In this article we will understand the impact on your trading because of the upcoming lot size changes in Nifty, BankNifty, Sensex from November 20, 2024. Just want to make it clear I personally hate the random frequent changes SEBI keep on doing in last 3 years.

It takes a lot of time for any trader to create, backtest their strategies in market and due to such changes things get messed up and we all need to again start from scratch. Now before you understand the impact let us first know how these changes in lot size for index derivatives will take place in a phased manner.

SEBI issued a circular on October 1st, aiming to strengthen the equity index derivatives framework. The circular mandated an increase in the lot size for index derivatives. Following this, exchanges released their own circulars (NSE and BSE), specifying the revised lot sizes and their implementation date.

Having said that the lot size for Nifty nearest expiry options is still 25, while for the 2nd January options, it is 75, and then it reverts to 25 for the 30 January options.

So, what exactly is the lot size for Nifty and other index derivatives? And if it is changing, when do these changes actually take effect? Let us break it down and understand everything around lot size changes in detail.

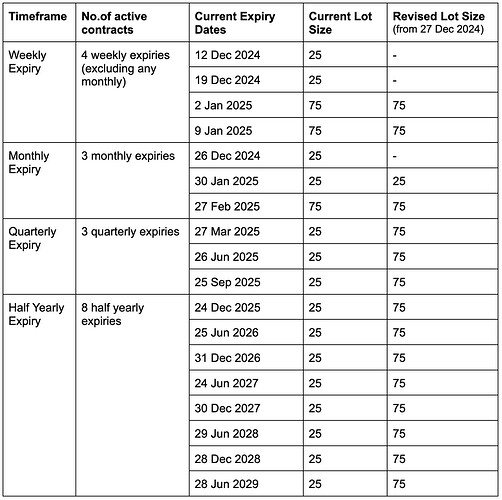

We will take the example of Nifty, which includes all types of expiries—weekly, monthly, quarterly, and half-yearly. By the way Nifty is the only index derivatives whose expiry day remains unchanged.

For Nifty, the existing lot size of 25 was revised to 75, but this change applies only to contracts introduced after November 20, 2024. Contracts introduced before this date including weekly and monthly contracts retain the old lot size of 25.

The first weekly Nifty options contract introduced after November 20 was the 02 January expiry, so contracts with expiries from January 2 onwards have the revised lot size of 75.

However, the 30 January contract still has the old lot size of 25. This is because the 30 January contract is a monthly expiry, and it was introduced before November 20.

Similarly, all quarterly and half-yearly expiries introduced before November 20 have also retained the existing lot size of 25.

But there is a catch, active quarterly and half-yearly Nifty contracts will undergo a lot size change from December 27, 2024.

To understand this better, let us go through the active contracts and their revision of lot size. Below is the Trading Cycle of NIFTY :

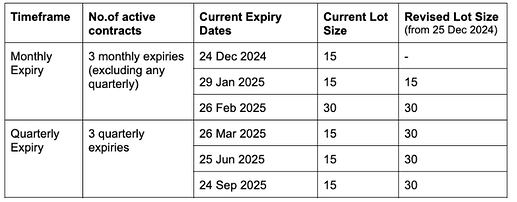

The same applies to BankNifty as well—the lot size for BankNifty quarterly contracts will change from 25 December 2024. Here is the Trading Cycle of BANKNIFTY.

The expiry day for BankNifty is shifting to Thursday from January 2025.

Important Point– if you carry forward positions in contracts with the current lot size past the due date for the lot size change, you will face challenges in managing those positions. Exiting such positions may not be possible, and even your broker will not be able to help.

These positions will remain active until expiry. To avoid this, ensure that any positions carried overnight on December 24 for BankNifty and December 26 for Nifty are not affected by the lot size revision. This small precaution will save you from unnecessary complications.

Hope this has clarified all the doubts around the lot size revision. Again, make sure you are not carrying any quarterly & half yearly BankNifty/Nifty positions on lot size revision due date (24 & 26 Dec respectively).

Incase if you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Now let us understand the impact of these lot size changes on you as a retail trader.

Impact of Upcoming Lot Size Changes in Nifty, BankNifty, Sensex From November 20, 2024 on retail traders:

The Securities and Exchange Board of India (SEBI) increasing the index lot size can impact traders negatively in the following ways:

1. Higher Capital Requirement

- Increasing the lot size means traders will need more capital to trade in index futures or options.

- This could make it difficult for small or retail traders to participate, as the margin requirements will also rise correspondingly.

- For example, if the lot size of an index increases from 50 to 75, traders must pay 50% more in margin upfront.

2. Reduced Flexibility

- With a larger lot size, traders have less flexibility in scaling their positions.

- Smaller traders who want to hedge or speculate with lower risk might find it challenging to manage larger exposure.

3. Increased Risk Per Trade

- A bigger lot size amplifies the financial risk per trade because each point movement in the index has a greater monetary impact.

- For instance, a 10-point move in an index with a 50-lot size may cause a ₹500 profit/loss, whereas the same move with a 75-lot size would result in a ₹750 profit/loss.

4. Liquidity Concerns for Smaller Players

- Retail participation might decrease due to affordability issues, potentially affecting liquidity in index derivatives.

- This could widen the bid-ask spreads, especially during volatile market conditions.

5. Challenges in Risk Management

- Larger lot sizes make it more expensive to manage risk using options strategies like spreads, straddles, or strangles.

- Retail traders relying on such strategies might find it uneconomical to execute their trades effectively.

6. Impact on Psychological Comfort

- Smaller traders often feel more comfortable trading with smaller positions due to reduced financial stress.

- A larger position size can heighten anxiety and lead to irrational decisions during market volatility.

However, if you are looking for a positive impact then:

- For institutional players: Larger lot sizes could streamline trades and reduce the number of transactions.

- Potential for reduced speculative noise: Discouraging smaller, speculative trades could lead to a more stable market environment.

However, for the retail trading community, the increase in lot size primarily raises entry barriers and trading costs, which could stifle participation and impact their trading strategies significantly.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

If, you have liked the content please do share it with your friends or on social media, as sharing do bring the good karma. If you have any questions or feedback you can leave them in comment box below.

Note: Please do your own research and make investment. Moneycontain will not be responsible for any of your losses at all. The point made is for educational purpose only and intended to give information. All investments are subject to risks, which should be considered prior to making any investments.