What Are Single Leg Options Strategies?

Imagine you like a cricket bat priced at ₹1,000. You tell the shopkeeper, “I’ll pay ₹50 now to keep the right to buy it at ₹1,000 within 1 month.” If the bat’s price increases to ₹1,500, you’ll still buy it at ₹1,000. If the price drops to ₹800, you won’t buy it. You’ll just lose ₹50.

Let’s continue with Single leg options strategies which involves only one option leg – either buying or selling a Call or Put.

There are 4 basic strategies:

-

Long Call

-

Long Put

-

Short Call

-

Short Put

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Let’s explore single leg strategies one by one

LONG CALL – Buying a Call Option (Bullish Strategy)

When to Use: You think NIFTY or a stock will go UP.

How It Works: You pay a premium to buy the right to buy at a certain price (strike).

Example:

-

Underlying: NIFTY

-

Current Price: 22,000

-

You buy 22,100 Call for ₹100 (premium)

-

Lot Size: 50

-

Total Investment: ₹100 × 50 = ₹5,000

What Can Happen:

-

If NIFTY goes to 22,400:

-

Intrinsic Value = 22,400 – 22,100 = 300

-

Profit = (300 – 100) × 50 = ₹10,000

-

-

If NIFTY stays at or below 22,100:

-

You lose the entire premium = ₹5,000

-

Long Call Payoff Graph:

You Buy a Call Option (Bullish)

You lose maximum ₹5,000, but upside is unlimited.

-

Flat loss = premium paid (if price doesn’t rise)

-

Profit starts once price rises above Strike + Premium

Example:

-

Strike = 22,100

-

Premium = ₹100

-

Breakeven = 22,200

-

Unlimited upside above 22,200

Greeks Impact:

-

Delta: Positive (goes up as price rises)

-

Theta: Negative (you lose money as time passes)

-

Vega: Positive (you benefit from rise in volatility)

Do’s:

-

Buy calls only when you’re very bullish

-

Choose strikes just above current price (ATM/OTM)

Don’ts:

-

Don’t hold near expiry if price hasn’t moved

-

Don’t buy far OTM (like 500+ points away)

Pro Tip: Use weekly options for quick moves, monthly for more time cushion.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

LONG PUT – Buying a Put Option (Bearish Strategy)

When to Use: You believe the market or a stock will fall.

How It Works: You buy the right to sell at a fixed price.

Example:

-

Stock: Reliance

-

Current Price: ₹2,900

-

Buy 2,850 Put for ₹60

-

Lot Size: 250

-

Investment = ₹60 × 250 = ₹15,000

What Can Happen:

-

Stock falls to ₹2,700:

-

Intrinsic Value = 2,850 – 2,700 = ₹150

-

Profit = (150 – 60) × 250 = ₹22,500

-

-

If stock stays above 2,850:

-

You lose the premium = ₹15,000

-

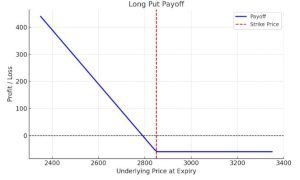

Long Put Payoff Graph:

You Buy a Put Option (Bearish)

Fixed loss, high profit potential if price drops.

-

Max loss = premium paid

-

Profit starts when price falls below Strike – Premium

Example:

-

Strike = ₹2,850

-

Premium = ₹60

-

Breakeven = ₹2,790

-

Gains increase as price falls below ₹2,790

Greeks Impact:

-

Delta: Negative

-

Theta: Negative

-

Vega: Positive

Do’s:

-

Use if news or results may crash stock

-

Go ATM/just OTM for better probability

Don’ts:

-

Avoid deep OTM Puts

-

Don’t hold too close to expiry with no movement

Pro Tip: Puts are often underused in Indian markets – but great for shorting with limited risk.

SHORT CALL – Selling a Call Option (Bearish/Neutral Strategy)

When to Use: You think the stock/index won’t go up much.

How It Works: You receive a premium by selling a call but must sell at strike if required.

Example:

-

NIFTY at 22,000

-

Sell 22,200 Call for ₹70

-

Lot: 50

-

You receive ₹3,500 upfront

What Can Happen:

-

If NIFTY stays below 22,200:

-

You keep entire ₹3,500

-

-

If NIFTY moves to 22,500:

-

Loss = (22,500 – 22,200 – 70) × 50 = ₹11,500

-

Risk: Unlimited loss if market jumps

Short Call Payoff Graph:

You Sell a Call Option (Bearish/Neutral)

Limited profit (premium), unlimited risk.

-

Max profit = premium received

-

Loss is unlimited if price rises above strike

Warning:

Naked call selling is risky — avoid without a hedge.

Greeks Impact:

-

Delta: Negative

-

Theta: Positive (you benefit from time decay)

-

Vega: Negative

Do’s:

-

Sell Calls above resistance or far OTM

-

Use hedge/spread if you’re new

Don’ts:

-

Don’t sell naked calls in volatile market

-

Never sell ATM calls unless you’re hedged

Pro Tip: Sell calls only if you understand risk, or hedge with higher call.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

SHORT PUT – Selling a Put Option (Bullish/Neutral Strategy)

When to Use: You believe stock/index won’t fall or will rise.

How It Works: You earn premium by selling a put, but must buy if price drops.

Example:

-

Reliance at ₹2,900

-

Sell 2,850 Put for ₹50

-

Lot: 250

-

Receive ₹12,500 upfront

What Can Happen:

-

If price stays above ₹2,850:

-

Keep full ₹12,500

-

-

If price falls to ₹2,700:

-

Loss = (2,850 – 2,700 – 50) × 250 = ₹25,000

-

Risk: Large loss if price crashes

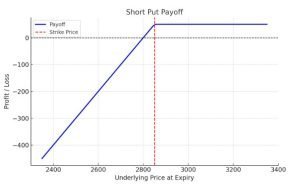

Short Put Payoff Graph:

You Sell a Put Option (Bullish/Neutral)

Limited profit, high loss potential

-

Max profit = premium received

-

Loss increases as price falls below strike

Example:

-

Strike = ₹2,850

-

Premium = ₹50

-

Breakeven = ₹2,800

-

Loss if stock falls below ₹2,800

Greeks Impact:

-

Delta: Positive

-

Theta: Positive (time decay helps)

-

Vega: Negative

Do’s:

-

Sell puts below support, not ATM

-

Use margin protection or hedge

Don’ts:

-

Don’t sell puts on earnings day

-

Avoid naked puts on weak stocks

Pro Tip: A great way to acquire stocks cheaper — if you’re okay owning the stock.

BASIC SINGLE LEG OPTIONS STRATEGIES CHEAT SHEET

Strategy |

Market View |

Risk |

Reward |

Ideal Strike |

Time to Expiry |

|---|---|---|---|---|---|

Long Call |

Bullish |

Limited |

Unlimited |

ATM/OTM |

2–3 weeks |

Long Put |

Bearish |

Limited |

High |

ATM/OTM |

2–3 weeks |

Short Call |

Bearish/Sideways |

Unlimited |

Limited (Premium) |

Deep OTM |

<1 week |

Short Put |

Bullish/Sideways |

High |

Limited (Premium) |

Deep OTM |

<1 week |

Greek Summary Table

Strategy |

Delta |

Theta |

Vega |

|---|---|---|---|

Long Call |

+ve |

–ve |

+ve |

Long Put |

–ve |

–ve |

+ve |

Short Call |

–ve |

+ve |

–ve |

Short Put |

+ve |

+ve |

–ve |

Risk Reward Summary Table

| Strategy | Graph Shape | Risk | Reward |

|---|

| Long Call | Starts flat, slopes up | Limited | Unlimited |

| Long Put | Starts flat, slopes down | Limited | High |

| Short Call | Flat then slopes down | Unlimited | Limited (Premium) |

| Short Put | Flat then slopes down | High | Limited (Premium) |

Conclusion: Start with the Basics, Trade Smart!

Single-leg strategies are the foundation of options trading. Once you master them, you can move to spreads and combos. Start small, understand risk-reward, and never trade without a reason.

For recap

-

Long Call – Profit when the market goes up

-

Long Put – Profit when the market goes down

-

Short Call – Earn premium if market stays below strike

-

Short Put – Earn premium if market stays above strike

💡 If you’re just starting, begin with buying options (calls or puts) to keep your risk limited.

Please do not just speculate while trading in stock market in any segment, instead look for learning new strategies such as

Call Butterfly Spread Strategy

Call Ratio Back Spread Strategy

Disclaimer:

This content is intended for educational purposes only and does not constitute financial or investment advice. Options trading involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Always do your own research or consult a SEBI-registered financial advisor before making any trading decisions. The examples provided are for illustration only and do not represent any recommendations.