What Is Call Ratio Back Spread?

Call ratio back spread is a bullish strategy that becomes highly profitable when the underlying moves sharply upward. It’s structured by selling fewer call options and buying more at a higher strike.

Structure:

-

Sell 1 ITM/ATM Call

-

Buy 2 OTM Calls

Goal: To benefit from a strong upside breakout while maintaining limited loss if the market stays flat or drops slightly.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Why Use Call Ratio Back Spread Strategy?

The Call Ratio Back Spread is used when you expect a big, fast upside move in the market and want to maximize profits with limited risk. It’s a smart strategy because it protects you if you’re wrong (small loss or breakeven) and rewards you massively if you’re right.

| Feature | Benefit |

|---|

| Unlimited Upside | Massive profits if breakout happens |

| Limited Downside | Small, known maximum loss |

| Benefit from Volatility | Extra gains from rising IV |

| Low-Cost Setup | Small debit or even net credit |

| Safer Than Naked Calls | Offset theta decay with short call |

1. Unlimited Profit Potential:

-

If the underlying asset (e.g., Nifty, Bank Nifty, stock) moves up sharply, the long calls explode in value.

-

Your loss is limited, but your profit grows unlimited with the move upwards.

Example: If Nifty jumps 400–500 points after you set it, your profits could be 5x–10x of what you risked.

2. Limited and Predictable Risk:

-

The maximum loss happens only if the underlying stays around the sold call strike at expiry.

-

You know upfront the worst-case loss — it’s small compared to the possible upside.

Safer than just buying naked calls (where 100% premium can get wiped).

3. Takes Advantage of Volatility Expansion:

-

If implied volatility (IV) rises after you enter, your long calls gain value faster.

-

IV spike + price rally = Double benefit.

Especially useful before events like RBI policy, Budget, Fed meetings — when volatility can suddenly shoot.

4. Lower Cost Entry (Sometimes Credit!)

-

Unlike buying a call option alone (which costs full premium), a Call Ratio Back Spread can often be created with:

-

Very low debit, or

-

Small net credit (you even get paid to set it up!).

-

This makes it a “cheap bet” on a big move.

5. More Forgiving than Buying Calls Alone

-

Buying only call options is risky — time decay (theta) eats premium fast if the move doesn’t happen quickly.

-

In Call Ratio Back Spread:

-

The short call premium collected offsets some time decay.

-

Gives you a little more breathing room if the move is delayed.

-

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Call Ratio Back Spread Strategy Example (NIFTY – Weekly Expiry)

Spot Price: ₹23,330

Action |

Strike Price |

Premium |

Quantity |

|---|---|---|---|

Sell 1 Call |

₹23,400 |

₹125 |

-1 |

Buy 2 Calls |

₹23,500 |

₹80 |

+2 |

Net Debit = (2 × ₹80) – ₹125 = ₹160 – ₹125 = ₹35

Lot Size = 50

Max Loss = ₹35 × 50 = ₹1,750

Unlimited Profit above ₹23,635 (breakeven)

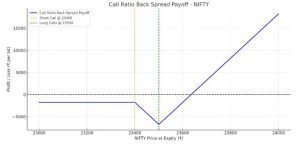

Call Ratio Back Spread Strategy Payoff Graph:

N Expiry Price |

Outcome |

P&L (Per Lot) |

|---|---|---|

Below ₹23,400 |

All options expire worthless |

Loss of ₹1,750 |

₹23,400 – ₹23,635 |

Mixed P&L; one call loses, two gain slowly |

Max loss at ₹23,500 |

Above ₹23,635 |

Explosive gains due to 2x long call advantage |

Unlimited Profit |

Let’s Plot the Payoff Graph:

Interpretation of the Graph:

-

Flat zone below ₹23,400: All options expire worthless. You lose the net debit of ₹1,750.

-

Small dip near ₹23,500: This is the maximum loss zone.

-

Explosive profit after ₹23,635: Your long calls (2x) start gaining big, far outpacing the single short call.

Call Ratio Back Spread Strategy Option Greeks Breakdown:

Greek |

Behavior in Ratio Back Spread |

Practical Meaning |

|---|---|---|

Delta |

Turns positive as market moves up |

Bullish strategy; gains from upside |

Theta |

Slightly negative |

Time decay may hurt if market is flat |

Vega |

Positive |

Higher volatility helps (long calls gain value) |

Gamma |

High |

Strategy becomes very reactive to price moves |

When to Use Call Ratio Back Spread?

- You expect a big upside breakout or rally

- Strong technical signals: breakout, trend reversal, high momentum

- IV (Implied Volatility) is low to moderate and expected to rise

- Event-driven trades (e.g., budget, earnings) with smart entry timing

- 10–25 days left for expiry (enough time for move)

- You want unlimited upside with limited risk

Example:

Nifty trading at 22,000

Sell 1 lot 22,100 CE

Buy 2 lots 22,300 CE

Small net debit or slight credit collected

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Call Ratio Back Spread Adjustments (If Market Doesn’t Move)

Situation |

Adjustment |

Why? |

|---|---|---|

Market is flat |

Exit and re-enter near expiry |

Avoid theta decay |

Slight down move |

Add lower long call to hedge |

Reduce drawdown |

Market turns bearish |

Convert into a butterfly |

Define risk tightly |

Call Ratio Back Spread BankNifty Example:

Let’s construct a Call Ratio Back Spread strategy on the Bank Nifty Index, tailored for the weekly expiry. This strategy is ideal when you anticipate a significant upward movement in the index.

-

Bank Nifty Spot Price: ₹52,379.50

-

Lot Size: 25 units per lot

Strategy Setup:

We’ll select strike prices based on the current market conditions:

-

Sell 1 Call Option: Strike Price ₹52,500

-

Premium Received: ₹538.50

-

-

Buy 2 Call Options: Strike Price ₹53,000

-

Premium Paid: ₹324.95 each

-

Net Debit: (2 × ₹324.95) – ₹538.50 = ₹649.90 – ₹538.50 = ₹111.40

Total Debit (per lot): ₹111.40 × 25 = ₹2,785

Profit & Loss Analysis

-

Maximum Loss: Occurs if Bank Nifty stays at ₹53,000 at expiry

-

Loss: Net Debit × Lot Size = ₹2,785

-

-

Breakeven Point: Strike Price of Long Calls + Net Debit per unit

-

₹53,000 + ₹111.40 = ₹53,111.40

-

-

Profit Potential: Unlimited above the breakeven point

Key Considerations:

-

Market Outlook: Strongly bullish

-

Risk-Reward Ratio: Limited risk with unlimited profit potential

-

Time Decay (Theta): May work against the position if the market remains stagnant

-

Implied Volatility (IV): An increase in IV benefits the position

When NOT to Use a Call Ratio Back Spread Strategy (and Why)?

The Call Ratio Back Spread is a strategy where you buy more calls than you sell (typically 2 bought : 1 sold), aiming to profit from big bullish moves or spike in volatility. However, there are clear conditions where this strategy can underperform or even lose heavily.

1. When Market Is Expected to Be Range-Bound

-

Why: The Call Ratio Back Spread needs sharp up-moves to be profitable.

-

Risk: If the market stays sideways, the bought calls lose premium faster (time decay hurts).

-

Better Option: Use strategies like iron condor or straddles if expecting range.

2. When Volatility (IV) Is Already Very High

-

Why: If you enter when IV is already at extreme highs (due to event hype like Budget, elections), any post-event IV crush can devalue your long calls sharply.

-

Risk: Loss due to volatility collapse, even if price doesn’t move much.

-

Better Option: Wait for IV to normalize post-event before using this strategy.

3. When Trend Strength Is Weak or Uncertain

-

Why: The strategy benefits only if the underlying shows explosive directional moves upward.

-

Risk: In a choppy trend or fake breakout, premiums fall without major movement.

-

Better Option: Wait for confirmation (moving averages crossover, volume breakout) before entering.

4. Too Close to Expiry

-

Why: As expiry nears, gamma risk increases and you have less time for a big move to happen.

-

Risk: Time decay will erode the value of long calls very fast, making it difficult to recover costs.

-

Better Option: Deploy this strategy earlier in the week or month to allow enough time for moves.

5. Improper Ratio or Strike Placement

-

Why: Selling calls too close to CMP and buying higher strikes can cause losses if the price settles just above the sold strike but below long calls.

-

Risk: Partial profits, no protection zone; worst-case zone around sold strike.

-

Better Option: Use balanced strikes and prefer slight OTM short strikes with farther OTM long strikes.

Key Risk Zone in Call Ratio Back Spread:

-

If underlying closes near the sold call strike at expiry, you can face a net loss due to the short call being ITM (loss) and long calls being OTM (worthless).

When to Avoid Call Ratio Back Spread?

-

Market is sideways or sluggish.

-

IV is already very high and due for a crash.

-

No clear breakout or strong momentum signs.

-

Too close to expiry.

-

Poor strike selection.

Pro Tip: Best used when you expect a BIG move + possible volatility expansion — such as during strong trending phases, major policy announcements (if timed properly), or after strong technical breakouts.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Pro Tips for Call Ratio Back Spread:

- Place sold strike slightly OTM; not too close to spot.

- Prefer wider distance between sold call and long calls.

- Initiate 2–3 weeks before expiry for best gamma exposure.

- If IV rises sharply before move, consider rolling up/down.

- Don’t chase this strategy in already overbought markets!

- Confirm trend using moving averages, RSI breakout, MACD crossover, or strong news flows.

- Prefer quality stocks or indices (like Nifty, Bank Nifty) — avoid illiquid options.

The Call Ratio Back Spread is best when you expect a violent upside breakout and/or spike in volatility.

Avoid it when the market is dull, IV is high, or you’re close to expiry — or you’ll suffer from time decay and wrong side gamma!

Conclusion: Call Ratio Back Spread Strategy

The Call Ratio Back Spread is an exciting, aggressive bullish strategy that offers unlimited upside potential with limited downside risk. It is designed for situations where you expect the market (or stock) to make a big upward move not just a slow climb, but a strong breakout or rally.

By selling fewer calls and buying more calls (typically in a 1:2 ratio), you set up a position that earns maximum profit if the underlying surges upward sharply.

Even if the move is moderate or volatility rises, you can still profit, although the best returns come from strong, fast moves.

“The Call Ratio Back Spread is like loading a rocket. It may cost a little to set up, but when the ignition happens you want to be ready for the blast!

Use it smartly when momentum, trend, and volatility align — and you’ll be trading with the big probabilities on your side.

Learn Bull Put Spread Strategy here

Learn Covered Call Option Strategy here

Learn Bull Call Spread Strategy here

Disclaimer:

This content is for educational purposes only and does not constitute financial or investment advice. Trading in derivatives like options involves substantial risk and is not suitable for all investors.

All examples, strategies, and calculations (including those involving NIFTY, BANKNIFTY, or any other instruments) are hypothetical and meant solely to illustrate how options strategies work under certain conditions.

Market conditions, pricing, and premiums may vary significantly in real-time trading. Past performance is not indicative of future results.

You are advised to consult with a SEBI-registered investment advisor or a qualified professional before making any investment or trading decisions. Always perform your own due diligence.

The author or platform is not responsible for any direct or indirect loss arising from any information provided here.