Knowing Theta in options trading helps you to be a better options trader because it is a critical component of options trading and refers to the time decay of an option. Theta measures how much an option’s price decreases as time passes, assuming all other factors remain constant.

There is a very important term which should be known to an option trader termed as Option Greeks.

When it comes to options trading, understanding the greeks – Delta, Gamma, Theta, Vega, and Rho is critical for building effective strategies.

This article provides a deep dive into Theta, its relationship with Delta and Gamma, its practical applications, and examples to illustrate its significance.

Before we go in depth in Theta I would request you to have Basic understanding of options ,Option moneyness , How to read option chain table what is Delta in option trading and how to use Gamma while trading options.

By understanding these Options Greeks traders can make more informed decisions about buying, selling or holding options positions.

Having said that let us now understand deeply what is Theta of an Option and how it will be enhancing your option trading?

There are majorly four Greeks one should be aware i.e. Delta, Gamma, Vega, Theta.

- Delta – Delta is the amount an option price (premium) is expected to move based on a 1 rupee change (up or down) in the underlying stock or index.

- Gamma – It helps in measuring Rate of change of delta.

- Vega – This calculate rate of change of premium depending up on change in volatility.

- Theta – It helps in knowing the effect on premium in respect to days or time left for expiry

As of now let us concentrate on Theta in options trading.

but before moving straight to Theta just a brief reminder about delta and gamma is necessary so that you can connect the dots.

“Delta is the amount an option price (premium) is expected to move based on a 1 rupee change in the underlying stock”.

In other words Delta of an option helps in Measuring how an options value changes with respect to the change in the underlying.

Most of the beginners in option trading assume that when a stock moves Rs.1, the price of options premium based on that stock will move more than Rs.1.

Always remember the option is a derivative contract, it derives its value from its respective underlying, it can never move faster than the underlying. In reality it does not work like this at all.

This is when we need to be aware of Delta of an option. By knowing this you will be able to find ” how many points will the option premium change for every 1 point change in the underlying.

Whereas Gamma measures the rate of change of Delta for every 1 point change in the price of the underlying asset. In other words Gamma of an option helps us to find the corresponding change in the delta of the option with respect to the change in the underlying value.

Delta measures how much an option’s price will change for a 1 point move in the underlying asset. Gamma explains how that Delta itself will change if the underlying asset continues to move.

Gamma peaks when the option is at-the-money (ATM). This is because small changes in the underlying price can quickly alter the probability of the option expiring in the money (ITM) or out of the money (OTM).

For deeply ITM or OTM options, the Delta is less sensitive to underlying price changes, resulting in a smaller Gamma. As options approach expiration, Gamma increases for ATM options. This phenomenon, often called Gamma risk, makes it challenging to manage positions near expiry.

Gamma is positive for both call and put options. It ensures that Delta moves predictably in response to changes in the underlying, regardless of the option type.

Remember you do not need to calculate these option greeks values manually as it is available with many brokers in built in their trading platform.

and if you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

now let us comeback to the original topic Theta and how it will help you to be a better option trader.

What is Theta?

- Theta measures the rate at which the time value of an option decreases as it approaches its expiry date.

- It’s a component of the options Greeks, which are used to understand the behavior of options prices.

- Theta is generally negative for option buyers and positive for option sellers.

- Theta is expressed as the amount the option price will lose per day due to time decay.

Now before we dive deep in to the subject as an investor you should know the (TMV) “time value of money” the value of money does not remain the same across time.

Meaning, the value of Rs.10,000 today is not really Rs.10,000, 3 years from now. Likewise the value of Rs.10,000, 3 years from now is not really Rs.10,000 as of today.

Whenever there is motion of time, there is an element of opportunity. Money has to be accounted or adjusted for that opportunity.

For e.g. Your father might have told told you that we used to get 1 kg of mangoes in our time at only 5 rupees or may be even less than that. But if you go now to buy the same, this sound unrealistic, reason being with time there is inflation (interest).

That is why one should know, what will be the future investment he made for the retirement or any other goal such as wedding, vacation, children studies, etc. is sufficient enough, if you calculate it in today’s term in respect to certain cost (interest) accounted.

Due to inflation, the value of money decreases over time. For example if you have kept Rs. 1,00,000 with you as idle for 5 years instead of investing, assuming an inflation rate of 7% per annum the value of your money will be reduced to Rs.71,299 in percentage terms its -28.70% decline overall.

Below infographic representation shows you how inflation have impact on your life as well as investments across different asset class.

As you can see the value of Rs. 1 lakh after 20 years declines to Rs.25,842 assuming a inflation rate at 7% per annum. If you convert this in percentage terms it is down by -74.16% due to inflation.

Keeping the same logic in mind, think about the following situation Nifty Spot is 24000, you buy a Nifty 24,200 Call option – what is the likelihood of this call option to expire In the Money (ITM) in 30 days, 15 days or 5 days.

This is where Theta plays a major role as it inform us that if there is more time for expiry the likelihood for the option to expire In the Money (ITM) is higher and vice-versa.

Just like in above example of time value of money inflation helped us to find the real value of money similarly the Theta helps in identifying the value of your option contract.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

How Theta Works?

Understanding Theta in “Time is Money” Context:

When you buy an option, you’re paying for two things:

- Intrinsic Value: The real value if the option is exercised immediately.

- Time Value: The cost of the “possibility” that the option will become profitable before it expires.

Since time keeps moving forward, this “possibility” diminishes with every passing day, reducing the time value. The closer you get to expiry, the less time value the option has — until it’s completely gone at expiration.

Theta represents this “cost of time” for holding an option. For buyers, time is a cost; for sellers, time is income.

If you do not know what is Intrinsic value let me example it with an example:

Suppose you buy a call option at strike price of 30, and the underlying stock’s market price is Rs.38 per share. Than intrinsic value of the call option would be 8.

Intrinsic Value of a Call option = Spot Price – Strike Price so, Rs.38 stock price minus 30 strike price (38-30)= 8.

To put it differently the intrinsic value of an option is the money the option buyer would make from an options contract, If he has the right to exercise the options on a given day.

To understand this as an illustration we will be doing a little exercise.

Underlying |

Nifty50 |

|---|---|

Spot Value |

11200 |

Option strike |

11000 |

Option Type |

Call Option (CE) |

Premium price |

200 |

Position |

Long(buy) |

Let us assume you bought Call Option for NIFTY 50 @ 11000CE and instead of waiting till expiry you had the right to exercise the option today.

It’s important to realize when you exercise a long option (buy call), the money you make is equal to the intrinsic value of an option minus(-) the premium paid.

To answer the above question we will be calculating the intrinsic value of an option:

Formula to calculate IV:

Intrinsic Value of a Call option = Spot Price – Strike Price

= 11200 – 1100

= 100

So, if you were to exercise this option right now, you would be making Rs.100. You need to subtract this from premium paid to get the net P&L.

Likewise for Put Option formula to know IV

Intrinsic Value(IV) = Strike Price – Spot Price

Now Assume, Spot Value = 11000 and Option strike = 11500 Than, IV= 11500-11000 = 500

Important Note : Intrinsic value of an options contract can never be negative. It can be either positive number or Zero.

I know you might be thinking why IV is non-negative number? To understand this let’s go through another example, Strike price is at 500, spot price is 480, option type is long call (BUY) & the premium is Rs.10.

If you were to exercise this option, How much is the intrinsic value?

Intrinsic Value = 480 – 500 = -20

Which means Rs.20 is going from out from our pocket. Now let us assume this is true for a second, what will be the total loss? Adding premium paid with this value, 10 + 20 = Rs.30/-

But on the contrary we know the maximum loss for a call option buyer is limited to the extent of premium one pays, in this case it will be Rs.10/-.

This is termed as “non linear property of option payoff”, Hence in order to maintain this Intrinsic value can never be negative.

You can apply same argument to the put option intrinsic value calculation as well.

This is the concept of Intrinsic value, I hope you have understood it completely now.

Now let us discuss the main topic i.e. Theta

Example of Theta: Time is Money

Scenario

- Underlying: NIFTY at 19,000.

- Option: A Call Option with a strike price of 19,100, expiring in 10 days.

- Premium Today: ₹100 (Time Value = ₹100, Intrinsic Value = ₹0 because it’s OTM).

- Theta (Time Decay): ₹5/day.

Day-by-Day Analysis of Time Value

Day |

Premium (₹) |

Time Value (₹) |

Intrinsic Value (₹) |

Theta Decay (₹/day) |

|---|---|---|---|---|

10 |

100 |

100 |

0 |

5 |

9 |

95 |

95 |

0 |

5 |

8 |

90 |

90 |

0 |

5 |

… |

… |

… |

… |

… |

1 |

10 |

10 |

0 |

5 |

0 |

0 |

0 |

0 |

0 |

Interpreting the Table

- Buyer’s Perspective:

- As time passes, the premium you paid (₹100) shrinks, regardless of whether the underlying NIFTY moves.

- If NIFTY doesn’t rise above the strike price (19,100), you lose the entire ₹100 by expiration.

- This shows that “time is money” — you’re losing value daily just by holding the option.

- Seller’s Perspective:

- If you sold the option for ₹100, you’re earning ₹5 each day from time decay, provided the price stays below the strike price.

- For option sellers, time literally is money, as every day of stable or favorable market movement earns them income.

Why Theta Accelerates Near Expiry?

- The chart of time decay is non-linear:

- In the first few days, the premium drops slowly (less daily Theta).

- In the final days, the time value erodes rapidly.

This is because there’s little time left for the option to become profitable, and the chance of a big move diminishes significantly.

Key Takeaways

- Time is Money: As time passes, the value of the “time” portion of an option’s premium diminishes. For buyers, it’s a cost. For sellers, it’s an income.

- Accelerated Decay: Time decay speeds up as the expiration date approaches.

- Strategic Implication:

- Buyers should act early to capitalize on price movements.

- Sellers benefit from Theta decay, especially in the last week before expiration.

Understanding Theta as “time is money” helps traders grasp the importance of timing and how time decay impacts profits and losses.

Characteristics of Theta:

- Magnitude of Decay:

- ATM Options (At-the-Money): Highest time value and hence, highest Theta decay.

- OTM Options (Out-of-the-Money) and ITM Options (In-the-Money): Lower time value, and therefore, smaller Theta decay.

- Timeframe:

- Time decay is non-linear; it accelerates as expiry approaches.

- For example:

- If an option has 30 days to expiry, the decay might be gradual in the first 20 days and rapid in the last 10 days.

- Direction:

- Buyers of options lose money due to Theta decay if the stock price doesn’t move favorably.

- Sellers of options gain money from Theta decay as they pocket the premium while the time value erodes.

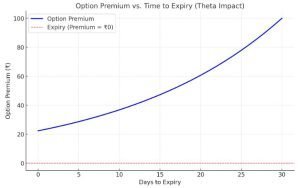

The chart above illustrates how an option’s premium decays over time due to Theta, assuming a constant rate of time decay.

Explanation of the Theta Chart:

- X-Axis: Represents the number of days remaining until the option expires.

- Y-Axis: Represents the option premium in ₹ (assumed here to start at ₹100).

- Decay Pattern:

- At the start (30 days to expiry), the decay is slower because there’s more time value.

- As the expiry approaches, the decay accelerates, especially in the final 5-10 days.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Theta Real-Time Example:

Let’s consider NIFTY options:

- Scenario:

- NIFTY is at 19,000.

- A trader buys a Call Option (CE) with a strike price of 19,100 for ₹100, expiring in 7 days.

- Theta Impact:

- Assume Theta is ₹5 per day.

- If the price of NIFTY stays at 19,000, the option price will reduce by ₹5 daily purely due to time decay.

Day |

Option Price |

Loss Due to Theta |

|---|---|---|

0 |

₹100 |

₹0 |

1 |

₹95 |

₹5 |

2 |

₹90 |

₹10 |

… |

… |

… |

7 |

₹0 |

₹100 |

- If the market doesn’t move favorably (above 19,100), the entire premium paid is lost.

Role of Theta for Option Buyers and Sellers:

- Option Buyers:

- Negative Theta: As time passes, the value of their position decreases, leading to potential losses.

- They need significant moves in the underlying asset to offset Theta decay.

- Option Sellers:

- Positive Theta: They benefit from time decay as they receive the premium and hope the option expires worthless.

- Theta decay works in their favor.

Option Strategies Using Theta:

- Theta-Neutral Strategies:

- Traders use combinations like straddles or strangles to neutralize the impact of Theta if they anticipate a big move.

- Theta-Positive Strategies:

- Selling options (e.g., covered calls, cash-secured puts) to earn premiums while benefiting from time decay.

Important Factors Affecting Theta:

- Time to Expiry:

- Longer expiry = lower Theta decay.

- Shorter expiry = higher Theta decay.

- Volatility:

- Higher implied volatility reduces Theta because the option retains more time value.

- Lower volatility increases the effect of Theta decay.

- Moneyness:

- ATM options experience the highest Theta decay, as their time value is the largest.

Theta Example with Bank Nifty Weekly Options:

- Scenario:

- Bank Nifty is trading at 45,000.

- A trader sells a 45,200 Call Option for ₹120 with 5 days to expiry.

- Theta decay per day is estimated at ₹10.

Day |

Option Premium |

Profit from Theta |

|---|---|---|

0 |

₹120 |

₹0 |

1 |

₹110 |

₹10 |

2 |

₹100 |

₹20 |

… |

… |

… |

- By expiry, if the option remains OTM (Bank Nifty below 45,200), the seller keeps the entire ₹120.

- For Buyers:

- Risk: Losses from Theta decay if the underlying doesn’t move enough.

- Mitigation: Trade close to events or news that might cause significant volatility.

- For Sellers:

- Risk: Unlimited losses if the underlying moves sharply.

- Mitigation: Use stop-loss or hedge positions with spreads.

Theta is a powerful concept in options trading. Understanding how time decay affects options can help traders make informed decisions:

- Option Buyers: Need to act quickly and target volatile moves to overcome Theta losses.

- Option Sellers: Can use Theta decay to their advantage, especially in range-bound markets.

By combining Theta with other Greeks like Delta and Vega, traders in the Indian stock market can create strategies that align with their market outlook and risk tolerance.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Theta Example For NIFTY Option:

Scenario:

- Underlying Stock: NIFTY trading at 19,050.

- Option: Call Option with a strike price of 19,000.

- Option Premium: ₹120.

- Days to Expiry: 5.

Step 1: Calculate Intrinsic Value

Since the option is in-the-money (ITM):

Intrinsic Value=Spot Price−Strike Price

Intrinsic Value=19,050−19,000=₹50

Step 2: Calculate Time Value

The remaining portion of the premium is the time value:

Time Value=Premium−Intrinsic Value

Step 3: Impact of Theta

- As expiry approaches, the time value decreases due to Theta decay.

- Assume a daily Theta of ₹10:

- On Day 4, Time Value = ₹70 – ₹10 = ₹60 → New Premium = ₹50 (Intrinsic) + ₹60 = ₹110.

- On Day 3, Time Value = ₹60 – ₹10 = ₹50 → New Premium = ₹50 (Intrinsic) + ₹50 = ₹100.

- On the day of expiry, Time Value = 0, so: Premium=Intrinsic Value=₹50

Visualization of Decay

Day |

Spot Price |

Premium (₹) |

Intrinsic Value (₹) |

Time Value (₹) |

|---|---|---|---|---|

Day 5 (Today) |

19,050 |

120 |

50 |

70 |

Day 4 |

19,050 |

110 |

50 |

60 |

Day 3 |

19,050 |

100 |

50 |

50 |

Day 0 (Expiry) |

19,050 |

50 |

50 |

0 |

Key Observations

- Time Value Decay: Time value decreases rapidly as expiry nears, especially in the last few days.

- Intrinsic Value Stays Constant: If the underlying price doesn’t change, the intrinsic value remains stable.

- Theta’s Role: Theta affects only the time value, not the intrinsic value.

Practical Takeaways

- Option Buyers: Need to ensure the market moves significantly before the time value erodes entirely.

- Option Sellers: Benefit from Theta decay as the time value drops, especially when the underlying remains stable or moves in their favor.

The concept of Theta in options trading can be simplified as “time is money” because the value of an option’s time component decreases as time passes, regardless of what the underlying stock or index does.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Theta Vs Delta:

Theta and Delta are two important Greeks in options trading, and understanding how they interact can significantly improve trade execution and risk management.

While they represent different aspects of options pricing, they complement each other in helping traders make informed decisions.

Theta (Time Decay)

- Measures the rate of decline in an option’s premium due to the passage of time.

- Theta is negative for buyers and positive for sellers.

- Indicates how much the premium will lose each day if all other factors remain constant.

Delta (Directional Sensitivity)

- Measures the sensitivity of an option’s price to changes in the price of the underlying asset.

- Call Option Delta: Positive (ranges from 0 to +1).

- Put Option Delta: Negative (ranges from 0 to -1).

- Indicates how much the option price is expected to change for a ₹1 move in the underlying asset.

Key Differences:

Aspect |

Theta |

Delta |

|---|---|---|

What It Measures |

Time decay (impact of time) |

Price sensitivity to the underlying |

Focus |

Time value of the option |

Directional movement of the asset |

Buyer/Seller Impact |

Negative for buyers, positive for sellers |

Positive for buyers if aligned with the direction of the underlying |

Primary Use |

Time-based strategies |

Direction-based strategies |

Theta helps evaluate time-sensitive trades, while Delta helps understand the price sensitivity of an option.

Combining them allows you to:

-

- Choose the right strike prices.

- Balance risk and reward.

- Execute trades that align with market expectations (directional or non-directional).

By mastering both Theta and Delta, traders can create robust strategies that adapt to various market conditions.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Theta Vs Gamma:

Theta and Gamma are two critical Greeks in options trading, and understanding their interplay is essential for better trade execution and risk management. While they measure different aspects of an option’s pricing behavior, they can complement each other in refining your strategies.

Overview of Theta and Gamma:

Greek |

What It Measures |

Impact on Options |

Key Behavior |

|---|---|---|---|

Theta |

Time decay: the rate at which an option loses value as time passes. |

Negative for buyers, as time erodes the premium. Positive for sellers, as time decay benefits them. |

Decay accelerates closer to expiry. |

Gamma |

Sensitivity of Delta: how much Delta changes with a ₹1 move in the underlying. |

High Gamma means Delta is highly reactive to price movements, causing sharp premium changes. |

Higher for near-the-money (NTM) options close to expiry. |

Key Differences

Aspect |

Theta |

Gamma |

|---|---|---|

Focus |

Time (value loss over time) |

Price sensitivity (Delta’s behavior) |

Trader’s Use |

Time-based strategies |

Managing directional exposure |

When It’s High |

Near expiry, regardless of moneyness |

Near-the-money, especially close to expiry |

Who It Benefits |

Option sellers |

Option buyers (high Gamma = high potential profit) |

Combining Theta and Gamma for Better Trade Execution:

Scenario 1: Range-Bound Market (Theta Dominant Strategy)

- Trade Setup: You believe the underlying asset will stay within a range until expiry.

- Key Objective: Maximize Theta while minimizing Gamma risk (directional moves).

- Strategy:

- Sell options like Iron Condors, Butterflies, or Strangles.

- Focus on strikes with low Gamma (far OTM or deep ITM), where Delta is stable.

- Example:

- NIFTY at 19,000. Sell 19,200 Call and 18,800 Put.

- As time passes, Theta decay benefits the position unless NIFTY makes a large move (Gamma risk).

Scenario 2: Expecting a Big Move (Gamma Dominant Strategy)

- Trade Setup: You expect significant price movement in the underlying.

- Key Objective: Maximize Gamma exposure to capture sharp premium changes.

- Strategy:

- Buy near-the-money (NTM) options with high Gamma.

- Avoid far OTM options as their Gamma and Delta are low (limited sensitivity).

- Example:

- NIFTY at 19,000. Buy a 19,000 Call Option.

- If NIFTY moves to 19,300, the Delta increases quickly, magnifying gains due to Gamma.

Scenario 3: Managing Gamma Risk for Option Sellers

- Trade Setup: You sell options and want to avoid large losses from sudden price moves.

- Key Objective: Minimize Gamma exposure while profiting from Theta.

- Strategy:

- Adjust strikes to manage Gamma risk.

- Use spreads (e.g., Iron Condor) to limit maximum loss.

- Example:

- NIFTY at 19,000. Instead of selling naked 19,100 Call, create a Bear Call Spread (sell 19,100 Call, buy 19,200 Call).

- This caps Gamma risk while still benefiting from Theta decay.

Scenario 4: Hedging with High Gamma

-

- Trade Setup: You have a directional portfolio (e.g., long stock) and want to hedge against sharp movements.

- Key Objective: Use Gamma to create a responsive hedge.

- Strategy:

- Buy options with high Gamma near expiry to hedge sudden price moves.

- Example:

- Hold NIFTY futures (long). Buy NTM (near the money) Put options. If NIFTY drops sharply, the Put Delta increases due to Gamma, providing strong downside protection.

Practical Insights: Theta vs Gamma

Impact on Short-Term Trading

- High Gamma options are preferable when you expect significant short-term moves.

- Be cautious of Theta decay eroding the premium if the move doesn’t happen quickly.

Impact on Long-Term Trading

- High Theta options are suitable for range-bound markets or neutral strategies where time decay works in your favor.

- Manage Gamma risk to avoid large directional losses if the market moves unexpectedly.

Example: Using Theta and Gamma in a Strategy:

Setup:

- Underlying: NIFTY at 19,000.

- Call Option (Strike: 19,000):

- Premium = ₹120.

- Theta = ₹5/day.

- Gamma = 0.02.

Scenarios:

- No Movement in NIFTY (Theta Dominates):

- Each day, the option loses ₹5 due to Theta.

- After 5 days, premium = ₹120 – (₹5 × 5) = ₹95.

- NIFTY Moves to 19,100 (Gamma Dominates):

- Delta increases due to Gamma, amplifying premium gains.

- Premium may rise sharply (e.g., ₹150), even after accounting for Theta decay.

Combining Theta and Gamma in Trade Execution:

Market View |

Primary Greek |

Suggested Strategy |

|---|---|---|

Range-Bound Market |

Theta |

Short Strangles, Iron Condors, Covered Calls |

Expecting Big Move |

Gamma |

Buy NTM (near the money) Calls/Puts, Straddles |

Hedging Sharp Moves |

Gamma |

Buy options close to expiry with high Gamma |

Income Generation |

Theta |

Sell options with low Gamma (e.g., far OTM or deep ITM options) |

- Theta is ideal for strategies focused on time decay, especially in low-volatility, range-bound markets.

- Gamma is crucial for capturing profits in high-volatility markets or protecting against sharp movements.

- A balanced approach—combining Theta-driven income with Gamma-aware risk management—can lead to more effective trade execution and consistent profitability.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.

Theta Vs Delta Vs Gamma:

Using Theta, Delta, and Gamma together provides a comprehensive approach to options trading, enabling better trade execution by addressing time decay, price sensitivity, and risk management.

Let’s explore their combined use through examples in different market scenarios.

Overview of the Greeks

- Theta: Measures time decay in an option’s value.

- Positive for sellers, negative for buyers.

- Key for time-sensitive strategies.

- Delta: Measures the sensitivity of an option’s price to changes in the price of the underlying.

- Indicates directional exposure and probability of expiring ITM.

- Gamma: Measures how much Delta changes with a ₹1 move in the underlying.

- High Gamma increases Delta sensitivity.

- Relevant for managing rapid directional changes.

Combining Theta, Delta, and Gamma: Examples

Scenario 1: Range-Bound Market

- Market View: The underlying index (e.g., NIFTY) is likely to remain between 18,900 and 19,100 for the next week.

- Objective: Maximize profit from time decay (Theta) while minimizing directional risk (Delta and Gamma).

Strategy:

- Use a Short Strangle: Sell 19,200 Call and 18,800 Put (far OTM).

- Greek Analysis:

- Theta: Positive. Daily time decay works in favor of the position.

- Delta: Near zero initially, ensuring limited exposure to directional moves.

- Gamma: Low, as strikes are OTM, meaning Delta changes are limited.

Outcome:

- If NIFTY stays range-bound, Theta decay leads to consistent profits.

- If NIFTY moves sharply, Gamma increases Delta risk, requiring adjustments (e.g., buying back one leg).

Scenario 2: Expecting a Big Move

- Market View: Anticipating significant volatility due to an upcoming event (e.g., central bank meeting).

- Objective: Capture profits from a large price movement.

Strategy:

- Use a Long Straddle: Buy 19,000 Call and 19,000 Put (ATM).

- Greek Analysis:

- Theta: Negative. Time decay works against the position.

- Delta: Starts near zero but shifts significantly as the underlying moves.

- Gamma: High. Delta adjusts quickly, magnifying the impact of a large move.

Outcome:

- A sharp move in either direction increases Delta, leading to large gains in premium.

- If the market stagnates, Theta decay erodes the premium.

Scenario 3: Directional Trade with Limited Risk

- Market View: Bullish on NIFTY, expecting it to rise from 19,000 to 19,200.

- Objective: Leverage Delta for upside potential while managing Theta and Gamma risk.

Strategy:

- Use a Bull Call Spread: Buy 19,000 Call and sell 19,200 Call.

- Greek Analysis:

- Theta: Negative for the bought option, partially offset by positive Theta from the sold option.

- Delta: Positive, capturing gains as NIFTY rises.

- Gamma: Moderate, as the bought option reacts more strongly to price changes.

Outcome:

- If NIFTY rises, the spread gains value, with Delta amplifying profits.

- Loss is limited if the market doesn’t move significantly, thanks to the capped Theta loss.

Scenario 4: Hedging a Portfolio

- Market View: You hold a long equity portfolio and want protection against a sudden drop in the market.

- Objective: Use Gamma to hedge against adverse moves while considering Theta cost.

Strategy:

- Use Protective Puts: Buy ATM or slightly OTM Put options on NIFTY.

- Greek Analysis:

- Theta: Negative. Time decay is a cost for holding protection.

- Delta: Negative, offsetting the long portfolio’s positive Delta.

- Gamma: High, ensuring strong protection against sharp drops.

Outcome:

- If the market falls, the Put’s Delta increases (due to Gamma), providing effective protection.

- If the market remains stable, the portfolio incurs Theta loss as a cost of insurance.

Key Takeaways for Trade Execution Using Theta, Delta, and Gamma Together

Greek |

Key Use |

Strategy Design |

|---|---|---|

Theta |

Maximize or mitigate time decay |

Focus on positive Theta for income strategies like selling options. |

Delta |

Directional exposure and adjustments |

Use Delta to gauge how an option reacts to price changes. |

Gamma |

Manage rapid Delta changes |

Prioritize Gamma when expecting sharp movements or managing risk. |

Trade Execution Guidelines

- Directional Moves:

- Use Delta for directional bias.

- Pair with Gamma to identify high-sensitivity trades.

- Range-Bound Markets:

- Maximize Theta (e.g., sell options or spreads).

- Keep Gamma low to minimize directional risk.

- High-Volatility Scenarios:

- Use high Gamma options (e.g., straddles or ATM options).

- Be prepared to adjust for Theta decay if the move is delayed.

- Hedging:

- Use high Gamma options (e.g., ATM Puts) for responsive protection.

- Manage Theta cost by using spreads or rolling positions.

Example: Theta vs Gamma vs Delta

Setup:

- Underlying Asset: NIFTY at 19,000.

- Position: Long 19,000 Call Option.

- Greeks:

- Theta: -₹5/day.

- Delta: +0.5 (sensitivity to price moves).

- Gamma: +0.04 (Delta increases by 0.04 for every ₹1 move).

Scenario 1: NIFTY Rises to 19,050

- Delta Impact: Premium increases by ₹25 (50 × ₹0.5).

- Gamma Impact: Delta increases to 0.54, amplifying future moves.

- Theta Impact: A loss of ₹5 is deducted.

Net Impact: Gains are driven primarily by Delta and Gamma, with Theta having a small negative impact.

Scenario 2: NIFTY Stagnates

- Delta Impact: No change in premium (no price movement).

- Gamma Impact: Minimal, as there’s no price move.

- Theta Impact: ₹5/day loss due to time decay.

Net Impact: Losses are entirely due to Theta.

By combining Theta, Delta, and Gamma, traders can build strategies that align with their market outlook while effectively managing risks and rewards. This multidimensional approach ensures informed trade execution and better profitability.

If you are looking for the best stockbroker for option trading I would recommend you to checkout this broker, or you can directly use the below link to open the account free of cost.