What Is a Bull Call Spread?

A Bull Call Spread is a moderately bullish options strategy using two call options:

- Buy 1 Call Option (Lower Strike)

- Sell 1 Call Option (Higher Strike)

Both options have the same expiry. This helps reduce the premium you pay, compared to just buying a call.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies. So do check them out, also if you are beginner in options trading I would request you to first have Basic understanding of options ,Option moneyness , How to read option chain table.

Why Use Bull Call Spread Strategy?

-

You expect the stock to go up gradually, not a massive rally

-

You want to limit your risk and reduce cost compared to naked calls

-

Great for budget-conscious traders

Bull Call Spread Strategy Example:

Let’s assume,

Detail |

Value |

|---|---|

Current INFY Price |

₹1,400 |

Buy 1 Call @ |

₹1,380 (Premium ₹35) |

Sell 1 Call @ |

₹1,440 (Premium ₹12) |

Lot Size |

300 shares |

Net Premium Paid:

-

Paid ₹35 – Received ₹12 = ₹23

-

Total cost = ₹23 × 300 = ₹6,900

Max Profit & Loss:

Scenario |

Calculation |

Amount |

|---|---|---|

Max Profit (price ends above ₹1440) |

₹60 spread – ₹23 net premium |

₹37 × 300 = ₹11,100 |

Max Loss (price ends below ₹1380) |

Net premium paid |

₹23 × 300 = ₹6,900 |

Breakeven Point |

₹1380 + ₹23 = ₹1,403 |

— |

Option Greeks (Basic View):

Greek |

Impact |

|---|---|

Delta |

Positive (net bullish) |

Theta |

Slightly negative (time decay hurts) |

Vega |

Neutral to low |

Gamma |

Lower than naked call |

Variations:

Weekly Version:

-

Use near-expiry calls, tighter strike gaps (₹20–₹30)

-

Suitable for short-term breakout trades

Conservative vs Aggressive:

-

Conservative: wider spread, lower debit

-

Aggressive: narrower spread, higher cost but more profit potential

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

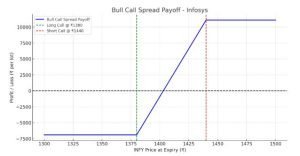

Payoff Graph — Bull Call Spread (Infosys Example):

What the Payoff Graph Shows:

- Left of ₹1380: You’re in loss equal to the premium paid (₹6,900).

- Between ₹1380 and ₹1440: Your profit increases gradually.

- Above ₹1440: Profit is capped at ₹11,100, no matter how high INFY goes.

Summary Table – Bull Call Spread (Infosys Example)

Criteria |

Details |

|---|---|

Strategy Type |

Moderately Bullish |

Max Profit |

₹11,100 (if INFY ≥ ₹1440) |

Max Loss |

₹6,900 (if INFY ≤ ₹1380) |

Breakeven |

₹1403 |

Capital Efficient? |

Yes |

Greeks Sensitivity |

Delta positive, low Vega impact |

Best Market View |

Slightly bullish with limited upside |

When to Use Bull Call Spread:

-

You are moderately bullish on the stock/index.

-

You expect an upward move but within a limited range (target-based).

-

Implied Volatility (IV) is high, and you expect it to drop post-event.

-

There are 15–25 days to expiry (enough time for the move).

-

You want a cost-effective alternative to buying a naked call.

-

You prefer defined risk and limited reward — perfect for conservative trades.

Example: Nifty at 22,000 — You expect a move to 22,300. You buy 22,000 CE and sell 22,300 CE.

Learn Covered Call Option Strategy here

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

When NOT to Use a Bull Call Spread (and Why)?

Knowing when not to use a strategy is just as important as knowing when to use it. Here’s a clear breakdown of when not to use a Bull Call Spread and why.

1. When You’re Strongly Bullish

-

Why: The upside is capped. If the underlying rallies sharply, you won’t benefit beyond the short call strike.

-

Better Alternative: Consider a naked call or call ratio back spread to capture larger moves.

2.When Volatility is Low and Expected to Rise

-

Why: Bull Call Spreads benefit less from a volatility rise because the short call limits your vega exposure.

-

Better Alternative: Long call or straddle (to benefit from volatility expansion).

3. When You Expect a Quick, Sharp Move

-

Why: The strategy is risk-defined but reward-limited, so fast, large upside moves don’t benefit you fully.

-

Better Alternative: Long call or synthetic call (more responsive to rapid delta gain).

4. When Time to Expiry is Very Short

-

Why: If you enter the spread near expiry and the underlying hasn’t moved, time decay eats your long leg faster, leaving little chance to profit.

-

Better Alternative: Use outright directional trades or focus on intraday futures.

5. When the Spread Is Too Narrow

-

Why: A very narrow strike difference (e.g., 50 points on Nifty) can lead to poor risk-to-reward ratios and high breakeven points.

-

Better Alternative: Choose wider strikes or rethink the directional view.

Bonus Caution:

Don’t use this strategy blindly during event-driven uncertainty (like RBI policy or budget day) — unless you have a defined view, as implied volatility crush afterward can hurt both legs.

Points to keep in mind when not to use it:

-

You’re very bullish and expecting a strong breakout or rally.

-

The strike difference is too narrow (e.g., <50 points on Nifty), giving poor risk-reward.

-

It’s too close to expiry (e.g., last 2–3 days), and time decay is too aggressive.

-

IV is low and expected to rise — strategy won’t benefit much from vega.

-

You want unlimited profit potential, and are okay with higher risk.

-

You are trading intraday or need quick gains — time decay can hurt.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Conclusion: Bull Call Spread Strategy

The Bull Call Spread is a smart, risk-defined strategy for traders with a moderately bullish outlook on the market. By buying a lower strike call and simultaneously selling a higher strike call, the trader reduces the upfront cost of the trade compared to buying a naked call. This strategy is ideal when you expect a limited upside move in the underlying.

Key Takeaways:

-

Risk is limited to the net premium paid.

-

Reward is capped, but higher probability of profit compared to buying a call alone.

-

Works best in range-bound bullish markets.

-

Benefits from time decay on the short leg.

-

Has a positive delta and negative theta (if debit), so it benefits from upward moves early in the expiry cycle.

Real Market Fit:

-

Suitable for indices like Nifty or BankNifty around key support levels.

-

Often used around news events or earnings with a directional bias but where volatility is already priced in.

Pro Tip: Use Bull Call Spreads when implied volatility is high, and you expect the price to move up but not skyrocket.

Disclaimer:

This content is for educational purposes only and does not constitute financial or investment advice. Trading in derivatives like options involves substantial risk and is not suitable for all investors.

All examples, strategies, and calculations (including those involving NIFTY, BANKNIFTY, or any other instruments) are hypothetical and meant solely to illustrate how options strategies work under certain conditions.

Market conditions, pricing, and premiums may vary significantly in real-time trading. Past performance is not indicative of future results.

You are advised to consult with a SEBI-registered investment advisor or a qualified professional before making any investment or trading decisions. Always perform your own due diligence.

The author or platform is not responsible for any direct or indirect loss arising from any information provided here.