The Iron Condor strategy works if you are expecting range-bound movement. With limited risk and reward, it’s perfect for consistent, low-volatility income. When volatility is high and you’re not expecting a big move the Iron Condor can be your best bet.

It is especially effective in instruments like NIFTY, BANKNIFTY, and FINNIFTY, which often trade in ranges.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Let’s dive deep and understand Iron Condor strategy in the simplest way possible.

What is the Iron Condor Strategy?

An Iron Condor is a non-directional options trading strategy that profits when the underlying stock/index (like NIFTY or BANKNIFTY) stays within a specific price range. It involves selling one call and one put (short options), while simultaneously buying one call and one put (long options) to limit the risk.

It is ideal for low-volatility markets and is widely used by option sellers to earn consistent income.

Components of an Iron Condor:

The Iron Condor strategy consists of 4 legs:

-

Sell 1 OTM Call Option (Short Call)

-

Buy 1 OTM Call Option (Long Call) – Higher Strike

-

Sell 1 OTM Put Option (Short Put)

-

Buy 1 OTM Put Option (Long Put) – Lower Strike

All options have the same expiry

This forms two spreads:

-

A Bear Call Spread (Call options)

-

A Bull Put Spread (Put options)

Market View – Rangebound

-

Best used when you expect very little movement in the market.

-

You profit the most when the underlying remains between the sold strikes.

Iron Condor Example (Nifty)

Assume Nifty is trading at ₹22,000

Leg |

Strike Price |

Type |

Action |

Premium (₹) |

|---|---|---|---|---|

Buy Put (Lower hedge) |

₹21,700 |

PE |

Buy |

₹60 |

Sell Put (Higher) |

₹21,800 |

PE |

Sell |

₹100 |

Sell Call (Lower) |

₹22,200 |

CE |

Sell |

₹90 |

Buy Call (Upper hedge) |

₹22,300 |

CE |

Buy |

₹50 |

Total Premium Collected = ₹100 + ₹90 − ₹60 − ₹50 = ₹80

Net Credit = ₹80 × 50 (lot size) = ₹4,000

Iron Condor Payoff Structure

Nifty Expiry Value |

Outcome |

|---|---|

Between ₹21,800–₹22,200 |

✅ Max Profit = ₹4,000 |

Below ₹21,700 or Above ₹22,300 |

❌ Max Loss = ₹(100) per lot = ₹5,000 |

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

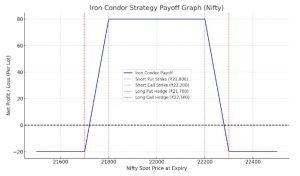

Payoff Graph (Iron Condor)

Here’s the payoff graph for the Iron Condor strategy:

-

✅ Maximum profit occurs between ₹21,800 and ₹22,200 (the short strikes).

-

❌ Losses are limited beyond ₹21,700 or ₹22,300 due to the protective long options.

-

📉 Risk-reward is well-defined and lower risk compared to Short Strangle.

Let’s now break down the impact of Option Greeks on the Iron Condor strategy, focusing on how each Greek affects profitability and risk, particularly in the context of Indian indices like Nifty or Bank Nifty.

Option Greeks and Their Impact on Iron Condor

The Iron Condor is a non-directional, range-bound strategy. It earns from time decay and benefits from high implied volatility when entered. Here’s how each Greek impacts it:

Delta (Δ) – Directional Exposure

-

Definition: Measures sensitivity of option value to changes in the underlying asset’s price.

-

Impact:

-

Iron Condor is typically delta-neutral (Delta ≈ 0).

-

As price moves away from the middle range, Delta may shift:

-

Toward +1 if nearing call side.

-

Toward –1 if nearing put side.

-

-

You start losing if Nifty trends strongly in one direction.

-

Tip: Keep adjustments ready if price approaches breakouts (e.g., roll legs or convert to butterfly).

-

Gamma (Γ) – Delta Sensitivity

-

Definition: Measures the rate of change of Delta with respect to price.

-

Impact:

-

Low Gamma in Iron Condor = stable Delta.

-

Gamma spikes near expiry and near strikes → increases risk of rapid losses.

-

-

❌ Risk: If Nifty moves sharply near expiry, losses can accelerate due to Gamma.

-

✅ Tip: Avoid holding Iron Condor close to expiry unless price is firmly in range.

Theta (Θ) – Time Decay

-

Definition: Measures the daily loss/gain in option value due to time decay.

-

Impact:

-

Iron Condor profits from Theta – time decay is your best friend.

-

Highest Theta gain is when the spot price is between the short strikes.

-

Each day that passes without significant price movement increases profits.

-

-

Tip: Use Iron Condor in weekly expiries for faster time decay.

Vega (V) – Volatility Sensitivity

-

Definition: Measures sensitivity to changes in implied volatility (IV).

-

Impact:

-

Entry: You want to sell the Iron Condor when IV is high.

-

Exit: Ideally, IV falls → sold options lose value faster → you profit.

-

If IV rises suddenly, e.g., due to news, losses may widen.

-

-

❌ Risk: Vega can hurt you if volatility surges unexpectedly.

-

✅ Tip: Avoid entering Iron Condor before major events (like RBI policy or elections).

Rho (ρ) – Interest Rate Sensitivity

-

Definition: Sensitivity of option price to changes in interest rates.

-

Impact:

-

Has negligible impact in short-term strategies like Iron Condor.

-

Only relevant for long-dated options (LEAPS).

-

-

Tip: Can be ignored for weekly/monthly Iron Condors on Indian indices.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Summary: Greek Sensitivity Table

| Greek | Ideal Scenario for Iron Condor | Risk When… |

|---|

| Delta | Neutral (non-directional) | Underlying moves sharply |

| Gamma | Low near the center | Approaches expiry & strikes |

| Theta | High (time decay) | Max profit when range-bound |

| Vega | Start with high IV | Volatility increases after entry |

| Rho | Negligible (short-term) | N/A |

Final Tips for Managing Greeks in Iron Condor:

-

Enter at high IV, exit on IV crush.

-

Avoid expiry days unless you’re deep inside the range.

-

Monitor price movement vs strike width – adjust legs if breakout risk increases.

-

Use tools like Dhan customized option strategy builder to track real-time Greeks in Indian options.

When to Use the Iron Condor Strategy?

Ideal Conditions:

-

Market Outlook: Neutral; expecting the index to trade within a range.

-

Volatility: High Implied Volatility (IV) preferred, as it allows for higher premium collection.

-

Timeframe: Short to medium-term, often used in weekly options.

Best Suited For:

-

Instruments: NIFTY, BANKNIFTY, and FINNIFTY options.

-

Events: Post major events like RBI policy announcements, budget declarations, or elections, when the market is expected to stabilize.

When Not to Use Iron Condor?

Avoid deploying an Iron Condor when:

-

Market is Trending: Strong bullish or bearish trends can lead to breaches of the profitable range.

-

High Volatility Events: Upcoming earnings announcements, geopolitical tensions, or economic data releases can cause significant price movements.

-

Low Implied Volatility: Limited premium collection reduces the strategy’s profitability.

Iron Condor Strategy – Summary Table

| Parameter | Details |

|---|

| Strategy Type | Non-directional |

| Risk | Limited |

| Reward | Limited |

| Ideal Market Outlook | Sideways/Range-bound |

| Breakeven Points | Lower: Short Put Strike – Net Premium Upper: Short Call Strike + Net Premium |

| Maximum Profit | Net Premium Collected |

| Maximum Loss | Difference between strikes – Net Premium |

| Margin Requirement | Lower than naked options due to hedging |

Pro Tips & Tricks For Iron Condor Strategy

-

Prefer weekly expiries for faster time decay

-

Keep strikes ~200 points wide on NIFTY

-

Exit at 70–80% of max profit (don’t wait for full expiry)

-

Use stop-losses on each wing to manage risk

-

Use India VIX as a guide: enter when VIX > 14 for better premium

-

Avoid earnings, RBI policy, or major events

-

Monitor Greeks: focus on theta (decay) and delta (direction)

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Iron Condor vs Strangle Strategy Comparison

| Feature / Criteria | 🦅 Iron Condor | 🔔 Strangle (Long/Short) |

|---|

| Market Outlook | Range-bound with limited movement expected | Volatile (Long) / Range-bound (Short) |

| Number of Legs | 4 (2 calls, 2 puts) | 2 (1 call, 1 put) |

| Risk Profile | Limited Risk | Unlimited Risk (Short) / Limited (Long) |

| Reward Potential | Limited Reward | Unlimited Reward (Long) / Limited (Short) |

| Breakeven Points | Defined, narrower range | Wider breakeven range |

| Margin Requirement | Moderate to High | Lower (Long) / Higher (Short) |

| Implied Volatility (IV) | Ideal in High IV (to sell) | Long Strangle: Low IV Short Strangle: High IV |

| Theta (Time Decay) | Positive (benefits seller) | Positive (Short) / Negative (Long) |

| Vega Sensitivity | Slightly positive or neutral | High (Long) / Negative (Short) |

| Capital Efficiency | More efficient due to hedged wings | Short: risky without hedges |

| Greeks (Net) | Delta ≈ 0, Low Gamma, Mild Vega, +Theta | Directionally sensitive depending on setup |

When to Use Each Strategy?

Use Case |

Best Strategy |

|---|---|

Expecting very little movement |

Iron Condor |

Expecting huge breakout (up/down) |

Long Strangle |

Expecting consolidation with high IV |

Short Strangle (only for advanced traders) |

-

Iron Condor is safer and more beginner-friendly with defined risk.

-

Strangles, especially short ones, can be risky but rewarding if used with discipline and strict risk management.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Conclusion: Is Iron Condor Right for You?

The Iron Condor is an excellent strategy for traders anticipating minimal price movement in the underlying asset. It offers a balanced approach with defined risk and reward, making it suitable for conservative traders aiming for consistent income. When volatility is high and you’re not expecting a big move — the Iron Condor can be your best bet.

However, it’s crucial to monitor positions and be prepared to make adjustments in response to market movements. Always consider transaction costs, taxes, and slippages in real-world execution.

Learn Call Butterfly Spread Strategy here

Learn Bear Call Ladder Strategy here

Learn Bull Put Spread Strategy here

Learn Covered Call Option Strategy here

Learn Bull Call Spread Strategy here

Learn Call Ratio Back Spread Strategy here

Disclaimer:

This content is for educational purposes only and does not constitute financial or investment advice. Trading in derivatives like options involves substantial risk and is not suitable for all investors.

All examples, strategies, and calculations (including those involving NIFTY, BANKNIFTY, or any other instruments) are hypothetical and meant solely to illustrate how options strategies work under certain conditions.

Market conditions, pricing, and premiums may vary significantly in real-time trading. Past performance is not indicative of future results.

You are advised to consult with a SEBI-registered investment advisor or a qualified professional before making any investment or trading decisions. Always perform your own due diligence.

The author or platform is not responsible for any direct or indirect loss arising from any information provided here.