The Straddle Strategy is a popular options trading method used when you expect a big move in the market but aren’t sure about the direction. This guide explains everything you need to know about the Long Straddle Strategy, using real stock market examples.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Let’s dive deep and understand Straddle strategy in the simplest way possible.

What is a Straddle Strategy?

A Straddle Strategy involves buying a Call and a Put option at the same strike price and expiry. It is a non-directional strategy, meaning it can profit from a significant price move in either direction.

Key Characteristics:

-

Market Outlook: Highly Volatile

-

Risk: Limited to premium paid

-

Reward: Unlimited on upside, substantial on downside

-

Complexity: Simple to moderate

Components of a Long Straddle

To create a Long Straddle:

-

Buy 1 ATM Call Option

-

Buy 1 ATM Put Option

Both options:

-

Same strike price

-

Same expiry

-

Same underlying

Straddle Strategy Example (Nifty 50)

Let’s say Nifty is trading at ₹22,000.

Here’s how you create a Straddle:

Action |

Option Type |

Strike Price |

Premium (Approx.) |

|---|---|---|---|

Buy |

Call |

₹22,000 |

₹150 |

Buy |

Put |

₹22,000 |

₹170 |

Net Premium Paid:

-

Total = ₹150 + ₹170 = ₹320 per lot

-

Nifty lot size = 50

-

Total Investment = ₹320 × 50 = ₹16,000

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

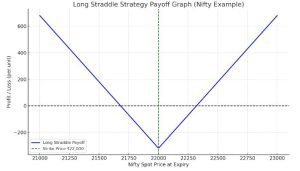

Straddle Strategy Payoff Graph

We’ll now plot the payoff graph for this strategy.

Here is the Long Straddle Payoff Graph based on the Nifty example:

- Maximum Profit: Unlimited on large moves (up or down)

- Maximum Loss: Limited to ₹16,000 (premium paid)

- Breakeven Points: Around ₹21,680 and ₹22,320

When to Use the Straddle Strategy?

Use a Straddle when:

-

You expect a big move, but don’t know the direction.

-

During major news events: RBI policy, Union Budget, elections, earnings.

-

Before volatility spikes (event-based trades).

When NOT to Use the Straddle Strategy?

Avoid this strategy when:

-

Market is range-bound or consolidating.

-

Implied Volatility (IV) is already high (you’re paying a premium).

-

You don’t have a risk management plan.

Straddle Strategy Tips & Tricks for Beginners

-

Check IV before entry: Enter when IV is low; exit before it drops.

-

Avoid far OTM options: Stick to ATM for best gamma and delta exposure.

-

Time your entry: A few days before events work better.

-

Don’t hold till expiry: Profit often comes early due to volatility spikes.

-

Hedge or adjust: Convert to a strangle or iron condor if outlook changes.

Pros and Cons for Straddle Strategy

Advantages:

-

Profits from any big movement

-

Simple to construct

-

Limited loss

-

Works well in high event periods

Disadvantages:

-

High cost

-

Time decay (Theta) erodes value

-

Losses if market remains stagnant

Straddle Summary Table (Nifty)

| Nifty at Expiry | Profit / Loss (Approx.) |

|---|

| ₹22,000 | -₹16,000 (Max Loss) |

| ₹21,680 or ₹22,320 | ₹0 (Breakeven) |

| ₹<21,680 or >₹22,320 | Unlimited Profit |

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Impact of Option Greeks on Straddle Strategy

Understanding Option Greeks is crucial to manage and optimize your Straddle.

1.Delta (Δ): Sensitivity to Price Movement

-

Delta of Call: Positive (0 to +1)

-

Delta of Put: Negative (0 to -1)

-

In a Long Straddle, you buy both, so initial net delta is close to 0 (neutral).

-

As the price moves sharply in one direction, delta becomes more directional (either strongly positive or negative), amplifying profits.

Tip: You’re not betting on direction but on magnitude of the move.

2.Gamma (Γ): Speed of Delta Change

-

Gamma is highest for ATM options (which you use in a straddle).

-

High gamma means delta changes rapidly with price movement.

-

This is great for a straddle because if the underlying moves, delta kicks in quickly, increasing gains.

Tip: High gamma helps you benefit rapidly when Nifty moves after entering the trade.

3.Theta (Θ): Time Decay

-

Time decay works against you in a Long Straddle.

-

Both call and put lose value daily if the underlying doesn’t move.

-

Theta decay accelerates closer to expiry, especially when the price is near the strike.

In our Nifty example, if Nifty stays at ₹22,000:

Your ₹320 premium erodes toward ₹0 as expiry nears.

Tip: Exit early if there’s no move. Avoid holding till expiry unless movement occurs.

4.Vega (ν): Volatility Sensitivity

-

Long straddle has positive Vega.

-

If IV increases, both options gain in value, even without price movement.

-

If IV drops after entry, you’ll lose money (even if direction is correct).

Best time to enter: Before an event when IV is low.

Avoid when IV is already high (like post-RBI announcement).

Tip: Monitor India VIX before entering; a low VIX often favors straddles.

5.Rho (ρ): Interest Rate Impact

-

Has minimal impact on near-term straddles.

-

Very low influence on Indian retail traders unless trading long-dated options.

Straddle Strategy Greeks Summary Table

| Greek | Impact on Straddle | What It Means |

|---|

| Delta | Neutral → directional | Big moves = better returns |

| Gamma | High | Profits accelerate post-breakout |

| Theta | Negative | Loses value without movement |

| Vega | Positive | Loves volatility spikes |

| Rho | Negligible | Not a concern for short-term |

Final Tips Based on Greeks for Straddle Strategy

Gamma + Vega = Your Best Friends — enter before expected movement.

Theta is Your Enemy — don’t hold too long if market stagnates.

Manage IV Risk — avoid entering when IV is at 1-month highs.

Monitor Greeks using broker tools like Dhan customized option strategy builder

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Conclusion: Is the Straddle Strategy Right for You?

If you’re expecting a sharp move in the market — up or down — the Straddle Strategy is one of the best tools in options trading. It offers unlimited reward potential with limited risk, making it ideal for high-volatility events. Use it with caution and timing for maximum effectiveness.

Learn Call Butterfly Spread Strategy here

Learn Bear Call Ladder Strategy here

Learn Bull Put Spread Strategy here

Learn Covered Call Option Strategy here

Learn Bull Call Spread Strategy here

Learn Call Ratio Back Spread Strategy here

Disclaimer:

This content is for educational purposes only and does not constitute financial or investment advice. Trading in derivatives like options involves substantial risk and is not suitable for all investors.

All examples, strategies, and calculations (including those involving NIFTY, BANKNIFTY, or any other instruments) are hypothetical and meant solely to illustrate how options strategies work under certain conditions.

Market conditions, pricing, and premiums may vary significantly in real-time trading. Past performance is not indicative of future results.

You are advised to consult with a SEBI-registered investment advisor or a qualified professional before making any investment or trading decisions. Always perform your own due diligence.

The author or platform is not responsible for any direct or indirect loss arising from any information provided here.