Retirement planning is crucial especially with inflation reducing the value of your savings over time. Retirement Planning Calculator With Inflation is a tool you should use in order to find out how much you need to save to live a comfortable life post retirement.

In this guide, we’ll answer the most common questions, provide real-life examples, and show you how to calculate your retirement corpus with inflation using Retirement Planning Calculator With Inflation.

There are many retirement planning calculator available online but none of them takes account of inflation rate, which means it is a half truth. Moreover, those retirement calculator will ask you tonnes of question to submitted before they show you the result.

Hence, at moneycontain keeping the practicality of the situation, retirement planning calculator with inflation is developed to be used anytime and within 4 simple steps it tells you the monthly saving to reach the retirement goal plus it tells you the future value of the retirement corpuses in present terms keeping the adjusted inflation rate in mind.

As an investor you should know the (TMV) “time value of money” the value of money does not remain the same across time. Meaning, the value of Rs.100,000 today is not really Rs.100,000, 5 years from now. Likewise the value of Rs.100,000, 5 years from now is not really Rs.100,000 as of today.

Whenever there is motion of time, there is an element of opportunity. Money has to be accounted or adjusted for that opportunity. Therefore, we have to keep inflation in mind whenever we make any investment in different financial instruments and even while you plan for retirement.

Whether you earn and invest in dollars, rupees, pounds, euros or any other currency it does not matter.

In order to use the retirement planning calculator with inflation you just need to enter the exact amount you would want when you will retire, enter the tenure in months when you think you will retire, enter the cagr returns earned from investment and at last enter the average rate of inflation during the investment tenure i.e. till retirement.

So, go ahead now and try it out yourself below using retirement planning calculator with inflation and see how much you need to save and invest every month to reach your retirement goals and also find out how much is the value of your retirement corpus keeping adjusted inflation rate.

If you are thinking, alright I understood the value of my retirement corpus will get decrease due to reverse inflation and the amount received is certainly going to miss the expected target goal, still can you tell me how much pension will I be able to generate?

Yes, it is very simple math, you only need to multiply you average life expectancy that is no. of years or months to monthly expenditure, for example let us say post retirement you want Rs.50,000 every month to spend in order to live a comfortable life, than just multiply this amount with no. of year (months) you think you are going to live.

Rs.50,000 * 240 months (20 years) = Rs.1.2 crore (This much amount will be finished)

But here is the thing even your expenditure is limited you cannot control the inflation outside,

I mean things you buy or use or everyday such as clothes, food, medical, household grocery rates etc. will certainly going to increase day by day. which leads us back to same old thing i.e. the importance of investing.

Now, that you have calculated the amount you need every month to reach the specific target for your retirement and have also calculated how much decline will be in the retirement corpus you desired due to inflation, it is time to know how to fill this gap.

I mean below we will learn the different types of best investment options available to you as an investor and more important why you should invest at all? But before knowing the best options let us first few important things.

Why Is Inflation Important in Retirement Planning?

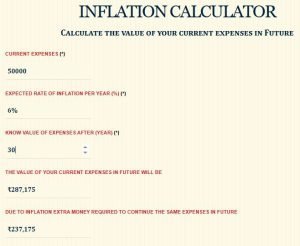

Inflation reduces the purchasing power of your money over time. If your monthly expense is ₹50,000 today, it will be much higher in 30 years due to inflation.

-

Current Age: 30

-

Retirement Age: 60

-

Inflation Rate: 6% (India’s long-term average)

-

Current Monthly Expense: ₹50,000

Using the moneycontain inflation calculator

In 30 years, you’ll need ₹2.87 lakh per month to maintain today’s lifestyle!

How Much Retirement Corpus Do You Need?

A common rule is the 25x Rule, which suggests you should save 25 times your expected annual expenses at retirement.

Example Calculation:

-

Expected Monthly Expense at 60: ₹2,87,174

-

Expected Annual Expense at 60: ₹34,46,088 (₹2,87,174 × 12)

-

Retirement Corpus Needed:

34,46,088×25=₹8.6 Crores

You need approximately ₹8.6 Crores to retire comfortably at age 60.

If you are looking for the best stockbroker I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

How to Calculate Monthly Savings for Retirement?

To calculate how much you need to invest monthly, we use the Future Value of an Annuity formula:

Example Calculation :

-

Target Corpus: ₹8.6 Crores

-

Years to Retirement: 30

-

Expected Return: 12% (Mutual Funds / Equity)

-

Total Months: 30 × 12 = 360

Solving for P (Monthly Savings):

Using moneycontain personal finance calculator

You need to save ₹24,607 per month for the next 30 years in a high-return investment (like mutual funds or stocks) to retire with ₹8.6 Cr.

How Can You Reduce the Impact of Inflation on Retirement?

-

Invest in High-Return Assets:

-

Equity Mutual Funds: Average return of 12-15% in the long term.

-

Index Funds / Stocks: Beat inflation over time.

-

NPS (National Pension System): Provides tax benefits and market-linked returns.

-

-

Increase SIP Contributions Yearly:

-

If you increase SIP by 10% every year, you can retire faster.

-

-

Delay Retirement If Possible:

-

Each extra year of work allows savings to compound longer.

-

-

Use a Mix of Investment Options:

-

Real Estate: Passive rental income.

-

PPF & EPF: Stable and tax-free returns.

-

FD & Bonds: Safe but lower returns (good for post-retirement).

-

If you are looking for the best stockbroker I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Where Should You Invest for Retirement in India?

Investment Option |

Expected Return |

Risk Level |

Best For |

|---|---|---|---|

Equity Mutual Funds (SIP) |

12-15% |

High |

Long-term wealth |

Stocks & Index Funds |

10-15% |

High |

Beating inflation |

NPS (National Pension System) |

8-12% |

Medium |

Tax benefits |

PPF (Public Provident Fund) |

7-8% |

Low |

Safe, tax-free growth |

EPF (Employee Provident Fund) |

8% |

Low |

Salaried employees |

Fixed Deposits (FDs) |

5-6% |

Very Low |

Post-retirement income |

Real Estate (Rent) |

5-10% |

Medium |

Passive income |

What is the Best Age to Start Saving for Retirement?

The earlier you start, the easier it is to build a larger retirement corpus with less monthly savings due to the power of compounding.

Example: Monthly SIP Needed to Reach ₹5 Crore (Assuming 12% Return)

Starting Age |

Monthly SIP Needed |

Total Investment |

Final Corpus |

|---|---|---|---|

25 years |

₹7,500 |

₹31.5L |

₹5 Cr |

30 years |

₹13,000 |

₹46.8L |

₹5 Cr |

40 years |

₹38,000 |

₹91.2L |

₹5 Cr |

50 years |

₹1,00,000 |

₹1.2 Cr |

₹5 Cr |

Starting early can reduce the amount you need to save each month!

How Can I Plan for Medical Expenses in Retirement?

Medical expenses in India are rising due to inflation in healthcare costs (8-12% per year). Without proper planning, healthcare costs can eat into your retirement savings.

Steps to Plan for Medical Costs:

✔️ Buy a Comprehensive Health Insurance Plan (₹10-25L cover).

✔️ Consider Critical Illness Insurance for major diseases.

✔️ Create a separate Medical Emergency Fund (₹10-20L).

✔️ Invest in Senior Citizen Health Plans after retirement.

A medical emergency without insurance can wipe out years of savings!

Should I Invest in Real Estate for Retirement?

Real estate can be a good passive income source, but it has low liquidity and high maintenance costs.

Pros of Real Estate for Retirement:

✔️ Rental Income – Steady cash flow.

✔️ Capital Appreciation – Property value may increase.

Cons:

❌ Not Liquid – Hard to sell in emergencies.

❌ High Initial Cost – Requires large upfront investment.

❌ Maintenance Costs & Taxes – Reduces returns.

If considering real estate, ensure it doesn’t consume all your savings. Diversify into mutual funds & bonds as well!

What’s the Safest Investment for Retirement?

If you want low risk & steady income, consider:

✔️ Senior Citizen Savings Scheme (SCSS) – 8.2% returns (Govt-backed).

✔️ Pradhan Mantri Vaya Vandana Yojana (PMVVY) – Pension scheme for 60+.

✔️ Public Provident Fund (PPF) – Tax-free 7-8% returns.

✔️ Bonds & Fixed Deposits (FDs) – Safe, but lower returns.

Best strategy? Use a mix of safe & high-return investments.

If you are looking for the best stockbroker I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

How to Protect Retirement Savings from Inflation?

Since inflation reduces purchasing power, you need investments that grow faster than inflation.

Best Anti-Inflation Strategies:

✔️ Equity Mutual Funds (12-15% return) – Beats inflation.

✔️ Gold & REITs – Hedge against inflation.

✔️ TIPS (Treasury Inflation-Protected Securities) – Safe inflation-linked bonds.

✔️ Real Estate with Rental Income – Passive cash flow.

Never keep all money in FDs or savings accounts—they give low returns (~6%), which may not beat inflation.

What is the Best Investment Mix for Retirement?

The best investment portfolio depends on your age & risk tolerance.

Retirement Investment Mix Based on Age:

Age Group |

Equity Mutual Funds |

Debt (PPF, FD, Bonds) |

Gold/Real Estate |

|---|---|---|---|

30-40 years |

70% |

20% |

10% |

40-50 years |

60% |

30% |

10% |

50-60 years |

40% |

40% |

20% |

After 60 years |

20% |

60% |

20% |

Key Rule: Higher equity when young, more debt & fixed income as you get closer to retirement.

What If I Start Retirement Planning Late (After 40)?

Starting late means you must save more aggressively. But it’s still possible!

Steps for Late Starters (40+ Years Old):

✔️ Increase Monthly Savings (₹40,000+ per month).

✔️ Invest in High-Return Assets (Equity Mutual Funds, NPS).

✔️ Reduce Unnecessary Expenses (Cut luxury spending).

✔️ Delay Retirement If Possible (Work till 60+).

A late start is better than no start! 🚀

What is the Best Retirement Plan for Self-Employed Individuals?

Unlike salaried employees (who get EPF), self-employed people must self-manage their retirement savings.

Best Investment Options for Self-Employed Individuals:

✔️ NPS (National Pension System) – Tax benefits & market-linked growth.

✔️ Equity Mutual Funds (SIP) – Best for long-term wealth creation.

✔️ PPF (Public Provident Fund) – Tax-free returns & stable growth.

✔️ Gold / Real Estate – Diversify assets.

Start early and invest consistently. You may also invest in gold ETFs as well.

If you are looking for the best stockbroker I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Final Thoughts:

Key Takeaways:

✔️ Inflation will triple your expense in 30 years (₹50K today → ₹2.87L at 60).

✔️ You need ₹8.6 Cr for retirement at 60 in India.

✔️ Start SIP early (₹24000/month) to build wealth over time.

✔️ EPF/PPF alone is NOT enough – You need equity investments.

✔️ Diversify between stocks, bonds, real estate, and pension schemes.

Start NOW! The earlier you begin, the easier your retirement journey will be. 🚀

I hope you have completely understood the concepts behind inflation and have used the Retirement planning calculator with Inflation to know the money you need to save and invest every month.

Understanding of inflation in life makes you better at spending, investing, saving at correct time.

The first step you need to take to start saving is setting your savings target. Until and unless you have a set goal, your plan will be directionless. Start by deciding your savings target so that you are financially secure after retirement.

So make sure and planned the things accordingly to be at better position than others post retirement, not only for you but for your family and children. For example as general rule of thumb start savings:

In your 20s: Aim to save 25 percent of your overall gross pay

By age 30: Have the equivalent of your annual salary saved

By age 35: Have twice your annual salary saved.

By age 40: Have three times your annual salary saved.

By age 45: Have four times your annual salary saved.

By age 50: Have five times your annual salary saved.

Not only save but invest that money to every month in anything which suits your risk appetite.

Nobody on this earth have imagined that we might be dealing with a pandemic such as Coronavirus in 2020-21, people have lost their jobs, business have been hampered drastically, economies throughout world have suffered enormously.

It is not easy to set things up how it was earlier, even if that have not happened, suppose you get fired from your job or you don’t want to do job further, assume you met an accident, do not get me wrong I am not hoping for these bad things to happened to anyone, I am just trying to point out – life is ruthless and at the same time unpredictable.

Saving and investing should be done by everyone at the very beginning of your life and should continue till you know this much would be enough for me to take a retirement or be financially free.

If you are looking for the best stockbroker I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Want to learn about stock market step by step than do read this amazing stock market guide designed specifically for beginners to clear the concepts in easy language.

You can also check my reviews on best brokers in India here:

Dhan Broker Review (recommended broker)

Incase you are looking for any Home loan or want to calculate the monthly EMI, than do check moneycontain free home loan EMI calculator.

If, you have liked the content please do share it with your friends or on social media, as sharing do bring the good karma. If you have any questions or feedback you can leave them in comment box below.

Note: Please do not take this as any recommendation, to trade or invest. This is just for reference, to make you understand more about Retirement planning Calculator With Inflation and its importance, under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset.

Please do your own research and make investment. Moneycontain will not be responsible for any of your losses at all. The point made is for educational purpose only. All investments are subject to risks, which should be considered prior to making any investments.

Disclaimer:

This Retirement Planning Calculator with inflation is for informational purposes only and should not be considered financial advice. The results are based on assumptions regarding inflation, returns, and savings, which may vary over time.

✔️ Actual investment returns are subject to market risks.

✔️ Inflation rates and expenses may change in the future.

✔️ This tool does not guarantee financial security.

We recommend consulting a certified financial advisor before making any investment or retirement decisions.