What is a Covered Call?

A Covered Call means you:

-

Own a stock

-

Sell a Call Option on that stock

A Covered Call involves holding a stock (or long futures) and selling a Call Option on the same stock. This way, you earn money (called a premium) from selling the call, just like earning rent from your house.

When to Use Covered Call Strategy:

- When you’re neutral to slightly bullish on a stock.

- You don’t mind selling your stock if it goes higher.

- You want to earn regular income from your holdings.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to have Basic understanding of options ,Option moneyness , How to read option chain table.

Covered Call Example:

Let’s assume:

-

You own 550 shares of HDFC Bank (1 lot)

-

Current Price = ₹1,550

-

You sell 1 Call Option (1 lot) with:

-

Strike Price = ₹1,580

-

Premium received = ₹20 per share

-

So you collect:

₹20 × 550 = ₹11,000 as premium income

What Happens at Expiry?

Case 1: HDFC Bank closes below ₹1,580

-

The call buyer will not exercise the option.

-

You keep your shares + ₹11,000 premium.

-

Profit = ₹11,000 (from premium)

Case 2: HDFC Bank closes above ₹1,580

-

You must sell your shares at ₹1,580

-

Let’s say it closes at ₹1,600:

-

You lose ₹20 of upside (but you already got ₹20 as premium)

-

-

Profit = ₹30/share (from ₹1,550 to ₹1,580) + ₹20 premium

= ₹50 × 550 = ₹27,500

Max profit is capped in this strategy

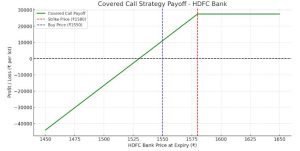

Covered Call Payoff Chart:

Let me show you a visual graph of how this looks.

Here’s the payoff graph for the Covered Call strategy using HDFC Bank:

What the Graph Shows:

-

Left of ₹1550 (Buy Price):

You start incurring a loss on your shares, but the ₹11,000 premium cushions it. -

Between ₹1550 and ₹1580:

You are in profit zone, gaining from stock movement + keeping full premium. -

Beyond ₹1580 (Strike Price):

Your profit gets capped, because you are obligated to sell at ₹1580.

Summary of Covered Call Strategy:

Feature |

Details |

|---|---|

Strategy Type |

Income-generating (neutral to bullish) |

Max Profit |

Capped (Gain on stock + premium) |

Max Loss |

If stock crashes → limited by stock fall |

Ideal For |

Long-term investors wanting to earn monthly income |

Market View |

Sideways to moderately bullish |

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Second Example:

-

Stock: Infosys (INFY)

-

CMP: ₹1,400

-

You buy 1 lot (300 shares) of INFY.

-

You sell 1 ATM Call Option of ₹1,420 strike for ₹30 premium.

Payoff at Expiry:

-

If INFY stays below ₹1,420: You keep the ₹30 premium.

-

If INFY goes above ₹1,420: You still keep ₹30, but profits on shares are capped.

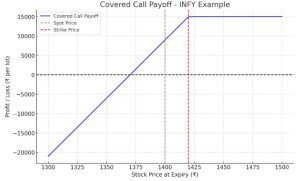

Graph:

Let us see the payoff graph for this.

Explanation of the Graph:

-

Maximum profit: ₹6,000 (₹30 x 300) if INFY stays below ₹1,420.

-

Break-even: ₹1,430 (₹1,400 + ₹30).

-

Above ₹1,430, profits from the stock are offset by losses on the call sold.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Let’s break down variations of the Covered Call strategy, each suited to different market views and objectives. We’ll explore 4 key variations.

1. Aggressive Covered Call Strategy

When to Use:

-

Slightly bullish outlook.

-

You want higher premium income.

-

You’re okay with higher chance of the stock being called away.

Example:

-

Stock: TCS, CMP: ₹3,800

-

Buy 1 lot (150 shares)

-

Sell ITM Call @ ₹3,760 for ₹70

Rationale:

-

ITM calls give higher premium but cap profits early.

-

You’re more focused on income generation than capital gain.

Insight:

-

Profit is capped early.

-

Downside risk still exists (limited by premium).

2. Conservative Covered Call Strategy

When to Use:

-

Mildly bullish or neutral.

-

You want to retain upside and still collect premium.

Example:

-

Stock: Reliance, CMP: ₹2,900

-

Sell OTM Call @ ₹2,950 for ₹20

Rationale:

-

Less premium collected but more room for stock to appreciate.

-

Good for long-term investors wanting passive income.

3. Weekly Covered Call Strategy(Short Duration)

When to Use:

-

Stock is in short-term range or low volatility.

-

You want to capitalize on time decay.

Example:

-

Stock: HDFC Bank, CMP: ₹1,550

-

Sell weekly Call @ ₹1,580 for ₹6

Rationale:

-

Weekly options decay fast.

-

Small but frequent profits.

4. Rolling Covered Call Strategy

When to Use:

-

After stock moves unexpectedly.

-

You want to adjust and continue strategy.

Scenarios:

-

Roll up: Move to higher strike if stock rallies.

-

Roll forward: Extend to next expiry to collect more premium.

Example:

-

You sold ₹1,400 INFY call, stock moved to ₹1,450.

-

Buy back ₹1,400 call at loss, sell ₹1,480 for next week.

Rationale:

-

Keeps you in the trade.

-

Avoids assignment and helps manage trend shifts.

Visualizing the Differences (Graphically):

We will plot 3 covered call payoff graphs together:

-

Aggressive (ITM)

-

Neutral (ATM)

-

Conservative (OTM)

All for the same stock (INFY, CMP ₹1,400) with 3 strike selections.

Graph Takeaways:

-

Aggressive (ITM): Highest premium but lowest profit potential. Best if you’re not expecting a big rally.

-

Neutral (ATM): Balanced income and risk. Moderate outlook.

-

Conservative (OTM): Lower income but more upside retained. Best when you’re bullish.

Here’s a clear comparison table for Covered Call variations

Covered Call Variations – Comparison Table

Aspect |

Aggressive (ITM) |

Neutral (ATM) |

Conservative (OTM) |

|---|---|---|---|

Strike Price |

Below CMP (e.g., ₹1380) |

At CMP (e.g., ₹1400) |

Above CMP (e.g., ₹1420) |

Premium Collected |

High |

Moderate |

Low |

Profit Potential |

Low (capped early) |

Moderate |

High (more upside left) |

Risk Level |

Medium |

Medium |

Higher (less premium buffer) |

Market Outlook |

Slightly Bullish/Neutral |

Neutral |

Bullish |

Chance of Assignment |

High |

Moderate |

Low |

Best For |

Income focus, short-term |

Balanced view |

Long-term bullish investors |

This gives you a strategic lens to choose the right covered call setup depending on market view and risk tolerance.

Learn Bull Call Spread Strategy here

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Conclusion – Covered Call Strategy

The Covered Call is one of the most straightforward and widely used strategies for investors who own stocks or indices (like NIFTY or BANKNIFTY) and want to generate extra income from them. It combines holding the underlying asset with writing (selling) a Call Option, giving you a steady cash flow through premiums.

It works best when your market view is:

-

Mildly bullish or neutral — you believe the asset will stay flat or rise slightly.

-

You’re okay with limited upside, in exchange for a guaranteed premium.

While the strategy limits your maximum profit (since you’re selling away the potential upside), it offers:

-

Downside protection (equal to the premium received),

-

Positive Theta (benefits from time decay), and

-

A passive income approach to options trading.

Ideal for long-term investors, positional traders, or even index ETF holders looking to enhance returns in sideways or moderately rising markets, particularly useful in weekly options selling setups in the Indian market.

-

Know your risk-reward boundaries (you cap gains beyond the strike).

-

Choose strike prices wisely based on technical resistance, expected volatility, and your profit target.

-

Be ready to adjust or roll the position if the price moves aggressively.

Disclaimer:

This content is for educational purposes only and does not constitute financial or investment advice. Trading in derivatives like options involves substantial risk and is not suitable for all investors.

All examples, strategies, and calculations (including those involving NIFTY, BANKNIFTY, or any other instruments) are hypothetical and meant solely to illustrate how options strategies work under certain conditions.

Market conditions, pricing, and premiums may vary significantly in real-time trading. Past performance is not indicative of future results.

You are advised to consult with a SEBI-registered investment advisor or a qualified professional before making any investment or trading decisions. Always perform your own due diligence.

The author or platform is not responsible for any direct or indirect loss arising from any information provided here.

I believe, you covered many scenarios and I appreciate it. One question I have regarding covered call. For example, if I bought Infosys 400 shares at 1500 and i have sold Dec 1520 CE and collected premium of 30/ and by month end, Infosys closes at 1400. For the next month Jan, which CE strike to sell? As the infosys has gone down by 100, selling anything lower than 1500 will be risk. What do you suggest?

Great question , so let’s break it down clearly.

Your Scenario

You own 400 shares of Infosys @ ₹1500

You sold Dec 1520 CE @ ₹30 (covered call)

Infosys falls to ₹1400 at expiry

Now you’re asking:

“For January, which CE strike should I sell?

Anything below ₹1500 risks my shares getting called away at a loss.”

⭐ First Key Principle: Your Share Cost Price Does NOT Decide Your Next Strike

This is the biggest misconception.

Covered calls are NOT meant to protect your purchase price.

They are meant to:

✔ generate consistent income

✔ reduce your cost basis

✔ hedge small declines

✔ create smooth returns over time

Your cost price (₹1500) is not relevant for choosing the next strike.

What matters is:

✔ Current market price (₹1400)

✔ Expected movement in the upcoming month

✔ Your risk tolerance

✔ Your willingness to sell shares

✔ Volatility (IV) and premium available

Your covered call strikes adjust with the stock, not your entry.

⭐ Think Like This:

You now own Infosys at ₹1500, but the market is saying it’s worth ₹1400 today.

Your job is NOT to “defend” your cost price.

Your REAL job is to:

👉 choose a strike ABOVE current price

👉 collect reasonable premium

👉 avoid your shares being assigned early

👉 slowly reduce your break-even

Let’s lay out your best choices.

⭐ OPTION 1 (Most Practical): Sell Slightly OTM — e.g., 1420 CE / 1450 CE

Why?

✔ Won’t risk immediate assignment (market at ₹1400)

✔ You still collect premium (likely ₹12–₹20 depending on IV)

✔ You give the stock space to recover

✔ You reduce your cost basis from ₹1500 → ₹1480 → ₹1460 over time

Example

Sell Jan 1450 CE and collect, say:

Premium: ₹18 × 400 shares = ₹7200 income

New effective cost after 2 months:

₹1500 – ₹30 (Dec) – ₹18 (Jan) = ₹1452

Even without price recovery, you’re lowering your effective buy price.

This is how covered calls work long-term.

⭐ OPTION 2: Be More Conservative — Sell Far OTM (e.g., 1500 CE)

This is for investors who DO NOT want to risk assignment under any condition.

If you sell 1500 CE again:

✔ Very low chance of assignment

✔ Lower premium

✔ Keeps your upside open if Infosys recovers

The premium might be small (₹5–₹8), but you keep reducing your cost basis slowly.

⭐ OPTION 3: Don’t Sell This Month (Sit Out Temporarily)

If:

the stock had a large fall

IV is extremely low

premiums are weak

or you expect a bounce back

You may choose NOT to sell a call for a month.

This is allowed.

Covered calls are flexible.

But note:

No call = no monthly income.

⭐ OPTION 4: Sell a Covered Call + Cash-Secured Put (Wheel Strategy)

This is smart if you see value in Infosys at lower levels.

You can:

Sell Jan 1450 CE (covered call)

AND sell Jan 1350 PE (cash-secured put)

This collects 2 premiums, reduces cost basis faster.

This is professional-level.

⭐ OPTION 5: Move to a Different Strike Family (1450–1550)

When a stock drops sharply, the previous strike family becomes irrelevant.

You simply realign:

Price: ₹1400

Range: 1450–1550

Sell inside that zone depending on aggressiveness

Covered calls must adapt to market realities.

⭐ So, What Should YOU Do in This Exact Scenario?

Given:

You bought at ₹1500

Stock is ₹1400

Trend weakened

You want income

You want low assignment risk

Best Balance (Recommended): Sell Jan 1450 CE

This gives you:

✔ A safe distance from current price

✔ Decent premium

✔ Low chance of assignment

✔ Faster cost basis reduction

✔ Room for stock recovery

If Infosys rises above 1450:

great — your shares appreciate

and you roll the call up and out if needed

⭐ KEY TAKEAWAY:

Covered calls are NOT about protecting your cost price.

They are about systematically lowering it over months.

You choose strikes based on:

current stock price (₹1400)

premium income potential

assignment risk you’re comfortable with

So yes:

selling 1450 CE or 1420 CE is NOT a risk — it’s exactly what covered call investors do when a stock falls.

Your job is to make the stock cheaper month by month

until your break-even becomes attractive again.

That’s long-term covered-call investing.