What is a Bear Call Spread?

You’re like: “NIFTY’s already gone up a lot. It probably won’t go much higher.”

So instead of just selling a risky Call (which can lose unlimited money), you:

-

Sell a Call Option at a lower strike (more premium)

-

Buy a Call Option at a higher strike (less premium)

This limits your risk. You receive a net credit (money upfront) — profit if the price stays below the strike!

Strategy Type:

Vertical Spread – using two Call options (one sold, one bought)

Market View:

You believe the market won’t rise above a certain level. You’re bearish or neutral.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Now Let’s explore Bear Call Spread Strategy with examples

When to Use a Bear Call Spread?

“I don’t think the market will rise much from here”

Or

“There’s strong resistance up ahead — I’ll bet it holds.”

Perfect when you’re:

-

Mildly Bearish or Neutral

-

Expecting range-bound price action

-

Looking for high-probability trades with defined risk and reward

Ideal Scenario:

-

The price stays below the short call strike until expiry

-

You keep the entire premium (maximum profit)

When to Avoid a Bear Call Spread?

-

Entering too close to major support or news events (volatility risk)

-

Choosing too narrow a spread (low reward vs risk)

-

Selling calls too close to ATM, unless you’re confident

Bear Call Spread Example (NIFTY):

-

NIFTY at 21,950

-

Sell 22,000 CE for ₹90

-

Buy 22,200 CE for ₹40

-

Lot Size = 50

-

Net Premium Received = ₹50 × 50 = ₹2,500

What Can Happen?

Scenario 1: NIFTY closes at 21,950

-

Both calls expire worthless

-

Keep entire ₹2,500 premium

Scenario 2: NIFTY closes at 22,100

-

22,000 CE = ₹100 loss

-

22,200 CE = ₹0

-

Net Loss = ₹100 – ₹50 = ₹50 × 50 = ₹2,500 Breakeven

Scenario 3: NIFTY closes at 22,250

-

22,000 CE = ₹250

-

22,200 CE = ₹50

-

Net Loss = (250 – 50 – 50) × 50 = ₹7,500 (Max loss)

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

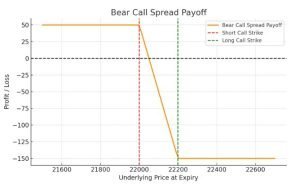

Bear Call Spread Payoff Graph

-

Flat profit until the sold strike

-

Loss starts if price moves above breakeven

-

Max loss capped due to long call hedge

Bear Call Spread Strategy Summary Table:

| Component | Action | Strike | Premium |

|---|

| Short Call | Sell | ₹22,000 | ₹90 |

| Long Call | Buy | ₹22,200 | ₹40 |

| Net Premium | – | – | ₹50 |

| Max Profit | – | – | ₹2,500 |

| Max Loss | – | – | ₹7,500 |

Greek Impact on Bear Call Spread

Greek |

Effect |

|---|---|

Delta |

Negative (bearish bias) |

Theta |

Positive (you benefit from time decay) |

Vega |

Negative (losses if volatility increases) |

How to Choose Strikes

-

Sell Call slightly OTM or ATM

-

Buy Call further OTM (to limit risk)

-

Choose expiries with 10–15 days for decent decay

-

Ideal when IV is high (you want it to fall later)

Do’s and Don’ts

Do’s:

-

Use when you expect resistance or flat market

-

Always hedge with long call to cap loss

-

Book profits before expiry when time decay is strong

Don’ts:

-

Don’t do it naked — always buy a hedge

-

Avoid in strong trending bullish markets

-

Don’t widen the spread too much if unsure

Pro Tips:

-

Combine with resistance levels and price action

-

Ideal for monthly expiry trades

-

Can be turned into an Iron Condor with a Put spread

-

Always sell options above a key resistance level

-

Enter when Implied Volatility is high (premium is juicier)

-

Use weekly or monthly expiries to benefit from Theta decay

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Bear Call Spread Cheat Sheet

Feature |

Value |

|---|---|

Max Profit |

Net Premium Received |

Max Loss |

Strike Difference – Premium Received |

Breakeven |

Short Call Strike + Net Premium |

Ideal View |

Bearish to Neutral |

Capital Used |

Medium (less than naked short call) |

Bear Call Spread – A Strategic Snapshot:

Feature |

Details |

|---|---|

Market Outlook |

Slightly Bearish or Neutral |

Max Profit |

Net Premium Collected |

Max Loss |

Difference in Strikes – Net Premium |

Risk Level |

Low to Moderate (defined) |

Reward Potential |

Limited, but high probability |

Theta (Time Decay) |

Positive – helps you every day |

Vega Sensitivity |

Negative – works better in falling IV |

Conclusion – Bear Call Spread Strategy

The Bear Call Spread is a conservative, income-generating strategy ideal for traders who believe the market (or stock) will stay below a certain level or move sideways to slightly bearish.

This strategy involves:

-

Selling a Call Option (higher premium)

-

Buying a higher strike Call Option (lower premium)

The result? You collect net premium upfront, and your maximum risk is capped.

Quick Summary:

The Bear Call Spread is like selling insurance — you collect a premium upfront and keep it if the market behaves.

It’s perfect for traders who want:

-

High probability trades

-

Limited capital exposure

-

A safe, income-based options strategy

Final Word:

Use this strategy near resistance zones or during consolidation phases in the market. It teaches you risk management and disciplined trading, two essential traits for long-term success in options trading.

Please do not just speculate while trading in stock market in any segment, instead look for learning new strategies such as

Single Leg Options Strategies for Indian Markets

Bear Put Spread Strategy – A Smart Strategy for Falling Markets

Call Butterfly Spread Strategy

Call Ratio Back Spread Strategy

Disclaimer:

This content is intended for educational purposes only and does not constitute financial or investment advice. Options trading involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Always do your own research or consult a SEBI-registered financial advisor before making any trading decisions. The examples provided are for illustration only and do not represent any recommendations.

![Read more about the article Best Option Strategy for Bank Nifty & Nifty 50 in 2026 [Complete Guide]](https://moneycontain.com/wp-content/uploads/2025/09/best-option-300x201.jpg)