELIANCE, etc.)

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Now Let’s explore diagonal spread Strategy with examples.

Types of Diagonal Spreads

Call Diagonal Spread – Bullish Bias

Setup:

-

Buy 1 OTM Call (far expiry)

-

Sell 1 higher strike Call (near expiry)

Put Diagonal Spread – Bearish Bias

Setup:

-

Buy 1 OTM Put (far expiry)

-

Sell 1 lower strike Put (near expiry)

Diagonal Spreads Examples

Let’s use RELIANCE for examples (price approx. ₹2,500):

Call Diagonal Spread (Bullish)

-

Buy 1 Lot RELIANCE 2400 CE (Next Month Expiry) @ ₹150

-

Sell 1 Lot RELIANCE 2600 CE (Current Month Expiry) @ ₹80

-

Net Debit = ₹70

You win if RELIANCE moves slowly up and stays between ₹2400–₹2600 by expiry.

Put Diagonal Spread (Bearish)

-

Buy 1 Lot RELIANCE 2600 PE (Next Month Expiry) @ ₹150

-

Sell 1 Lot RELIANCE 2400 PE (Current Month Expiry) @ ₹80

-

Net Debit = ₹70

You win if RELIANCE drops slowly and stays between ₹2600–₹2400 by expiry.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

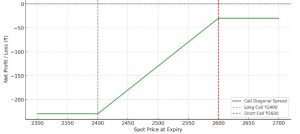

Diagonal Spreads Payoff Charts

Here are the payoff diagrams for both strategies:

Call Diagonal Spread (Bullish Bias)

-

Long Call at ₹2400 (far expiry)

-

Short Call at ₹2600 (near expiry)

-

Net Debit = ₹70

-

Bullish with time benefit

-

Max Profit near ₹2600

-

Limited risk (₹70 per lot)

-

Smooth upside curve with a peak

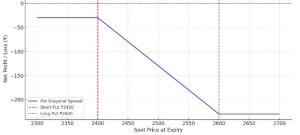

Put Diagonal Spread (Bearish Bias)

-

Long Put at ₹2600 (far expiry)

-

Short Put at ₹2400 (near expiry)

-

Net Debit = ₹70

-

Bearish with time benefit

-

Max Profit near ₹2400

-

Limited risk (₹70 per lot)

-

Smooth downside curve with a peak

You win if the stock moves in your direction, but not too fast.

When to Use Diagonal Spreads?

Use when:

-

You are slightly bullish or bearish, not expecting big moves

-

IV (Implied Volatility) is high in the short-term option (sell high)

-

You want to take advantage of time decay

When to Avoid Diagonal Spreads?

Avoid when:

-

Big events (earnings, budgets, RBI policy) are around the corner

-

Market is extremely volatile

-

You expect the stock to move rapidly

Greeks Impact On Diagonal Spread

| Greek | Impact on Strategy |

|---|

| Delta | Positive for Call Diagonal, Negative for Put |

| Theta | Positive — you benefit from time decay |

| Vega | Positive — long option gains if IV rises |

| Gamma | Lower than a plain long option |

Diagonal Spread Adjustments & Risk Management

-

Stock moves too fast: Close the position early to avoid loss on the long option.

-

Time decay hurts you: Roll the short option to a further expiry.

-

Market turns range-bound: Let short leg expire and keep the long option for trend.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Diagonal Spread Cheat Sheet Summary

| Strategy Type | Bias | Max Profit Zone | Entry Timing |

|---|---|---|---|

| Call Diagonal Spread | Bullish | Near short call strike | During low IV, trending up |

| Put Diagonal Spread | Bearish | Near short put strike | During low IV, trending down |

| Risk | Limited | Net debit paid | |

| Reward | Moderate | Depends on movement | |

| Time Decay (Theta) | Helps | Favors short leg | |

| Volatility (Vega) | Helps | Favors long leg |

Pro Tips

-

Choose far expiry for the long leg (4+ weeks), near expiry for the short leg (1–2 weeks).

-

Keep distance between strikes wide enough to reduce overlap.

-

Use liquid stocks/indexes (NIFTY, BANKNIFTY, RELIANCE).

-

Always backtest with virtual trades before going live.

Rolling Diagonals Like a Pro (Managing Your Trade Over Time)

Why roll?

Your short leg (weekly option) expires faster. Instead of closing the trade completely, you can:

-

Buy back the short call before expiry (at a lower price ideally)

-

Sell a new short call for the next week at a higher strike if bullish

This lets you:

-

Keep collecting premiums (positive Theta)

-

Reduce your cost basis

-

Stay in the trade longer with the same long leg

Example Roll (NIFTY):

-

Week 1: Sell 22,000 CE @ ₹90

-

Week 2: Buy it back @ ₹10, sell 22,100 CE @ ₹75

-

New cost basis = ₹120 (long call) – ₹90 – ₹75 = –₹45 (you’re in credit!)

Pro Tip

-

Roll up if you’re bullish

-

Roll down if you’re bearish

-

Always check IV — higher is better for selling

Weekly Trade Planner for Diagonal Spreads

Week |

Action |

Strike Selection |

Notes |

|---|---|---|---|

Mon |

Select underlying (e.g., NIFTY) |

ATM for short, OTM for long |

Entry near weekly opening works well |

Tue |

Watch price movement |

– |

No adjustments unless sharp move |

Wed |

Prepare for IV changes |

– |

Good time to roll if profitable |

Thu |

Roll short leg if needed |

Higher strike if bullish |

Do not wait till expiry hour |

Fri |

Let long leg ride or reset |

Depends on view |

Can exit with profit if target met |

Conclusion

The Diagonal Spread is like mixing your favorite ice creams — direction and time. You can profit if the market moves in your expected direction, slowly, and without high volatility shocks. It’s an excellent step-up for traders who’ve mastered vertical and calendar spreads.

Think of it as a refined strategy — not for wild markets, but for controlled, gradual moves. With the right setup, adjustments, and discipline, diagonal spreads can bring in consistent and smart returns.

Please do not just speculate while trading in stock market in any segment, instead look for learning new strategies such as

Single Leg Options Strategies for Indian Markets

Calendar Spread – Earn from Time Like a Pro Trader (Beginner-Friendly Guide)

Bear Call Spread – A Safer Way to Profit When You Think the Market Won’t Go Up

Bear Put Spread Strategy – A Smart Strategy for Falling Markets

Iron Butterfly Strategy – Earn from Stability, Limit Your Risk

Call Butterfly Spread Strategy

Call Ratio Back Spread Strategy

Disclaimer:

This content is intended for educational purposes only and does not constitute financial or investment advice. Options trading involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Always do your own research or consult a SEBI-registered financial advisor before making any trading decisions. The examples provided are for illustration only and do not represent any recommendations.