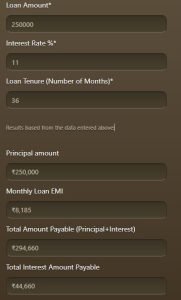

Are you planning to take a loan but unsure about the monthly EMI? Our easy-to-use Loan EMI Calculator helps you instantly calculate your monthly installments based on the loan amount, interest rate, and tenure.

Whether you’re considering a personal loan, home loan or business loan, this tool gives you clarity on your repayment plan. In addition, I’ve included expert tips on how to reduce EMIs, boost your loan eligibility, and avoid costly mistakes so you can make a confident, informed borrowing decision.

Loan EMI Calculator will help you to find out exact monthly EMI installments, total interest that you need to pay on the principal or loaned amount as well as the total amount payable at the end of the loan tenure.

Just enter the loan amount, interest rate% charged on loan by your lender ( Bank, NBFC etc.) and tenure in months in below moneycontain loan emi calculator and get all the information required within seconds.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Important Terms Related To Loan:

- Loan – A certain amount that is borrowed, and is expected to be paid back with interest.

- Principal – The total money owed or the total remaining balance of your loan.

- Interest – Interest is the cost of borrowing money for your loan from lenders.

- Loan Term/Tenure – The total amount of time it will take to pay off a loan as agreed upon with the lender.

- EMI – It is the total amount payable every month until the loan has been fully repaid.

Types of Interest Rates In a loan:

Interest is the cost of borrowing money for your loan from lenders.

Applicants for personal loans have to pay back at Adjustable also known as floating or fixed interest rates and other payment terms set by the bank or non-banking financial company. The interest rates policies are set and governed by RBI.

- Fixed Interest Rates: As the name suggests, in fixed interest rate the rate of interest remains same throughout the loan tenure. Hence, monthly EMI amount also remain fixed throughout the loan repayment period.

- Adjustable/Floating Interest Rates: This type of interest rates are usually depends on either the internal benchmark set by the lender or it may also depends on ongoing market conditions.

Therefore, floating interest rate is likely to change systematically which may cause increase/decrease in loan tenure or monthly EMI payouts depending on the movement of the interest rate up and low.

Usually, banks and NBFC’s charges fixed interest rate for personal loans.

Lower the interest rates for your loan, lower will be the total amount you pay.

For example: suppose you bought a personal loan of ₹2,00,000 At, Interest rate of 12 % with tenure (in years) 3 than your EMI for every month with Principal & Interest is ₹6,642

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

How Loan EMI’s Get Calculated?

EMI stands for equated monthly instalment. It is the total amount payable every month until the loan has been fully repaid. EMI consists of a principal amount and interest on the loan.

The principal amount is the original loan amount given to you by the bank, on which the interest will be calculated.

EMI comprises two components, such as principal and interest rates. The interest component is higher in the initial years and reduces over the years.

When you pay an EMI, all the interest is first paid, and the remaining amount is considered as principal. Every month the interest is calculated on outstanding amount.

Suppose you have taken Rs. 1 Lakh loan for 12 months at 12% rate. The EMI for the loan will be Rs. 8,885.

Interest component in 1st EMI = (12/12*100)*1,00,000 = Rs. 1000

Principal component in 1st EMI = 8,885 – 1,000 = 7,885

In next EMI, the interest amount will be calculated on an outstanding principal of 1,00,000 – 7,885 = Rs. Rs. 92,115. By the end of the tenure, the interest component will come down to zero and the amount you pay as EMI is the remaining principal. This is how interest and principal split in EMI.

How Accurate is moneycontain loan emi calculator?

Loan Eligibility Criteria:

There are many factors which effects the approval for the loan and its individual specific, having said that below are some of the points that affects the most:

- Age: A younger individual has a higher chance of getting a higher loan amount approved as compare to an older individual, as a younger person will have more years ahead and with time his chances of earning may increase.

- Income: Your income is also an important factor in your loan eligibility. Higher your income, more will be your scope of borrowing. Minimum Net monthly salary of Rs. 20,000/- is required.

- Salaried/Self-employed: Your occupation also have a role to play in how much and how soon will you get approved, employees of either MNCs, Public and Private limited companies with a minimum age of 18 years and maximum age of 58 years are eligible for a loan.

- Whereas for self-employed they have to show their regular stream of income and its sources like business or any other.

- Income stability: An individual with a steady and stable income (government) is more likely to get a loan than one with an irregular income (private).

- Expenses: Your monthly expenses will also be an factor for you to decide how much loan you can afford. So try to keep it low.

- Existing EMIs: If there is already an existing loan, than you have to be balance and get rid of that as soon as possible, however if you have paid it without any default this shows the credibility to the lender.

- Credit score: A higher credit rating makes the loan approval process faster and easier and vice versa.

- Rejected loan applications: If you have had prior loan applications on which you have defaulted, it will negatively impact your credit score, thus reduces the chances of fresh new loan.

How To Lower You EMI’s?

If you want to reduce your overall EMI you need to keep following things in mind:

- Loan principal – As a rule of thumb, the higher the amount borrowed as a loan, the higher will be your EMI as long as the tenure and interest rate remains constant.

- Interest rate – The higher the interest rate, the higher will be your individuals EMI pay out as well as the total interest payable on your loan.

- Tenure – When a longer tenure is opted for, individual EMI payments will decrease as compared to a shorter tenure for the same loan. But a longer tenure also results in higher total interest payable over the loan tenure.

- Increase Your Credit Score – A good credit score (750+) not only improves loan approval chances but also qualifies you for lower interest rates.

- Opt for Loan Balance Transfer – If you find a better interest rate elsewhere after a few EMIs, you can transfer your remaining balance to a new lender at a reduced rate.

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

How Loan Prepayment Works?

There are two ways a loan prepayment works:

Full Prepayment:

As discussed above, EMI comprises two components, such as principal and interest rates. The interest component is higher in the initial years and reduces over the years, so if the prepayment in full can be done somewhat early into the tenure of the loan, a customer may save a lot on the interest.

Any type of loan usually has a lock in of about one year after which the entire outstanding amount can be prepaid.

For example, if the loan is for Rs. 1 lakh at an interest rate of 15% and for a term of 2 years, the monthly EMI comes to Rs. 4,848.

At the end of the first year the customer would have paid Rs. 46,272 towards premium and Rs. 11,904 as interest. If the customer decided to prepay the full amount now, he would stand to pay Rs.4,464 less in the form of interest.

Now, suppose the tenure is much longer let say instead of two year if it was 4 or 5 years for the same amount and rate of interest, the earlier you would have made the full prepayment the more you would have saved the interest.

However, there are often prepayment penalties of about 3 to 4% on outstanding principal amount, linked with paying off loans ahead of time, it is generally cheaper and better to prepay your loan as compared to continuing to the longer tenure.

As in case of above example 3% of Rs.53,720 is about Rs. 1,611 even if you deduct that from interest amount you would still have saved around Rs.2852.

Prepayment of an ongoing loan may not have an immediate effect on your credit rating, however in the long term a full prepayment strengthen up your credit rating for sure.

Part Prepayment:

Part payment of a loan helps in reducing the burden of EMI as well as lowering down the interest charges on the principal amount. So, when you have a lump sum amount in between the loan tenure it is a good option to pay-off some part even if it is not equivalent to the entire principal outstanding loan amount.

However, it is important to keep in mind that only when you make a significant amount of lumpsum money as part payment, you EMI and interest will lower down.

Part pre payment of a loan has no effect on your credit rating, still it reduces your total loan burden, which in turn should help you to pay off the loan completely in the given tenure. Moreover it mark’s yourself as a better borrower than other others.

Smart Tips Before Taking a Loan

- Know Your Loan Eligibility – Before applying, check your eligibility using online tools or consult with your bank. Factors like your income, credit score, job stability, and current debts affect eligibility.

- Compare Multiple Lenders – Don’t settle for the first offer. Compare interest rates, processing fees, prepayment options, and repayment flexibility across banks and NBFCs.

- Aim for a Lower Interest Rate – Negotiate better terms based on your credit score (750+), steady income, or existing relationship with the bank. Even a 0.5% reduction in interest can save you thousands.

- Check for Hidden Charges – Look beyond the EMI—watch out for processing fees, insurance charges, foreclosure penalties, and late payment fines.

Crucial Things to Check Before Taking a Loan

- Assess Your Repayment Capacity – Use the EMI calculator to ensure you can comfortably pay the EMI without straining your monthly budget.

- Understand the Loan Type – Different loans have different rules. For example, business loans may have stricter documentation, while personal loans are quicker but more expensive.

- Read the Fine Print – Go through the loan agreement thoroughly to avoid surprises—especially regarding prepayment, penalties, and interest recalculations.

- Check If the Loan Is Secured or Unsecured – Secured loans (like home or car loans) often have lower rates but require collateral. Unsecured loans (like personal loan or business loans) carry higher rates.

Frequently Asked Questions (FAQ) for Loan Seekers

How can I improve my chances of getting a loan approved easily?

-

Maintain a high credit score (750+)

-

Keep your existing debts low

-

Choose a realistic loan amount based on your income

-

Provide accurate and complete documentation

-

Consider applying with a co-applicant if your income is borderline

What are some ways to reduce my EMI burden?

-

Opt for a longer repayment tenure

-

Make a higher down payment

-

Negotiate a better interest rate if you have a good credit profile

-

Choose a fixed vs floating rate carefully depending on market trends

-

Transfer your loan to a lower-interest lender if eligible

What should I check before taking a loan?

-

Interest rate (fixed vs floating)

-

EMI amount and total repayment

-

Processing fees and other hidden charges

-

Foreclosure and prepayment rules

-

Credibility of the lender

What documents do I need to apply for a loan?

Typically, you’ll need:

-

Identity proof (PAN, Aadhaar)

-

Address proof

-

Income proof (salary slips or ITR)

-

Bank statements

-

Business proof (for business loans)

Is it better to prepay or continue EMIs?

If you have surplus funds and there are no or low foreclosure charges, prepayment can save you a lot in interest. However, check if there are tax benefits on the loan that you might lose.

How does loan tenure affect my EMI?

-

Longer tenure = Lower EMI, but higher total interest

-

Shorter tenure = Higher EMI, but lower total interest

Use the EMI calculator to find the sweet spot that fits your budget.

Can I get a loan with a low credit score?

It’s difficult, but possible. You may need to:

-

Provide collateral (secured loan)

-

Apply with a co-applicant

-

Accept higher interest rates

Improving your credit score should be your long-term goal.

If you are looking for the best stockbroker I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Top Banks Offering Personal Loans at Low Interest Rates in 2025

Here’s a list of top banks and NBFCs offering personal loans at competitive interest rates as of May 2025. This information can help you compare options and choose the best lender based on your financial needs and eligibility.

Bank Name |

Interest Rate (p.a.) |

Loan Amount |

Tenure |

Processing Fee |

|---|---|---|---|---|

State Bank of India (SBI) |

Starting from 10.30% |

Up to ₹20 lakh |

Up to 6 years |

1.50% (Min ₹1,000 to Max ₹15,000) |

HDFC Bank |

Starting from 10.75% |

Up to ₹40 lakh |

Up to 6 years |

Up to ₹4,999 |

ICICI Bank |

10.85% – 16.65% |

Up to ₹1 crore |

Up to 5 years |

Up to 2% |

IndusInd Bank |

Starting from 10.49% |

Up to ₹50 lakh |

1 to 5 years |

Up to 3.5% |

Yes Bank |

11.25% – 21% |

Up to ₹40 lakh |

Up to 5 years |

Up to 2.5% |

Kotak Mahindra Bank |

Starting from 10.99% |

Up to ₹40 lakh |

Up to 6 years |

Up to 3% |

IDFC FIRST Bank |

Starting from 10.99% |

Up to ₹40 lakh |

Up to 5 years |

Up to 3.5% |

Bank of Baroda |

11.40% – 18.75% |

Up to ₹10 lakh |

Up to 5 years |

Up to 2% |

Punjab National Bank |

11.40% – 16.95% |

Up to ₹10 lakh |

Up to 5 years |

Up to 1% |

Bank of Maharashtra |

Starting from 10% |

Up to ₹20 lakh |

Up to 5 years |

Up to 1% |

Leading NBFCs Offering Personal Loans at Lower Rates in 2025

| NBFC Name | Interest Rate (p.a.) | Loan Amount | Tenure | Processing Fee |

|---|

| Tata Capital | 11.99% – 29.99% | Up to ₹35 lakh | Up to 7 years | Up to 5.5% |

| Bajaj Finserv | Starting from 11% | Up to ₹25 lakh | Up to 5 years | 1.5% – 3% |

| L&T Finance | Starting from 11.50% | Up to ₹15 lakh | 1 to 4 years | As per policy |

| Mahindra Finance | As per eligibility | ₹50,000 – ₹50 lakh | Up to 5 years | As per policy |

| IIFL Finance | 12.75% – 44% | ₹5,000 – ₹5 lakh | Up to 5 years | 2% – 9% |

| Aditya Birla Capital | 19.45% – 20.45% | Up to ₹40 lakh | Up to 5 years | Up to 3% |

| PaySense | 16% – 36% | Up to ₹5 lakh | Up to 2 years | Up to 3% |

| HDB Financial Services | Contact NBFC | Up to ₹20 lakh | Up to 5 years | As per policy |

Top Banks Offering Home Loans at Low Interest Rates in 2025

| Bank Name | Interest Rate (p.a.) | Loan Amount | Tenure | Processing Fee |

|---|

| State Bank of India (SBI) | Starting from 8.00% | Up to ₹5 crore | Up to 30 years | 0.35% of loan amount (Min ₹2,000; Max ₹10,000) |

| HDFC Bank | Starting from 8.50% | Up to ₹10 crore | Up to 30 years | Up to 0.50% of loan amount |

| ICICI Bank | Starting from 8.75% | Up to ₹5 crore | Up to 30 years | Up to 0.50% of loan amount |

| Kotak Mahindra Bank | Starting from 8.65% | Up to ₹5 crore | Up to 20 years | 0.50% for salaried; 1.00% for self-employed |

| Union Bank of India | Starting from 8.35% | Up to ₹5 crore | Up to 30 years | 0.50% of loan amount |

| Bank of Baroda | Starting from 8.40% | Up to ₹10 crore | Up to 30 years | Nil (limited period offer) |

| Central Bank of India | Starting from 8.10% | Up to ₹5 crore | Up to 30 years | 0.50% of loan amount (waived till March 31, 2025) |

Top NBFCs Offering Home Loans at Low Interest Rates in 2025

| NBFC Name | Interest Rate (p.a.) | Loan Amount | Tenure | Processing Fee |

|---|

| HDFC Ltd. | 8.45% – 10.70% | Up to ₹10 crore | Up to 30 years | Up to 0.50% of loan amount |

| LIC Housing Finance | 8.65% – 10.50% | Up to ₹5 crore | Up to 30 years | Up to 0.50% of loan amount |

| Tata Capital Housing Finance | Starting from 8.95% | Up to ₹5 crore | Up to 30 years | Up to 1.00% of loan amount |

| Bajaj Housing Finance | Starting from 8.75% | Up to ₹5 crore | Up to 30 years | Up to 0.50% of loan amount |

| PNB Housing Finance | 8.50% – 14.50% | Up to ₹5 crore | Up to 30 years | Up to 1.00% of loan amount |

If you’re looking for a broker that offers speed, transparency, and advanced tools, Dhan is one of the best choices today. With zero brokerage on delivery trades and intuitive charts, Dhan is built for both beginners and pro traders. Invest in Stocks, F&O, Commodities, Currency, ETFs, Mutual Funds, SGBs, IPOs, SIPs and much more.

Click Here to Open Your Free Dhan Account

No paperwork. No account opening charges. Get started in 5 minutes! Dhan also offers advanced tools like TradingView & Options Trader built-in.

Top Banks Offering Business Loans at Low Interest Rates in 2025

| Bank Name | Interest Rate (p.a.) | Loan Amount | Tenure | Processing Fee |

|---|

| State Bank of India (SBI) | Starting from 8.00% | Up to ₹5 crore | Up to 7 years | As per bank’s discretion |

| HDFC Bank | 10.75% – 22.50% | Up to ₹50 lakh | Up to 5 years | Up to 2.00% of loan amount |

| ICICI Bank | Starting from 13.00% | Up to ₹1 crore | Up to 5 years | Up to 2.00% of loan amount |

| Kotak Mahindra Bank | 11.69% – 15.00% | Up to ₹75 lakh | Up to 5 years | Up to 2.00% of loan amount |

| Bank of India | Starting from 9.95% | Up to ₹5 crore | Up to 7 years | As per bank’s discretion |

Top NBFCs Offering Business Loans at Low Interest Rates in 2025

| NBFC Name | Interest Rate (p.a.) | Loan Amount | Tenure | Processing Fee |

|---|

| IIFL Finance | 12.75% – 44.00% | Up to ₹50 lakh | Up to 5 years | 2% – 9% of loan amount |

| Aditya Birla Finance | 10.00% – 16.00% | Up to ₹50 lakh | Up to 7 years | Up to 2.00% of loan amount |

| Oxyzo Financial Services | Starting from 12.00% | Up to ₹1 crore | Up to 5 years | As per NBFC’s discretion |

| Shriram Finance | As per NBFC’s discretion | Up to ₹1 crore | Up to 5 years |

Key Considerations When Choosing a Lender:

-

Credit Score: A higher credit score (750 and above) can help you secure loans at lower interest rates.

-

Loan Purpose: Some lenders offer specialized loans for specific purposes like home renovation, business expansion, or working capital.

-

Repayment Flexibility: Check for options like part-prepayment, foreclosure, and flexible EMI plans.

-

Processing Time: NBFCs often have faster processing times compared to traditional banks.

Conclusion: Take Control of Your Loan Journey

Understanding your EMI in advance is the first step toward smart financial planning. With our Loan EMI Calculator, you can easily estimate your monthly outflow, adjust loan parameters to suit your budget, and make well-informed borrowing decisions.

Whether you’re planning a personal loan, business loan, or home loan, this tool helps you stay financially prepared and avoid surprises down the road.

Use the insights and tips shared on this page to lower your EMIs, improve loan eligibility, and ensure a smooth repayment journey. Start planning today a better loan experience begins with the right calculation.

If you ask me personally, I would advise anyone, any-day not to go for any loan until it is very critical for you.

Instead, save money or invest in other financial assets (like gold, fixed deposits, SIP, mutual funds, stocks indexes as long as you can. Buy anything when you have that amount in your hand instead of taking any loan.

Having said that there is no guarantee as such, I just wanted to present you the another point of view, its your hard earned money, so do proper research before taking any decision.

If, you have liked the content please do share it with your friends or on social media, as sharing do bring the good karma. If you have any questions or feedback you can leave them in comment box below.

Disclaimer

The Loan EMI Calculator is provided for informational purposes only and should not be considered as financial advice. The EMI results are based on the inputs provided and may vary depending on actual loan terms and lender policies. Interest rates, fees, and loan approval are subject to change at the discretion of the lending institution. Please consult with your financial advisor or the respective bank before making any borrowing decisions.

We do not guarantee the accuracy or applicability of the calculator’s output for your specific situation.