What Are Options?

Imagine this:

You want to buy an iPhone in 30 days, but you’re afraid the price might increase. So, you go to the shop and say:

“I’ll pay ₹500 now to lock in today’s price (₹80,000) for the next 30 days.”

If the iPhone price goes to ₹90,000, you saved ₹10,000 by paying ₹500 upfront.

If the price stays the same or falls, you lose just ₹500.

Options are not the same thing as stocks because they do not represent ownership in a company. Ownership comes when you buy a stock in normal equity (cash) segment and take delivery of that stock in your demat.

One of the benefit of option trading is you can close your position at any point until the expiration date. In simple words you can squareoff the position anytime in a day when market is opened till expiry.

Options Trading For Beginners may seem overwhelming. However I will try my best to explain it in simple terms.

This guide is designed to help you understand the basics of options trading, the steps to get started, and the strategies you can use to trade options effectively in the Indian stock market.

Whether you are a novice or someone with some experience in the stock market, this guide will provide you with the knowledge you need to start trading options confidently.

In India nearly 80% of the derivatives traded are options and the rest is credited to the futures trading. If you are not aware about derivatives, let me explain you in simple words, Options are part of derivatives market, so let us first know about derivatives.

Options trading is a type of derivatives trading, where the value of the option is derived from the price of an underlying asset, such as a stock, index, commodity, or currency. Understanding the basics of derivatives is essential for anyone looking to get into options trading.

What Are Derivatives?

Derivatives are financial instruments whose value is based on the price of another asset, known as the “underlying asset.” They are contracts between two or more parties, and the value of the derivative fluctuates with the price of the underlying asset.

The main types of derivatives include:

- Futures: Contracts to buy or sell an asset at a predetermined price on a specific future date.

- Forwards: Similar to futures but are customized contracts traded over-the-counter (OTC).

- Swaps: Contracts where two parties exchange cash flows or other financial instruments.

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specified price before or at a specific date.

Now, just forget about other derivatives and let us focus on options.

So the Book definition of options is, it is a type of derivative contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specific date.

The underlying asset can be stocks, indices, commodities, or currencies. In the context of the Indian stock market, options are typically associated with individual stocks or stock indices like the Nifty 50 or the FINNifty, Bank Nifty etc.

When you buy options you can either hold the option till expiry and let the exchange do the settlement for you this is called Exercising a contract or you can close the position before expiry and book profits/loss.

There are two types of options – The Call Option and the Put Option. You can be a buyer or seller of these options. There are four types of participants in options markets:

- Buyers of calls

- Sellers of calls

- Buyers of puts

- Sellers of puts

Buyers are referred to as having long positions, sellers are referred to as having short positions. Selling an option is also known as writing the option.

Option Styles:

There are two main styles of options:

- European Style: These options can only be exercised on the expiration date.

- American Style: These options can be exercised at any time before the expiration date. In the Indian market, index options are European style, while stock options are generally American style.

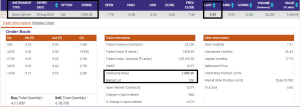

Now before we deep dive in to understanding them we need to be aware of few other concepts and for that you need to check out the image below:

As an illustration let us take an example of an stock option derivative, Tata Motors. Please keep an eye on things mentioned in black bracket only for time being.

Lot Size:

In Option contracts the minimum number or quantity you would be transacting is known as lot size. It depends on different securities and are predetermined. You can not choose it by yourself how many shares you want to buy.

As you can see in the image above market lot quantity for TATAMOTORS Option contract is 550. This is the minimum quantity you need to buy or sell in order to get the option contract for this particular stock.

Strike price:

It represents the price at which the stock can be bought on the expiry day. As in above image we choose 1090 as strike price , which means on expiry or before whenever the price of TATAMOTORS in spot market goes above 1090 you can exercise your right to buy it (premium goes higher when the spot price of any stock or index go high except in some cases).

There is a reason why your strike price should be lower than current market price in case of call option if you want to make profit. I have discussed that below.

Contract Worth:

As we know now the quantity is predetermined, contract value or worth would be multiplying quantity with current value of securities. So, Lot Size x Price = Contract total worth in case of above image we are buying call option and hence to buy we need to pay the premium showing Rs. 8.50, Multiply 8.50 x 550 = 4675 is the total premium you need to pay in order to get the call option contract. So this amount would be the total contract value for option buyer.

Expiry:

In the image above you can see expiry date showing 29 AUG 2024. Likewise every Option Contract is bound to time known as expiry. So if you purchase the contract for month of AUGUST, after 29 it will get expired.

Expiry happens on last Thursday of every month for every contract whether stocks or index. (Also keeps on changing sometime by exchange)

After this new contracts will be introduced by exchanges. Similar to futures contracts, option contracts also have the concept of current month, mid month, and far month. However the premium is not the same across different expiries.

Premium of a stock or index option is never fixed it keeps on changing depending up on time, news or any events occurring in market affecting the stock price or index price.

In the Indian market, options typically expire on the last Thursday of the contract month. There are various types of options based on their expiry:

- Weekly Options: These expire every Thursday.

- Monthly Options: These expire on the last Thursday of the month.

- Quarterly Options: These expire on the last Thursday of the quarter.

Instrument Type:

As you can see the image Above instrument type is Stock Option, underlying asset is the stock of a company as we want to buy TATAMOTORS Call Option we will select stock Option there.

Underlying Value:

Derivative contract derives its value from an underlying asset as we have discussed above. The underlying price is the price at which the underlying asset trades in the spot market. This is current market price at which stock is trading in spot or equity market.

In the above image the underlying value is showing 1085.35 which means the Tata motors stock is trading at that price currently in the market.

Spot market is the regular equity market, you would see the price difference in spot market and futures price. You might ask why is there difference in prices? Spot prices are for immediate buying and selling, while options contracts delay payment and delivery.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Meaning Of Premium In Options Trading?

Premium is the most important factor in option trading, this is what a call or put option buyer pays to get the contract with a call or put option seller who receives this premiums to be obliged to the contract.

Let us take an intraday option trading example and understand how one earns money in option trading on day trade. Checkout the rectangle box marked in red below:

The stock name is NTPC, if you see the premium value which is Rs.2.40, at the end of the trading day, also see the previous closing its about Rs0.95.

This reflects the premium got increased about Rs.1.45 next trading day, now let us do some math and now exactly how much money you can make.

If you have bought, let say 1 lot which is 5700 at premium value of Rs.1 than the total amount required to buy the call option contract would have been Rs.1*5700= Rs.5700, the very next day the premium value for NTPC made a high of Rs3.75.

Even if you have sold the contract at Rs.2 than it was an easy Rs.5700 profit excluding brokerages and taxes. Which is in my opinion more than 5 days salary of an average job going individual in India.

Now let us take another example as an seller. Check out the image below:

The stock name is ZEEL(Zee Entertainment) the stock made a high previous day of Rs.17, as an option trader, one could have sold the call option and enjoyed the premium which is by the way 3000*17= Rs.51000.

Can you imagine within a day a earning of Rs.51000, that is why option trading is very popular among the traders in stock market.

Having said that one has to do a well research before making any trade and always use stop-loss while trading.

What Is a Naked Option?

“Naked” means you’re trading options without owning the stock or any protection.

Naked Buying:

-

Buy a Call (if you think price will go UP)

-

Buy a Put (if you think price will go DOWN)

Naked Selling:

-

Sell a Call (if you think price will stay below strike)

-

Sell a Put (if you think price will stay above strike)

Selling naked options carries unlimited risk. Beginners should start with buying.

How Options Work?

There are two types of options:

Option Type |

You Expect Price To… |

You Do This |

Example |

|---|---|---|---|

Call Option |

Go Up |

Buy a Call |

NIFTY 22500 CE |

Put Option |

Go Down |

Buy a Put |

RELIANCE 2600 PE |

Premium: The price you pay for buying an option.

Strike Price: The fixed price at which you have the right to buy/sell.

Real Example:

NIFTY is at 22,000

You buy a 22,000 Call for ₹100

If NIFTY goes to 22,200 → Profit = ₹100

If it stays at 22,000 or drops → You lose ₹100

What Do ITM, ATM, and OTM Mean?

These terms tell you how far your option is from the current market price (called spot price).

Let’s assume:

-

Stock = Reliance

-

Current price = ₹2,500

Call Options (Right to BUY)

| Type | Meaning | Example (Strike) |

|---|

| ITM (In-the-Money) | Strike price < current price (already profitable) | ₹2,400 Call |

| ATM (At-the-Money) | Strike price = current price | ₹2,500 Call |

| OTM (Out-of-the-Money) | Strike price > current price (not yet profitable) | ₹2,600 Call |

Buying Call Option Example:

-

Buy ₹2,400 Call (ITM): Already profitable by ₹100 (₹2,500 – ₹2,400)

-

Buy ₹2,500 Call (ATM): Needs stock to move above ₹2,500 to profit

-

Buy ₹2,600 Call (OTM): Cheaper premium, but needs big move to profit

Selling Call Option Example:

-

Sell ₹2,600 Call (OTM): Safe unless stock jumps above ₹2,600

-

Sell ₹2,500 Call (ATM): Higher premium but higher risk

-

Sell ₹2,400 Call (ITM): Risky, already in profit for buyer

Put Options (Right to SELL)

Type |

Meaning |

Example (Strike) |

|---|---|---|

ITM (In-the-Money) |

Strike price > current price (already profitable) |

₹2,600 Put |

ATM (At-the-Money) |

Strike price = current price |

₹2,500 Put |

OTM (Out-of-the-Money) |

Strike price < current price (not yet profitable) |

₹2,400 Put |

Buying Put Option Example:

-

Buy ₹2,600 Put (ITM): Already profitable by ₹100

-

Buy ₹2,500 Put (ATM): Needs price to drop below ₹2,500

-

Buy ₹2,400 Put (OTM): Cheap premium, but risky

Selling Put Option Example:

-

Sell ₹2,400 Put (OTM): Safe unless price falls below ₹2,400

-

Sell ₹2,500 Put (ATM): Mid-risk, good premium

-

Sell ₹2,600 Put (ITM): High premium, but very risky

Quick Cheat Sheet

Option Type |

ITM (In Profit) |

ATM (Neutral) |

OTM (Needs Move) |

|---|---|---|---|

Call |

Strike < Price |

Strike = Price |

Strike > Price |

Put |

Strike > Price |

Strike = Price |

Strike < Price |

Why It Matters:

-

ITM Options: Expensive but more likely to be profitable

-

ATM Options: Balanced risk/reward

-

OTM Options: Cheap, but need big moves to make money

Key Option Terms You Must Know (With Simple Examples)

| Term | Meaning | Example |

|---|

| Call Option | Right to buy | You buy Reliance 2400 CE |

| Put Option | Right to sell | You buy Infosys 1300 PE |

| Strike Price | Pre-fixed price | Reliance 2400 |

| Premium | Cost of option | ₹30 per share |

| Expiry | Last day of contract | Every Thursday (weekly) |

| Lot Size | Minimum quantity | NIFTY: 50 units |

| ITM | In The Money | Option already profitable |

| ATM | At The Money | Strike = Current Price |

| OTM | Out of The Money | Not profitable yet |

.

If you’re looking for a modern, feature-rich, and trader-friendly platform, Dhan is easily one of the best choices available today. From zero account opening charges to advanced tools like native TradingView, options strategy builder, and free API access, Dhan is clearly built with the modern Indian trader in mind.

With Dhan you can also invest and trade in IPO’s, NFO’s, SIP, Bonds, ETF, SGB, and many other financial products with so much ease.

Whether you’re an intraday trader, an options strategist, or a long-term investor, Dhan offers the perfect blend of speed, simplicity, and smart technology — without burning a hole in your pocket.

Why wait? Open your Dhan account now and take control of your trading journey with confidence.

👉 Click here to get started with Dhan

Open a Free Dhan Trading & Demat Account

Dhan offers cutting-edge tools for fast, powerful, and informed trading:

- ✅ Zero brokerage on delivery trades

- ✅ Auto-detection of candlestick patterns on charts

- ✅ Advanced Option Chain with Greeks, Max Pain, PCR & more

- ✅ Pre-built & custom Option Strategy Builder (Free)

- ✅ 20 Depth Market Data and Flash Trade execution

- ✅ Margin Trading Facility (MTF) with 4X leverage (75%)

- ✅ 3 Platforms: Mobile App, Web App & Dedicated Options App

- ✅ ScanX Screener: stock insights, trends & news

- ✅ Advanced orders: Trailing SL, Iceberg, Forever Orders

- ✅ Instantly pledge 1,500+ stocks for options margin

- ✅ Trade commodities: Gold, Silver, Crude, Natural Gas

- ✅ Fundamental + Technical analysis across all platforms

No paperwork. Zero account opening charges. Setup in minutes.

Step-by-Step: Buying a Naked Call or Put Option

Example: Buy a NIFTY 22500 Call Option

-

Open your trading app (e.g., Dhan Option trader)

-

Go to F&O > Index Options

-

Select strike price (e.g., 22,500 CE)

-

Check premium (e.g., ₹80)

-

Click Buy, enter lot size (e.g., 50 units)

-

Review and Confirm

If NIFTY rises above 22,580 (Strike + Premium), you make profit.

Step-by-Step: Selling a Naked Call or Put Option

Caution: Naked selling is risky. Always have a stop-loss.

Example: Sell a NIFTY 22,600 Call for ₹40

-

Ensure your broker has margin enabled

-

Sell the option → Receive ₹40 x 50 = ₹2,000 upfront

-

If NIFTY stays below 22,600 by expiry → You keep the ₹2,000

If NIFTY goes to 22,800 → Huge loss

Buying vs. Selling Options (Naked)

Factor |

Buying Option |

Selling Option (Naked) |

|---|---|---|

Risk |

Limited to premium paid |

Unlimited (esp. for Calls) |

Reward |

High |

Limited to premium received |

Capital Required |

Low |

High (margin required) |

Best For |

Beginners |

Experienced Traders |

Break-Even Calculation

-

Call Option = Strike Price + Premium Paid

-

Put Option = Strike Price – Premium Paid

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

How Much Money Do You Need to Trade Options in India?

The money required depends on whether you’re:

-

Buying options (lower risk, lower capital)

-

Selling options (naked) (higher risk, higher capital)

Buying Options: Low Capital Required

When you buy a Call or Put option, you only pay the premium × lot size.

Example:

-

You want to buy a NIFTY 22500 Call option

-

Premium = ₹100

-

Lot size = 50 (NIFTY)

Capital Needed = ₹100 × 50 = ₹5,000

That’s it. ₹5,000 is your maximum risk (the amount you can lose).

This is why buying options is beginner-friendly.

Key Points:

-

No margin required

-

Loss is limited to the premium paid

-

Profit potential can be high if the market moves in your favor

Selling Options (Naked Selling): High Capital Required

Selling options means you’re collecting the premium now, but you must keep margin in your account to cover potential losses.

Margin is set by the exchange (NSE) and varies based on:

-

Volatility

-

Strike price

-

Stock/index chosen

Example: Sell NIFTY 22700 Call Option

-

Premium = ₹80

-

Lot size = 50

-

Premium received = ₹4,000

BUT…

Margin required (approximate, varies daily) = ₹1.2 to ₹1.6 lakh

Why so much? Because if NIFTY goes above 22700, you’re on the hook to pay the difference to the buyer.

Key Points:

-

You need high capital or margin (~₹1.2 lakh+ per lot)

-

Losses can be unlimited (especially for naked Call selling)

-

Better suited for experienced or hedged traders

Options Buying/Selling Summary Table

| Trade Type | Capital Needed | Risk | Example Capital |

|---|

| Buy Call/Put | Premium × Lot Size | Limited | ₹3K–₹10K |

| Sell Naked Call | Margin (set by NSE) | Unlimited | ₹1.2–₹1.6 lakh |

| Sell Naked Put | Margin + fallback cash | High (if crash) | ₹1.2–₹1.6 lakh |

Pro Tip: Use margin calculator by brokers such as dhan margin calculator to get real-time margin requirements before placing any sell trades.

Understanding the Option Chain

You can call an option chain as a catalogue or directory or list of all available option contracts ( calls or puts) for any stock, index, currency, commodities or any other financial instrument where options are traded.

The option chain table includes data about various factor affecting options contract directly or indirectly such as, Open Interest(OI), volume, Implied Volatility(IV), strike price, premium, Bid/Ask price etc. of a option contract for a given expiration date.

Keep in mind just as there is an option chain for the Nifty, banknifty which by the way are two most traded index on NSE (National Stock Exchange), you also have option chains for currency and commodity derivatives as well as for individual stocks where options trading is permitted.

Once you understand the option chain, your option trading strategy and mindset of selecting the strike prices like, In the Money (ITM), At the Money(ATM), Out of the Money(OTM) will certainly going to change. Know more about Option Moneyness here.

An Option Chain is a table that shows all available Call and Put options for a particular stock or index along with important details like:

-

Strike prices

-

Premiums (prices)

-

Open Interest (OI)

-

Volume

-

Change in price and OI

Gone are those days when you have to go to NSE Website in order to check the option chain data, now with advanced trading platform available by best discount brokers in India such as Dhan you get option chain data inbuilt in the trading platform itself.

Let us go step by step to know where we can find the option chain list on NSE website.

- In the first place go to NSE India website, at the top of the website you will see in orange color the space for searching stocks. In orange color Equity will be written. Let us see how does it look like.

- At first we will see, how to search option chain data for any stock trading in FNO Segment. As you can see in the orange box, I kept it as equity and searched the name of the stock (SBI). By the way you can find the list of all FNO stocks on NSE here.

- Once you clicked the name searched, a new page will appear with all the statistics. You need to click on Option Chain at the top right as shown below.

- Once you click on option chain a new page will appear with all the option chain data included. In black box spot price of the stock i.e. the price at which the stock is currently trading in the market.

- You can also see expiry date of the contract highlighted in black box. On left hand side you can see all the call option data and on right put option data of SBI stock.

- I have marked the important observation to look for like in red box in middle is the different strike prices, In blue is the last trading price of the premium of the stock, in orange color is the volume and in green is the open interest.

- Apart from this there are many other data you can see such as IV implied volatility, bid/ask price, bid/ask quantity, change in open interest, net change in price of the premiums from last closing price etc.

You’ll see:

-

Call options on the left

-

Strike prices in the middle

-

Put options on the right

Example (NIFTY at 22,000)

CALL SIDE |

Strike Price |

PUT SIDE |

|---|---|---|

OI: 2L |

LTP: ₹100 |

22,000 |

OI: 1.8L |

LTP: ₹60 |

22,100 |

OI: 2.5L |

LTP: ₹30 |

22,200 |

-

LTP = Last Traded Price (premium)

-

OI = Open Interest (active contracts)

-

Strike Price = The price you’re betting on

Key Things to Look for in an Option Chain

1. At-the-Money (ATM) Strike

Find the strike closest to current price (e.g., if NIFTY = 22,000, then 22,000 strike is ATM).

2. Premium (LTP)

Check how much you’ll pay to buy or earn by selling the option.

3. Open Interest (OI)

-

High OI = more active = better liquidity

-

Increase in OI = people opening new positions

-

Decrease in OI = people exiting positions

Tip: High OI + high volume = strong support/resistance area

4. Change in OI

-

Increase in OI + rising premium = bullish

-

Increase in OI + falling premium = bearish

-

Decrease in OI = unwinding (traders closing positions)

5. Volume

-

Tells you how many contracts were traded today

-

More volume = more interest = tighter spreads

6. Support and Resistance Levels

-

High OI on Put side = Support

-

High OI on Call side = Resistance

Example:

-

Highest PUT OI at 21,900 → Support

-

Highest CALL OI at 22,200 → Resistance

How to Use Option Chain as a Beginner?

-

Direction Bias: Is the market expecting a move up or down?

-

Choose Strikes: Look for ATM or slightly OTM options to trade

-

Avoid Illiquid Options: Low OI or volume = bad for trading

-

Understand Crowd Behavior: Rising OI = fresh interest; falling OI = exit

Summary: What to Look For?

| Factor | What It Tells You |

|---|

| Strike Price | Where the action is happening |

| Premium (LTP) | Cost or income from buying/selling option |

| Open Interest | Crowd activity, support/resistance zones |

| Volume | Liquidity and tradability |

| Change in OI | Fresh positions or exits |

I won’t be explaining the option chain in detail as it itself is a very vast topic and you can read in detail about how to read option chain table step by step here. You can Use OI data to spot support and resistance levels.

What is Implied Volatility (IV)?

Implied Volatility (IV) is a percentage that tells you how much the market expects the stock or index to move in the future. It doesn’t say which direction, only how much movement traders are expecting.

Implied volatility (IV) is a metric that reflects the market’s expectation of the volatility of the underlying asset during the life of the option. Higher IV generally leads to higher option premiums, while lower IV results in lower premiums.

Traders often look at IV to assess whether an option is overpriced or underpriced.

Why Is IV Important in Options Trading?

-

IV impacts the premium (price) of an option.

-

Higher IV = higher premiums = options are expensive

-

Lower IV = lower premiums = options are cheap

As a buyer, you want to buy options when IV is low

As a seller, you want to sell when IV is high

Think of IV like weather forecasts:

-

A weather forecast says there’s a 70% chance of rain → you expect lots of activity

-

IV says there’s a 40% expected movement → the market expects the stock to swing around a lot

If people expect a storm (big movement), umbrella prices (option premiums) go up!

Example:

Let’s say:

-

Stock: Infosys

-

Current price: ₹1,400

-

You look at a 1-week Call Option with Strike Price = ₹1,400

Case 1: Low IV (10%)

-

Premium might be just ₹10

-

Market expects very little movement

-

Even if the stock moves ₹15, you only make ₹5 (₹15 – ₹10 premium)

Case 2: High IV (40%)

-

Premium might be ₹40

-

Why? Because market expects a big move — maybe due to earnings or news

-

If stock moves ₹30, you still lose ₹10 (₹30 move – ₹40 premium)

What Increases or Decreases IV?

IV Goes Up When… |

IV Goes Down When… |

|---|---|

Major news/events are coming (e.g. earnings) |

After events pass and market calms down |

Global markets are volatile |

Stable trends and sideways markets |

Elections, budgets, war, RBI decisions |

Quiet market periods |

Where Do I See IV?

-

Option Chain: NSE, Dhan Option Trading App

-

Each option has its own IV

-

ATM (At-the-Money) strikes usually show the most relevant IV

IV and Option Prices: Visual Summary

IV Level |

Option Buyer View |

Option Seller View |

|---|---|---|

High |

Avoid buying (costly) |

Good time to sell |

Low |

Good time to buy |

Avoid selling (cheap) |

Quick Tips on Using IV:

Compare IV with Historical Volatility (HV):

-

If IV > HV → Options are overpriced (good for selling)

-

If IV < HV → Options are underpriced (good for buying)

Use IV Rank or IV Percentile (available on Sensibull or TradingView Pro)

-

IV Rank 80% → IV is higher than usual → Sell

-

IV Rank 20% → IV is low → Buy

Beginner Rule of Thumb: “Buy when IV is low, sell when IV is high.”

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Profit and Loss in Options (P&L Explained Simply)

For Buying a Call:

-

Max Loss = Premium paid

-

Max Profit = Unlimited

For Selling a Call:

-

Max Profit = Premium received

-

Max Loss = Unlimited if stock goes up

Break-Even Point:

-

Call = Strike + Premium

-

Put = Strike – Premium

Options Risk vs Reward Table

Trade Type |

Max Profit |

Max Loss |

Margin Needed |

Beginner Friendly |

|---|---|---|---|---|

Buy Call/Put |

Unlimited/Large |

Premium Paid |

Low |

✅ Yes |

Sell Naked Call |

Premium Only |

Unlimited |

High |

❌ No |

Sell Naked Put |

Premium Only |

High (if stock falls) |

High |

❌ No |

When to Buy or Sell Options?

Situation |

Do This |

|---|---|

Expect big movement |

Buy Call or Put |

Expect sideways/stable market |

Sell Options (Advanced) |

Volatile earnings/news expected |

|

Range-bound week |

Avoid trading (as beginner) |

Real Time Examples

Buying Example:

Stock: INFY

Price: ₹1,400

Buy 1,400 PE @ ₹30

If INFY drops to ₹1,350 → Value = ₹50

Profit = ₹20 x 300 = ₹6,000 (lot size = 300)

Beginner Option Strategies

Buy ATM Call + ATM Put

→ Expect big movement either way

Buy OTM Call + OTM Put

→ Cheaper than straddle

Naked Put Selling:

Only if you are willing to buy the stock at lower price

Do’s and Don’ts In Options Trading

Do’s

-

Start with buying options

-

Use a trading journal

-

Learn before risking real money

Don’ts

-

Avoid naked selling early on

-

Don’t trade without a stop-loss

-

Don’t chase after missed trades

Common Mistakes

-

Overtrading after a win

-

Blindly following Telegram/YouTube tips

-

Not checking liquidity

-

Holding losing trades till expiry

Trading Psychology Tips

-

Think like a risk manager, not a gambler

-

Accept losses as part of the game

-

Be consistent, not perfect

Taxation of Options Trading in India

Profits: Profits from options trading are added to your total income and taxed according to the applicable income tax slab rate.

Losses: Losses from options trading can be set off against other business income. If there is no other business income, the loss can be carried forward for eight years and set off against future profits from business income.

-

Treated as business income

-

File ITR-3

-

Maintain P&L statements from broker

Books of Accounts – If your trading activity is substantial, you may be required to maintain books of accounts and get them audited, depending on your turnover and income levels.

Glossary of Key Terms In Options Trading

Term |

Meaning |

|---|---|

CE |

Call Option |

PE |

Put Option |

OTM |

Out of The Money |

ATM |

At The Money |

ITM |

In The Money |

OI |

Open Interest |

P&L |

Profit & Loss |

How to Buy & Sell Call/Put Options in India

First, A Quick Recap:

| Option Type | You Expect Market to | Action |

|---|

| Call | Go Up | Buy a Call |

| Put | Go Down | Buy a Put |

| Sell Call | Stay Flat or Fall | Sell a Call |

| Sell Put | Stay Flat or Rise | Sell a Put |

Part 1: How to Buy a Call Option (Bullish View)

Example:

-

Stock: Infosys

-

Current Price: ₹1,400

-

You buy a ₹1,400 Strike Call Option

-

Premium = ₹30

-

Lot Size = 300 shares (Infosys)

Your Total Cost:

₹30 × 300 = ₹9,000 (this is your maximum loss)

Your Profit:

If Infosys goes to ₹1,450 at expiry:

-

Intrinsic value = ₹50

-

Profit = ₹50 – ₹30 = ₹20

-

Net Profit = ₹20 × 300 = ₹6,000

Break-Even:

Break-even = Strike Price + Premium Paid

₹1,400 + ₹30 = ₹1,430

Part 2: How to Buy a Put Option (Bearish View)

Example:

-

Stock: Infosys

-

Current Price: ₹1,400

-

You buy a ₹1,400 Strike Put Option

-

Premium = ₹25

-

Lot Size = 300

Total Cost:

₹25 × 300 = ₹7,500 (maximum loss)

Profit:

If Infosys falls to ₹1,350:

-

Intrinsic value = ₹50

-

Net profit = ₹50 – ₹25 = ₹25

-

Total = ₹25 × 300 = ₹7,500

Break-Even:

Break-even = Strike – Premium Paid

₹1,400 – ₹25 = ₹1,375

Buying Call/Put – Key Points

Advantage |

Risk |

|---|---|

Limited loss (just premium) |

Time decay reduces value |

Unlimited profit potential |

Needs strong movement |

Part 3: How to Sell a Call Option (Bearish or Sideways View)

Warning: This has unlimited risk, not ideal for complete beginners.

Example:

-

Stock: Infosys

-

You sell a ₹1,450 Call

-

Premium = ₹15

-

Lot Size = 300

-

Margin needed ≈ ₹1.5 to ₹2 lakhs

If Infosys stays below ₹1,450:

You keep full ₹15 × 300 = ₹4,500 profit

If Infosys rises to ₹1,500:

-

You lose ₹50 – ₹15 = ₹35 loss per share

-

Total loss = ₹35 × 300 = ₹10,500

Break-Even:

Break-even = Strike Price + Premium Received

₹1,450 + ₹15 = ₹1,465

Part 4: How to Sell a Put Option (Bullish View)

You expect the stock to stay above the strike

Example:

-

Stock: Infosys

-

Sell ₹1,350 Put

-

Premium = ₹20

-

Lot size = 300

-

Margin ≈ ₹1.5 lakhs+

If stock stays above ₹1,350:

You keep ₹6,000 profit (₹20 × 300)

If Infosys falls to ₹1,300:

Break-even = Strike – Premium Received

₹1,350 – ₹20 = ₹1,330

Summary Table

| Strategy | View | Max Loss | Max Profit | Breakeven | Risk Level |

|---|

| Buy Call | Bullish | Premium Paid | Unlimited | Strike + Premium | Low |

| Buy Put | Bearish | Premium Paid | High | Strike – Premium | Low |

| Sell Call | Bearish | Unlimited | Premium Received | Strike + Premium | High |

| Sell Put | Bullish | High | Premium Received | Strike – Premium | Medium |

How to Place Buy/Sell Orders (Step-by-Step)

-

Login to Broker Platform (e.g. Dhan)

-

Go to F&O Segment

-

Open the Option Chain

-

Choose strike price based on your view

-

Select Buy or Sell, choose Call or Put

-

Enter lot size and price

-

Click Place Order

Done!

Pro Tips for Beginners

-

Start by buying, not selling

-

Choose ATM or slightly OTM for higher chances

-

Avoid low liquidity contracts

-

Use stop-loss if available

-

Watch IV, volume, and OI from the option chain

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Options Trading FAQs

Can I start options trading with ₹5,000?

Yes, if you’re buying options. Selling requires higher capital due to margin requirements.

What’s the difference between Call and Put options?

Call = Right to buy (bullish view).

Put = Right to sell (bearish view).

What is the safest way to start options trading?

Start with buying options, especially on indices like NIFTY.

How do I choose the right strike price?

Use ATM (At The Money) strikes for quicker results, or OTM (Out of The Money) for cheaper premiums.

Can I sell options without owning shares?

Yes — that’s called a naked option, but it’s risky and needs high margin.

What happens if I don’t square off before expiry?

Your broker may auto-settle it. For ITM options, you may receive or pay the difference. OTM options expire worthless.

Do I need to understand technical analysis?

It helps. Basic chart reading (support, resistance, trend) improves decision-making.

Are options better than stocks for beginners?

Not necessarily. Options are riskier but can offer better leverage. Start slow.

What is margin in options trading?

Margin is the money you must keep with the broker when selling options to cover risk.

Can I trade options daily?

Yes — this is called intraday trading, but it’s riskier. Use strict stop-losses.

Are profits from options taxable?

Yes — treated as business income and taxable under ITR-3.

What is Open Interest (OI)?

It shows how many contracts are open. Higher OI means more liquidity and trader interest.

What is the minimum lot size in options?

Varies by instrument. For NIFTY, it’s currently 50 units per lot.

Should I start with index options or stock options?

Start with index options (NIFTY, BANKNIFTY). They’re more liquid and predictable.

What is a straddle or strangle strategy?

Both involve buying Call + Put to profit from big price moves. Straddle = same strike. Strangle = different strikes.

Can I lose more than I invest?

Yes, if you’re selling naked options. Buying has limited loss (premium paid).

How much time should I spend learning before trading?

Ideally 2–4 weeks of basic learning and paper trading before risking real money.

Can I automate my options strategy?

Yes, with platforms like Dhan options strategy builder, or Dhan APIs. But automation still needs strategy.

Is options trading gambling?

No — if done with knowledge, discipline, and planning. But trading without strategy = gambling.

Options Trading Cheat Sheet for Beginners

Term |

Meaning |

|---|---|

Call Option |

Right to buy at a fixed price (bullish view) |

Put Option |

Right to sell at a fixed price (bearish view) |

Premium |

Price paid to buy an option |

Strike Price |

Fixed price at which you agree to buy/sell in the contract |

Lot Size |

Minimum tradable quantity (e.g. 50 for NIFTY) |

Expiry |

The last date when the option is valid |

ATM / ITM / OTM |

At / In / Out of The Money — position of strike vs market price |

Open Interest (OI) |

Total number of open contracts in the market |

How to Start Trading Options (Buy Side)

-

Choose stock or index (NIFTY, RELIANCE, etc.)

-

View option chain from NSE or Broker terminal

-

Select strike price

-

Buy Call (for bullish) or Put (for bearish)

-

Set a stop-loss and target price

-

Track position till expiry or square off early

Before You Trade – Checklist

-

Clear directional view (bullish/bearish)

-

Check news & earnings calendar

-

Use Technicals (support/resistance)

-

Risk ≤ 5% of total capital

-

Stop-loss defined

-

Record your trade logic

Avoid These Mistakes

-

Trading without understanding strike selection

-

Selling options without enough margin or risk protection

-

Blindly following Telegram/WhatsApp tips

-

Holding losses till expiry hoping they reverse

Pro Tips For Beginners In Options Trading

-

Always start with buying (not selling)

-

Practice paper trading for 2–4 weeks

-

Prefer NIFTY/BANKNIFTY for liquidity

-

Use weekly expiries (Thursdays) for faster learning

-

Avoid trading during events (budget, elections)

What Should I Trade Today? – Flowchart

Use this simple decision tool to help choose your option trade based on market direction.

Mini Quizzes / Self-Check for Beginners Trading Options

You buy a NIFTY 22,000 Call for ₹100. NIFTY goes to 22,200. What is your profit per lot (lot size = 50)?

₹200 profit – ₹100 premium = ₹100 × 50 = ₹5,000

You sell a 22,500 Call for ₹60. NIFTY closes at 22,400. What do you earn?

₹60 × 50 = ₹3,000 (You keep the full premium as NIFTY stayed below strike)

What is the break-even for a 21,800 Put bought at ₹80?

21,800 – 80 = ₹21,720

Can your loss exceed premium paid when buying options?

No. Your loss is limited to premium only.

The total number of outstanding contracts (helps track market sentiment).

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Common Beginner Scenarios In Options Trading & What to Do

Scenario 1: I forgot to close my option on expiry day!

Don’t panic. If it’s worth something, it will be auto-exercised. But if it’s worthless, it expires zero. You might still pay STT if ITM. Always try to square off earlier.

Scenario 2: My option is in loss. Should I hold or exit?

Check your original logic. If the reason for entry is invalid, exit. Don’t hold just to “recover”.

Scenario 3: I made a profit. Should I keep trading more today?

Take a break. Overtrading after profits often leads to giving them back.

Scenario 4: I bought an option, and the stock moved, but I still lost. Why?

Check if the move was big enough. You must cross the break-even point, not just the strike.

Scenario 5: I bought both a Call and Put, and both lost! How?

It may happen if the market didn’t move enough or moved late. This is common in straddles/strangles. Choose wisely and manage time decay.

Best Options Trading broker in India?

To trade options in the Indian stock market, you need to open a trading and Demat account with a registered stockbroker. The broker should offer access to the derivatives segment of the exchanges, such as the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE).

When choosing a broker, consider factors such as brokerage fees, trading platform features, customer service, and margin requirements. Below is what I recommend if you want a hassle free trading experience.

Dhan have 3 trading platform for all devices known as Dhan App for Mobile, Dhan for desktop web version and dedicated option trading platform (Web + App) by dhan. You can do fundamental as well as technical analysis quite easily on all its platform.

Apart from normal trading app dhan also have a dedicated option trading platform (Web + App) for a powerful options trading experience designed especially for F&O Traders.

Options Trader by Dhan is one of the best app for F&O trading because of features like:

- Readymade Option Strategies – Fast create and execute popular option strategies like Straddle, Strangle, Iron Condor, and many more with our options app.

- Custom Strategy Builder – Create your own derivative trading strategies and execute them from the same platform. Simple. Convenient. Powerful option strategy builder!

- Options Screener & Scanner – Identify and monitor scrips based on Volume, OI, Trends, Buildup, IV, and more with our option trading analysis app.

- Outlook Based Ideas – Search scrips available for option trading ideas based on Bullish, Bearish, or Neutral market outlook.

- Realtime Pay-off Graph – Dhan app for option analysis helps you understand the potential P&L for your strategies before you execute them.

- Dedicated Commodity & Currency Dashboard – If you are Trading Across Segments than you can Manage your positions in separate, dedicated dashboards.

- Forever Order with OCO – Set a target price that stays active on Dhan FnO app until the specified price hits, including OCO for F&O trading.

- Instant Pledge Margin – Pledge shares from your demat account to get more margin for f&o trading within minutes.

- Option Chain – Trade calls and puts directly from the option chain with Greeks and other awesome insights on Dhan option trading app.

- Synced Across All Dhan Platforms – All Dhan platforms are synced in real-time all across Positions, Orders, Basket, Margin & Funds, Portfolio, Charts, Watchlist and Tradebook.

Dhan option trading App have been downloaded on playstore by more than 2.5 million users with a user rating of 4.4.

There are no account opening charges as of now with dhan for a limited time period. You can open dhan trading and demat account with zero AMC (Annual Mainenetance Charges).

- ₹0 Demat Account Fees

- ₹0 AMC

- ₹0 Platform Fees

- ₹0 Brokerage for Delivery Trades

- Rs.20 or 0.03% (Whichever is lower) per order for intraday trades

Steps:

-

Submit PAN, Aadhaar, Bank proof

-

Enable F&O (Derivatives) in account settings

-

Add funds and get started

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Final Thoughts: How to Start Right

If you’ve read this far — congrats! You’re ahead of 90% of retail traders who jump in without learning. Options trading can seem overwhelming at first—but once you understand the basic building blocks, it becomes one of the most powerful tools in your trading arsenal.

As a beginner, your goal shouldn’t be to “get rich quick” but to learn the craft step-by-step:

- Start with buying small-lot NIFTY options

- Use Dhan Customized Strategy builder to plan trades

- Never risk money you can’t afford to lose

- Review every trade and build a system

With time, discipline, and smart risk management, you’ll be able to navigate the markets with more confidence.

I hope by now you have enough understanding of how to start Option Trading as a beginner, Keep in mind options are tricky so this is not the only thing you have to read there are lot of strategies you can make when trading options.

Trading in derivatives market such as futures and options can be a good source of income for a trader, besides this the margin required to take position are very low on intraday basis.

Having said that, one should always do proper research before taking any trades in FNO because of being highly leverage products the risk also increases.

Always go with more liquid contract in case of stocks options. The more liquid a stock is, chances of buying and selling the contracts instantly become high. Indexes are already very liquid by nature so you do not need to worry about that.

Please do not just speculate while trading in stock market in any segment, instead look for learning new strategies such as

Call Butterfly Spread Strategy

Call Ratio Back Spread Strategy

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Disclaimer:

This content is intended for educational purposes only and does not constitute financial or investment advice. Options trading involves substantial risk and may not be suitable for all investors. Past performance is not indicative of future results. Always do your own research or consult a SEBI-registered financial advisor before making any trading decisions. The examples provided are for illustration only and do not represent any recommendations.