What Is a Calendar Spread?

Imagine you’re dealing with time instead of strike prices.

Here’s what you do:

-

Sell a near-term option (expires soon – cheap but loses time value quickly)

-

Buy a long-term option (expires later – more expensive, holds value longer)

Both options have the same strike price.

You’re basically betting that the price won’t move much before the near-term expiry — so the short option expires worthless and you keep the premium. Then the long-dated option still has value left.

Strategy Type:

Horizontal/Calendar Spread – Same strike price, different expiries

Market View:

You expect the stock or index to stay close to a certain level in the short term, but might move later.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Now Let’s explore Calendar Spread Strategy with examples

Calendar Spread Example with NIFTY:

-

Strike Price = ₹22,000

-

Sell May expiry Call for ₹90

-

Buy June expiry Call for ₹120

-

Net Debit = ₹30 (you pay ₹120, receive ₹90)

-

Lot Size = 50

-

Total Cost = ₹1,500

What Can Happen?

Scenario 1: NIFTY closes at ₹22,000 at May expiry

-

May Call = expires worthless

-

June Call = retains most value (ideal!)

-

Big profit

Scenario 2: NIFTY at ₹22,300

-

May Call = ₹300 (loss)

-

June Call = ₹350 (partial gain)

-

Net = small loss or breakeven

Scenario 3: NIFTY moves too far up/down

-

May Call = in-the-money (loss)

-

June Call = may not gain enough to offset

-

Loss likely if movement is big

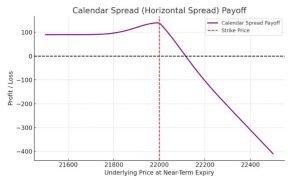

Calendar Spread Payoff Graph

-

Bell-curve shaped

-

Peak profit when stock closes at the strike price of the options

-

Losses occur if price moves far away in either direction

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Calendar Spread Strategy Summary

Component |

Action |

Expiry |

Strike |

Premium |

|---|---|---|---|---|

Long Call Option |

Buy |

June |

₹22,000 |

₹120 |

Short Call Option |

Sell |

May |

₹22,000 |

₹90 |

Net Debit |

– |

– |

– |

₹30 |

Max Profit Zone |

– |

– |

₹22,000 |

– |

Max Loss |

– |

– |

Outside of strike ± volatility |

Greek Impact on Calendar Spread

| Greek | Effect |

|---|

| Theta | ✅ Positive in short-term (due to sold option) |

| Vega | ✅ Positive – benefits from rise in volatility |

| Delta | Neutral near the strike, but changes quickly with price |

When to Use Calendar Spreads?

“I think the market will stay near this level for the next few days or weeks.”

Use it when you’re:

-

Neutral to slightly bullish or bearish

-

Expecting low volatility in the short-term, but potential rise in volatility later

-

Looking to benefit from Theta decay of the front option

Ideal Scenario:

-

The price stays close to the common strike as the near-term option expires

-

This allows your longer-dated option to gain relative value, leading to net profit

When to Avoid Using Calendar Spreads?

-

Deploying it during high implied volatility in the short-term leg

-

Using strike prices far from the current price

-

Holding without adjustment if the price moves far from the strike

Do’s and Don’ts

Do’s:

-

Use when stock is expected to stay sideways in near term

-

Choose ATM strike

-

Track volatility — you want it to rise after entering

Don’ts:

-

Avoid during high volatility events unless you know direction

-

Don’t hold past the long expiry unless you have a strong reason

-

Avoid OTM strikes — payoff weakens

Calendar Spread Cheat Sheet

Feature |

Value |

|---|---|

Max Profit |

Near strike at expiry (ATM peak) |

Max Loss |

If price moves far from strike |

Breakeven |

Approx ± the premium cost |

Ideal View |

Neutral short-term, volatile long-term |

Capital Used |

Low to Medium (net debit paid) |

Quick Snapshot of Calendar Spread

| Feature | Details |

|---|

| Market Outlook | Neutral to Moderately Bullish/Bearish |

| Profit Range | Around the strike price (max at ATM) |

| Max Profit | Occurs if underlying stays near strike at near expiry |

| Max Loss | Limited to net debit paid |

| Theta (Time Decay) | Positive (on front leg), Negative (on long leg) |

| Vega Sensitivity | Positive (benefits from increase in volatility) |

| Entry Condition | Best when front month IV is low |

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Pro Tips:

-

Strike selection: Use ATM strike or slightly OTM depending on bias

-

Enter when: Short-term IV is low, long-term IV is higher

-

Use weekly/monthly combo for better decay effect

-

Great for event-based plays, like earnings or policy meetings — place strike near expected price post-event

Summary – Why Calendar Spreads Are Brilliant:

They give you:

-

Time decay edge

-

Defined risk

-

A way to play neutral markets safely

-

Extra value from IV expansion in the long leg

Think of it as trading time — not just direction.

Conclusion – Why Use Spreads at All?

Options spreads like Bear Put, Bear Call, and Calendar Spread allow traders to:

✅ Limit their risk

✅ Reduce cost

✅ Define clear payoffs

✅ Use time and volatility to their advantage

While single-leg trades (like just buying Calls or Puts) can be thrilling, they often come with unlimited risk or cost. With spreads, you’re building smarter, more surgical trades. These are tools professionals use — and now, so can you.

A quick Recap:

The Calendar Spread is a smart, time-based options strategy ideal for traders who want to profit from time decay, stable price action, and changes in volatility all in one package.

This strategy involves:

-

Selling a Near-Term Option (to benefit from faster time decay)

-

Buying a Longer-Term Option (to retain value and hedge risk)

…both at the same strike price.

It’s like leasing out your short-term option while holding the long-term one.

Final Word:

If you’re looking to build a low-risk, non-directional options strategy with room for smart adjustments, the Calendar Spread is your go-to tool.

It teaches you how to:

-

Trade time vs time

-

Understand the behavior of different expiries

-

Take advantage of volatility structures — a next-level skill for any serious trader

Please do not just speculate while trading in stock market in any segment, instead look for learning new strategies such as

Single Leg Options Strategies for Indian Markets

Bear Call Spread – A Safer Way to Profit When You Think the Market Won’t Go Up

Bear Put Spread Strategy – A Smart Strategy for Falling Markets

Call Butterfly Spread Strategy

Call Ratio Back Spread Strategy

Disclaimer:

This content is intended for educational purposes only and does not constitute financial or investment advice. Options trading involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Always do your own research or consult a SEBI-registered financial advisor before making any trading decisions. The examples provided are for illustration only and do not represent any recommendations.